Answered step by step

Verified Expert Solution

Question

1 Approved Answer

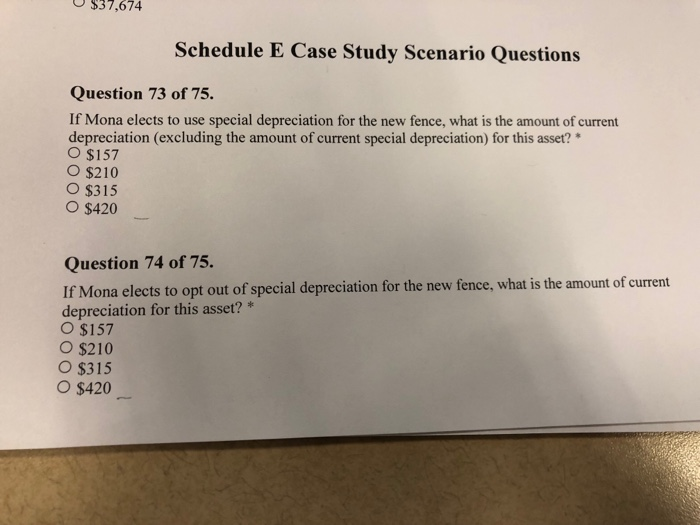

If Mona elects to use special depreciation for the new fences, what is the amount of current depreciation (excluding the amount of current special depreciation)

If Mona elects to use special depreciation for the new fences, what is the amount of current depreciation (excluding the amount of current special depreciation) for this asset?

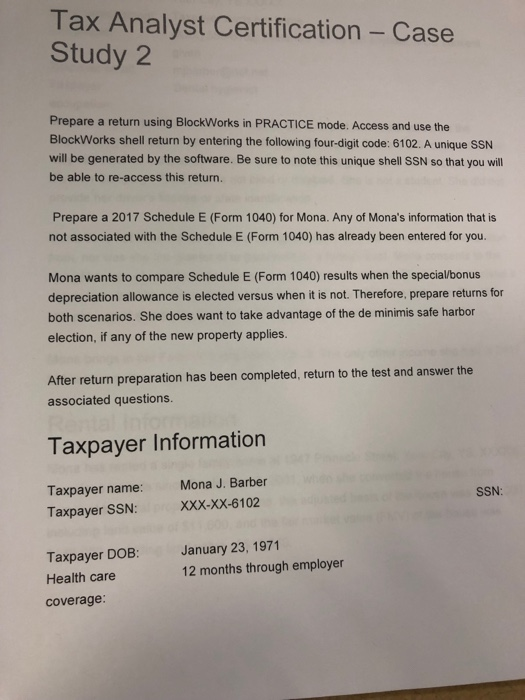

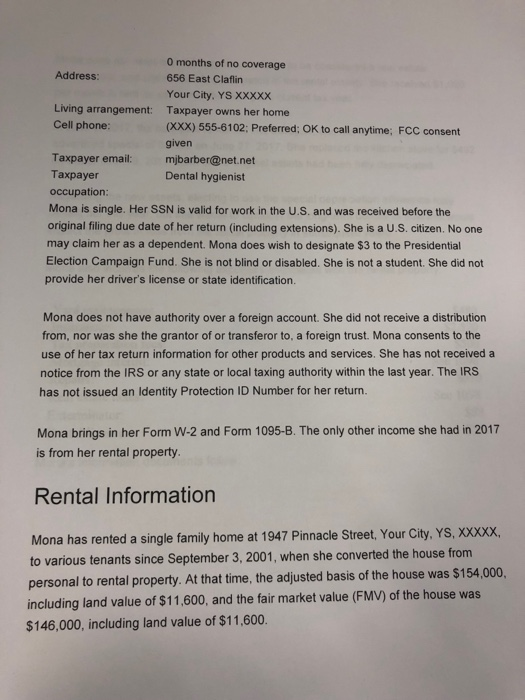

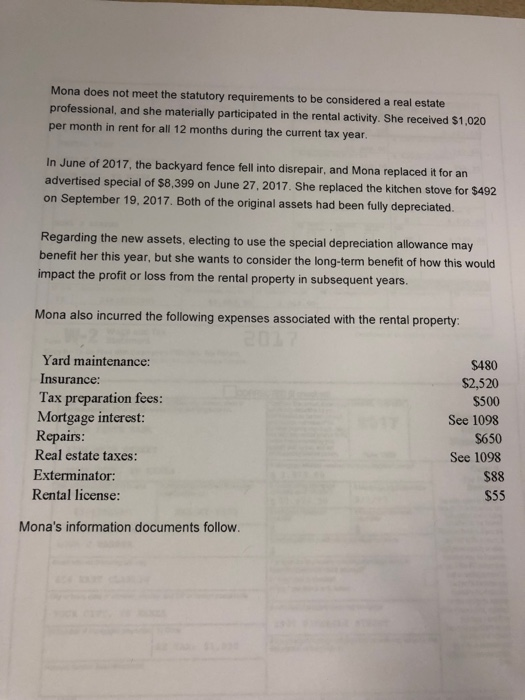

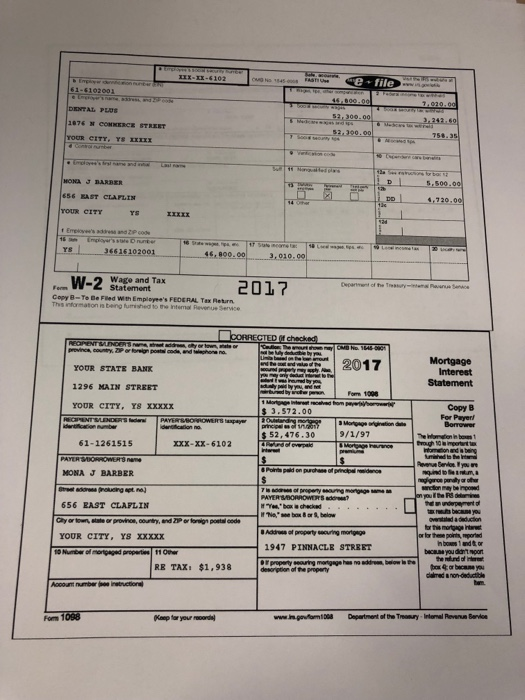

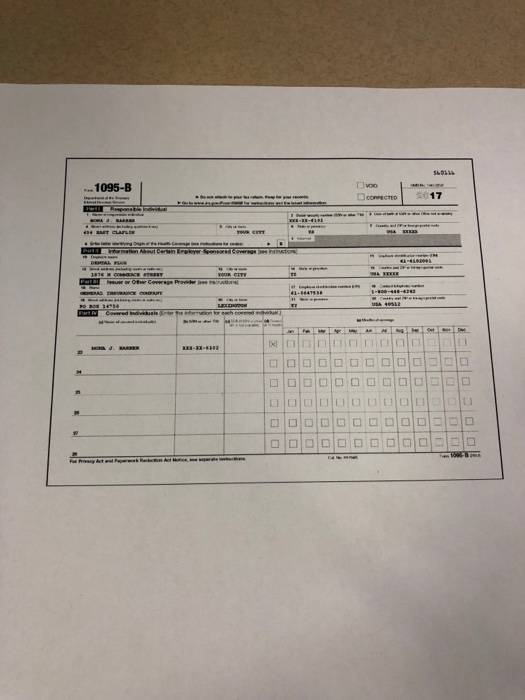

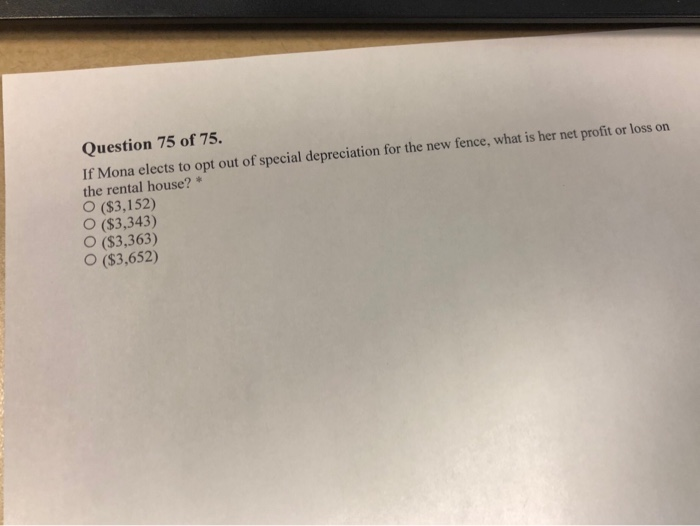

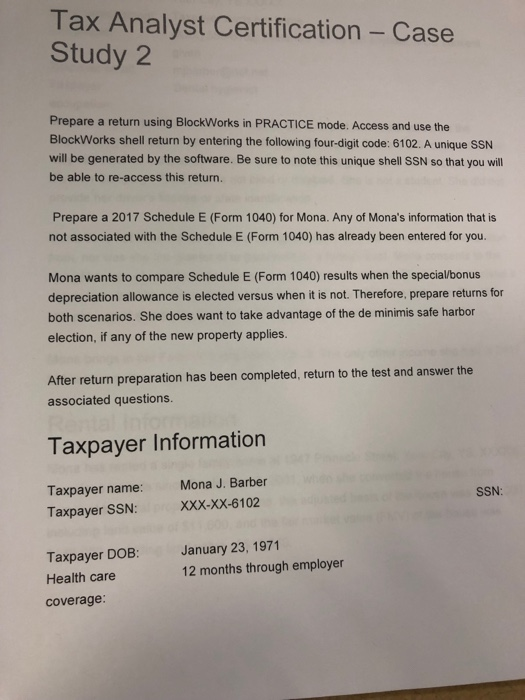

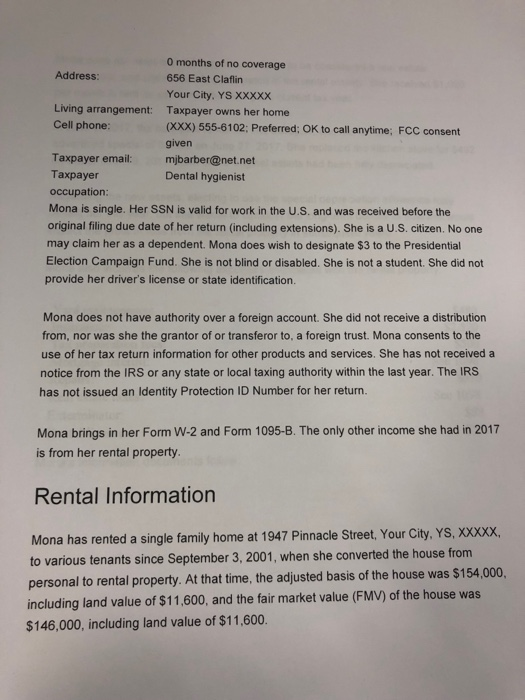

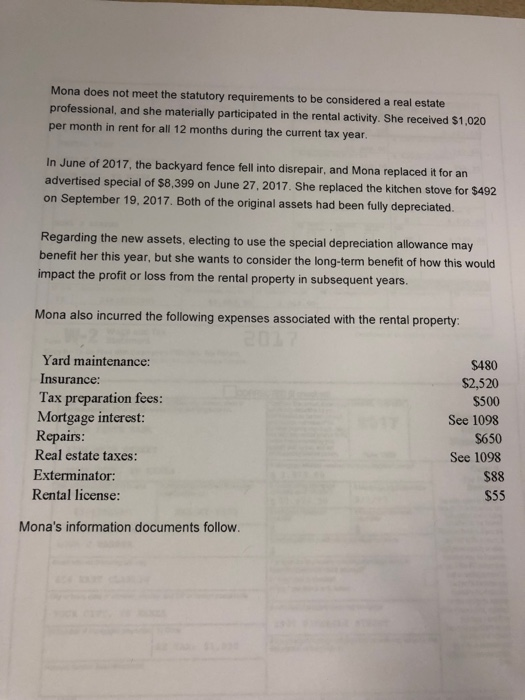

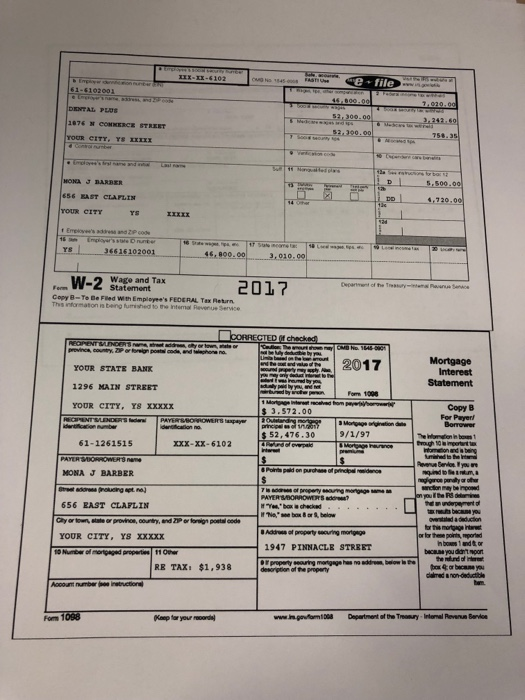

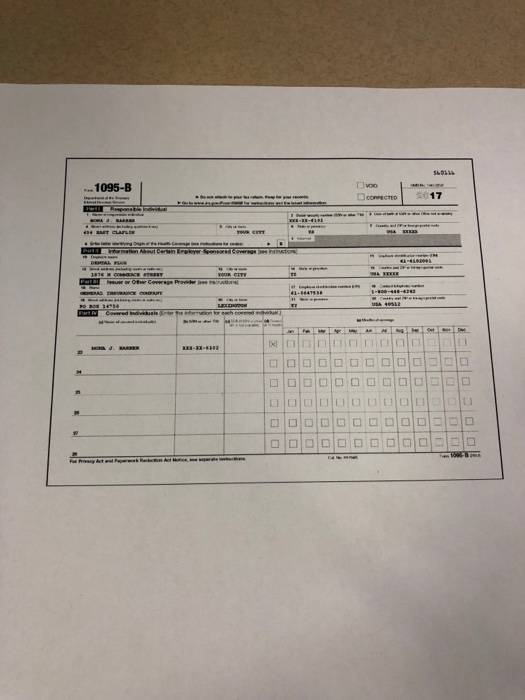

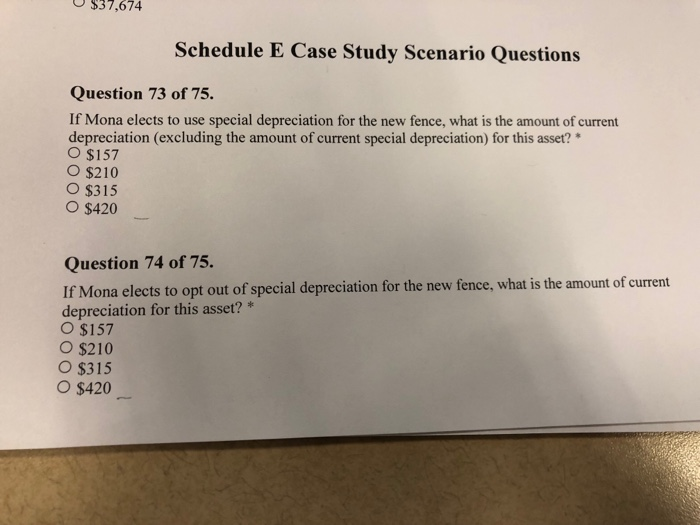

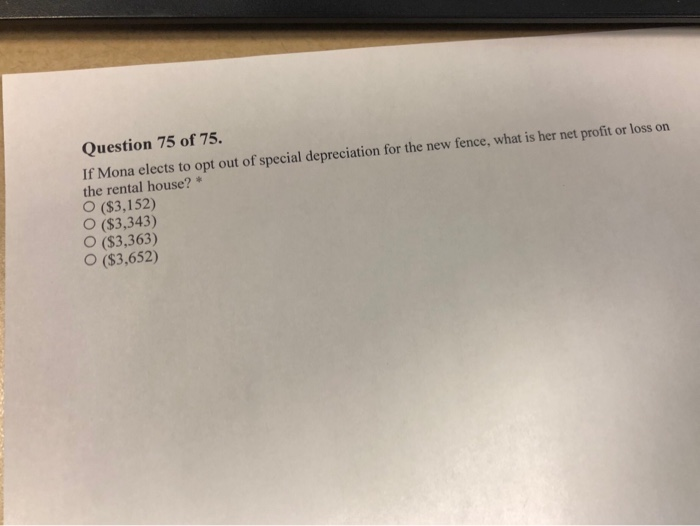

Tax Analyst Certification - Case Study 2 Prepare a return using BlockWorks in PRACTICE mode. Access and use the BlockWorks shell return by entering the following four-digit code: 6102. A unique SSN will be generated by the software. Be sure to note this unique shell SSN so that you will be able to re-access this return. Prepare a 2017 Schedule E (Form 1040) for Mona. Any of Mona's information that is not associated with the Schedule E (Form 1040) has already been entered for you Mona wants to compare Schedule E (Form 1040) results when the special/bonus depreciation allowance is elected versus when it is not. Therefore, prepare returns for both scenarios. She does want to take advantage of the de minimis safe harbor election, if any of the new property applies. After return preparation has been completed, return to the test and answer the associated questions Taxpayer Information Taxpayer name: Taxpayer SSN: Mona J. Barber XXX-XX-6102 SSN Taxpayer DOB: Health care coverage January 23, 1971 12 months through employer 0 months of no coverage 656 East Claflin Your City. YS XXXXX Taxpayer owns her home (xxx) 555-6102; Preferred; OK to call anytime; FCC consent given Address: Living arrangement: Cell phone: Taxpayer email: mjbarber@net.net Taxpayer occupation Mona is single. Her SSN is valid for work in the U.S. and was received before the original filing due date of her return (including extensions). She is a U.S. citizen. No one may claim her as a dependent. Mona does wish to designate $3 to the Presidential Election Campaign Fund. She is not blind or disabled. She is not a student. She did not provide her driver's license or state identification. Dental hygienist Mona does not have authority over a foreign account. She did not receive a distribution from, nor was she the grantor of or transferor to, a foreign trust. Mona consents to the use of her tax return information for other products and services. She has not received a notice from the IRS or any state or local taxing authority within the last year. The IRS has not issued an Identity Protection ID Number for her return. Mona brings in her Form W-2 and Form 1095-B. The only other income she had in 2017 is from her rental property Rental Information Mona has rented a single family home at 1947 Pinnacle Street, Your City, YS, xxxxx, to various tenants since September 3, 2001, when she converted the house from personal to rental property. At that time, the adjusted basis of the house was $154,000, including land value of $11.600, and the fair market value (FMV) of the house was $146,000, including land value of $11,600. Mona does not meet the statutory requirements to be considered a real estate professional, and she materially participated in the rental activity. She received $1,020 per month in rent for all 12 months during the current tax year. In June of 2017, the backyard fence fell into disrepair, and Mona replaced it for an advertised special of $8,399 on June 27, 2017. She replaced the kitchen stove for $492 on September 19, 2017. Both of the original assets had been fully depreciated. Regarding the new assets, electing to use the special depreciation allowance may benefit her this year, but she wants to consider the long-term benefit of how this would impact the profit or loss from the rental property in subsequent years Mona also incurred the following expenses associated with the rental property: Yard maintenance: Insurance: Tax preparation fees: Mortgage interest: Repairs: Real estate taxes: Exterminator Rental license: $480 $2,520 $500 See 1098 $650 See 1098 $88 $55 Mona's information documents follow. e file DENTAL PLOS 1876 COKERCE STREET YOUR CITY. Ysxx ,500-00 ,720.00 W-2age and Tax L Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return Ths informaton in being futmished to tre Intemal Revenue Service t checked and twlephone Mortgage Interest YOUR STATE BANX 1296 MAIN STREET YOUR CITY, YS xxxxx Form 1008 Copy B For Payeri 3.572.00 52,476.30 9/1/97 61-1261515 xxx-xx-6102 Poins MONA J BARBER 656 EAST CLAFLIN Addross of property 1947 PINNACLE STREET YOUR CITY, YS xXXXX RE TAX: $1,938 1098 . 1095-B 17 DC) $37,674 Schedule E Case Study Scenario Questions Question 73 of 75. If Mona elects to use special depreciation for the new fence, what is the amount of current depreciation (excluding the amount of current special depreciation) for this asset? O $157 O $210 O $315 O $420 Question 74 of 75. If Mona elects to opt out of special depreciation for the new fence, what is the amount of current depreciation for this asset? * O $157 O $210 O $315 O $420 Question 75 of 75 If Mona elects to opt out of special depreciation for the new fence, what is her net profit or loss on the rental house? * ($3,152) O ($3,343) O ($3,363) O ($3,652)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started