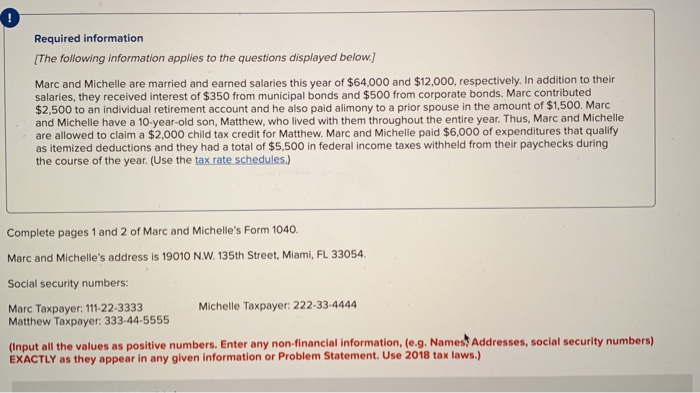

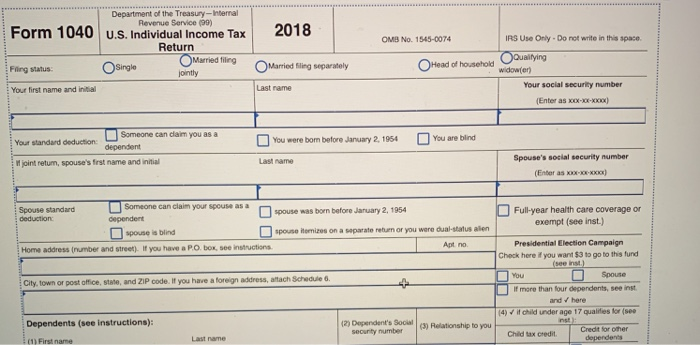

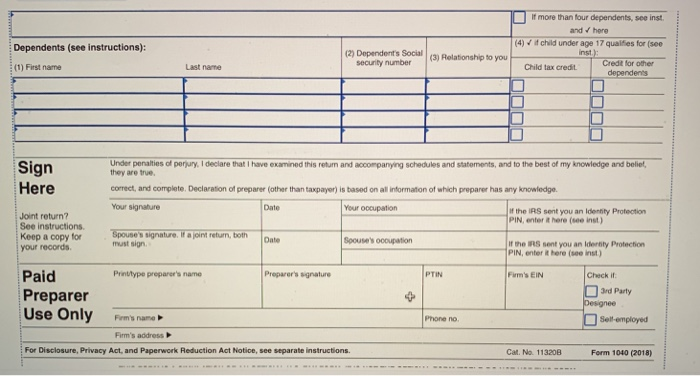

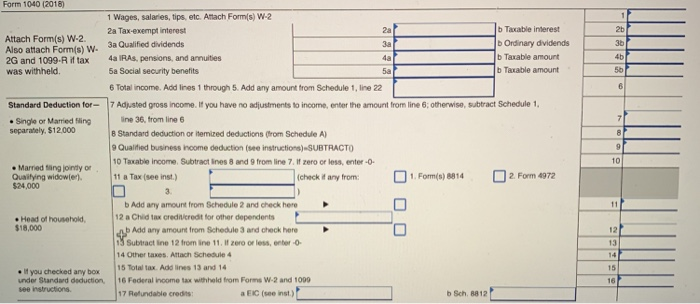

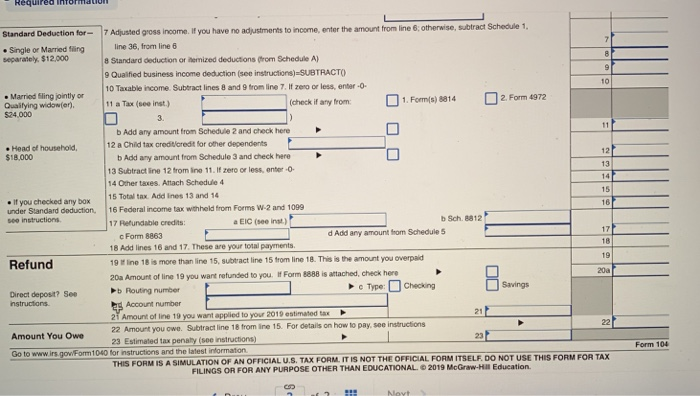

If more than four dependents, see inst. B and here 4) id child under age 17 quaifies for (see inst) Dependents (see instructions): (2) Dependent's Social (3) Rolationship to you security number Credt for other (1) First name Last name Child tax credit Sign Here Under penalties of perury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and beliet, they are true correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge Your signahure Date Your oocupation If the IRS sent you an Idenity Protection PIN, enter Rt here (see inst Joint return? See instructions Keep a copy for your records Spouse's signature. if a jort return, bot must sign Date Spouse's oooupation it the IRS sent you an iderbty Protection PIN, enter it here (see inst) Paid Preparer Printtype preparee's name Proparer's signature PTIN Firm's EIN Check if 3rd Party Designee Use Only m's namo Phone no Sell-employed Firm's address For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions Cat. No. 113208 Form 1040 (2018) If more than four dependents, see inst. B and here 4) id child under age 17 quaifies for (see inst) Dependents (see instructions): (2) Dependent's Social (3) Rolationship to you security number Credt for other (1) First name Last name Child tax credit Sign Here Under penalties of perury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and beliet, they are true correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge Your signahure Date Your oocupation If the IRS sent you an Idenity Protection PIN, enter Rt here (see inst Joint return? See instructions Keep a copy for your records Spouse's signature. if a jort return, bot must sign Date Spouse's oooupation it the IRS sent you an iderbty Protection PIN, enter it here (see inst) Paid Preparer Printtype preparee's name Proparer's signature PTIN Firm's EIN Check if 3rd Party Designee Use Only m's namo Phone no Sell-employed Firm's address For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions Cat. No. 113208 Form 1040 (2018)