Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If Mona elects to opt out of special depreciation for the new fence, what is the amount of current depreciation for this asset? $157 $210

If Mona elects to opt out of special depreciation for the new fence, what is the amount of current depreciation for this asset?

$157

$210

$315

$420

Question 2

If Mona elects to use special depreciation for the new fence, what is her net profit or loss on the rental house?

($7,853)

($7,643)

($7,562)

($7,352)

If Mona elects to use special depreciation for the new fence, what is the total depreciation deduction?

$9,297

$9,507

$9,588

$9,798

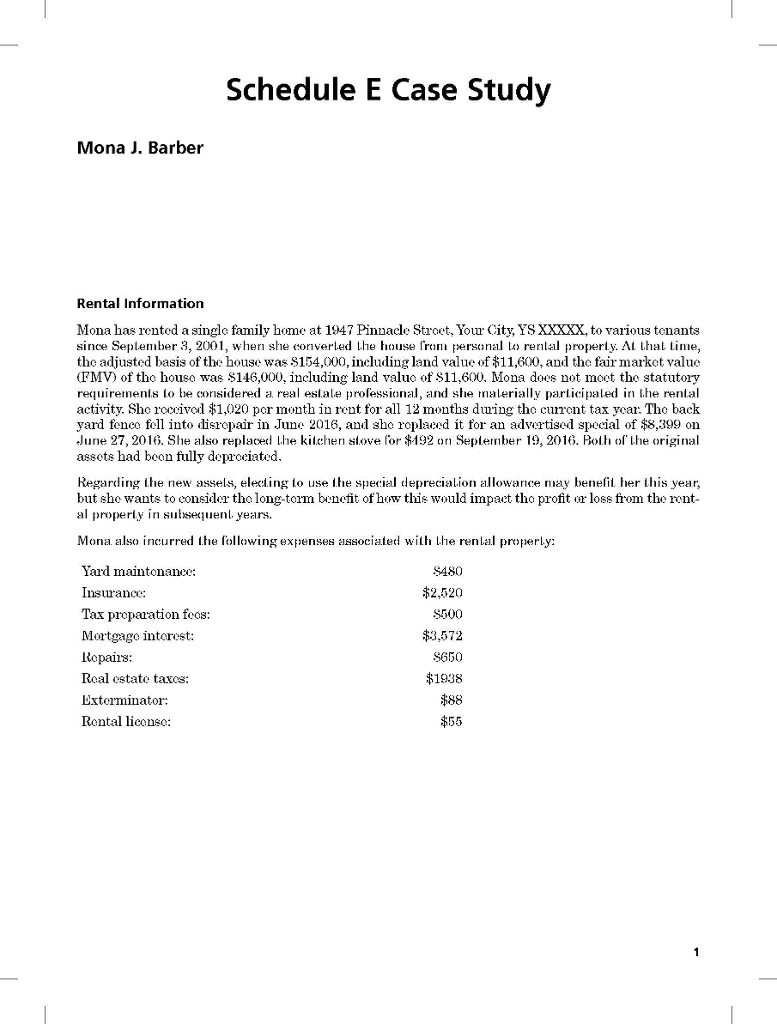

Schedule E Case Study Mona J. Barber Rental Information Mona has rented a singlc family home at 1947 Pinnacle Stroet, Your City, YS XXXXX, to various tenants since Seplember 3, 2001, when she cornverled Lhe house from personal renlal property. At thal Lime, the adjusted basis of the house was $154,000, including land value of 1,600, and the fair market value FMV) of tho houso was $146,000, including land valuo of S11,600. Mona does not moet the statutory requiremenis lo he considered a real estale professional, and she malerially participaled n Lhe renial activity. Shc roxivo11,020 por month in rent for all 12 mnths during the currant tax year. The back yard fence fell into disrcpair in June 2016, and she replaced it for an advertised special of $8,399 on June 27, 2016. She also replaced 1.he kitchen slove l'or92 on Sepi ember 19, 2016. Both of lhe original assots had beon fully deproeiated Regarding ihe new assels, eleciing lo use he special deprecialion allowance aybfi erths year, but sho wants to consider tho long-torm beneit of how this would impact tho profit r loss from tho rent al properly in subsequen years. Mona also incurred the following expenses associaled with Lhe renal prprly: SA80 $2,520 $500 #3,572 8650 $1938 Yard maintonanee: Insuranc: Tax proparation foos: Mortgage interest: Ropaiis Real estate taxos: Lxterminator Rontal liconso: Schedule E Case Study Mona J. Barber Rental Information Mona has rented a singlc family home at 1947 Pinnacle Stroet, Your City, YS XXXXX, to various tenants since Seplember 3, 2001, when she cornverled Lhe house from personal renlal property. At thal Lime, the adjusted basis of the house was $154,000, including land value of 1,600, and the fair market value FMV) of tho houso was $146,000, including land valuo of S11,600. Mona does not moet the statutory requiremenis lo he considered a real estale professional, and she malerially participaled n Lhe renial activity. Shc roxivo11,020 por month in rent for all 12 mnths during the currant tax year. The back yard fence fell into disrcpair in June 2016, and she replaced it for an advertised special of $8,399 on June 27, 2016. She also replaced 1.he kitchen slove l'or92 on Sepi ember 19, 2016. Both of lhe original assots had beon fully deproeiated Regarding ihe new assels, eleciing lo use he special deprecialion allowance aybfi erths year, but sho wants to consider tho long-torm beneit of how this would impact tho profit r loss from tho rent al properly in subsequen years. Mona also incurred the following expenses associaled with Lhe renal prprly: SA80 $2,520 $500 #3,572 8650 $1938 Yard maintonanee: Insuranc: Tax proparation foos: Mortgage interest: Ropaiis Real estate taxos: Lxterminator Rontal liconso

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started