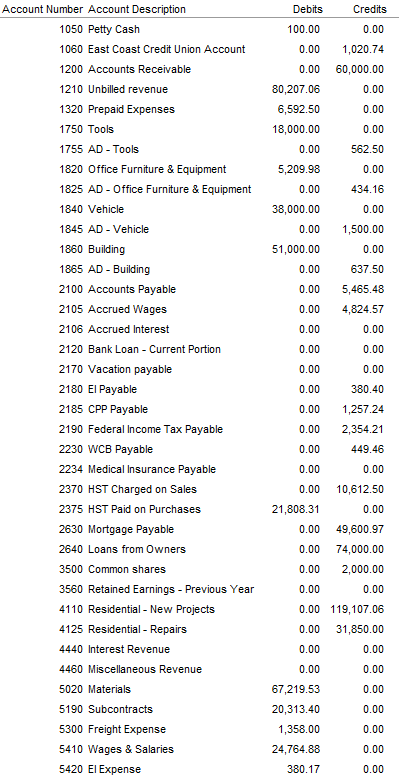

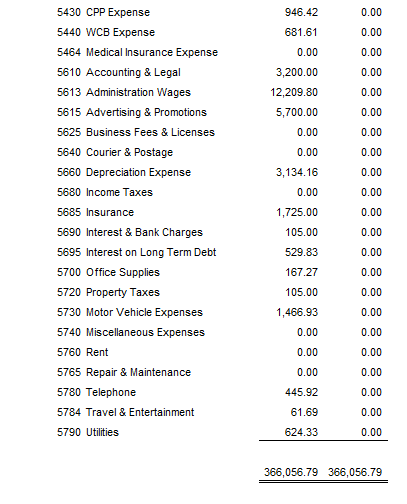

If Net income is 5,818.12 , kindly please create a Statement of Cash Flows in the Indirect Method with the following information:

Debits Credits 100.00 0.00 1,020.74 60,000.00 0.00 0.00 0.00 562.50 0.00 0.00 80,207.06 6,592.50 18,000.00 0.00 5,209.98 0.00 38,000.00 0.00 51,000.00 0.00 0.00 434.16 0.00 1,500.00 0.00 637.50 0.00 5,465.48 4,824.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Account Number Account Description 1050 Petty Cash 1060 East Coast Credit Union Account 1200 Accounts Receivable 1210 Unbilled revenue 1320 Prepaid Expenses 1750 Tools 1755 AD - Tools 1820 Office Furniture & Equipment 1825 AD - Office Furniture & Equipment 1840 Vehicle 1845 AD - Vehicle 1860 Building 1865 AD - Building 2100 Accounts Payable 2105 Accrued Wages 2106 Accrued Interest 2120 Bank Loan - Current Portion 2170 Vacation payable 2180 El Payable 2185 CPP Payable 2190 Federal Income Tax Payable 2230 WCB Payable 2234 Medical Insurance Payable 2370 HST Charged on Sales 2375 HST Paid on Purchases 2630 Mortgage Payable 2640 Loans from Owners 3500 Common shares 3560 Retained Earnings - Previous Year 4110 Residential - New Projects 4125 Residential - Repairs 4440 Interest Revenue 4460 Miscellaneous Revenue 5020 Materials 5190 Subcontracts 5300 Freight Expense 5410 Wages & Salaries 5420 El Expense 0.00 380.40 0.00 1,257.24 2,354.21 0.00 0.00 449.46 0.00 0.00 0.00 10,612.50 21,808.31 0.00 0.00 49,600.97 0.00 74,000.00 0.00 2,000.00 0.00 0.00 0.00 119,107.06 0.00 31,850.00 0.00 0.00 0.00 0.00 67,219.53 0.00 0.00 20,313.40 1,358.00 24,764.88 0.00 0.00 380.17 0.00 0.00 0.00 5430 CPP Expense 5440 WCB Expense 5464 Medical Insurance Expense 5610 Accounting & Legal 5613 Administration Wages 5615 Advertising & Promotions 5625 Business Fees & Licenses 5640 Courier & Postage 5660 Depreciation Expense 5680 Income Taxes 5685 Insurance 5690 Interest & Bank Charges 5695 Interest on Long Term Debt 5700 Office Supplies 5720 Property Taxes 5730 Motor Vehicle Expenses 5740 Miscellaneous Expenses 5760 Rent 5765 Repair & Maintenance 5780 Telephone 5784 Travel & Entertainment 946.42 681.61 0.00 3,200.00 12,209.80 5,700.00 0.00 0.00 3,134.16 0.00 1,725.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 105.00 0.00 529.83 0.00 0.00 0.00 167.27 105.00 1,466.93 0.00 0.00 0.00 0.00 0.00 0.00 0.00 445.92 0.00 61.69 0.00 5790 Utilities 624.33 0.00 366,056.79 366,056.79 Debits Credits 100.00 0.00 1,020.74 60,000.00 0.00 0.00 0.00 562.50 0.00 0.00 80,207.06 6,592.50 18,000.00 0.00 5,209.98 0.00 38,000.00 0.00 51,000.00 0.00 0.00 434.16 0.00 1,500.00 0.00 637.50 0.00 5,465.48 4,824.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Account Number Account Description 1050 Petty Cash 1060 East Coast Credit Union Account 1200 Accounts Receivable 1210 Unbilled revenue 1320 Prepaid Expenses 1750 Tools 1755 AD - Tools 1820 Office Furniture & Equipment 1825 AD - Office Furniture & Equipment 1840 Vehicle 1845 AD - Vehicle 1860 Building 1865 AD - Building 2100 Accounts Payable 2105 Accrued Wages 2106 Accrued Interest 2120 Bank Loan - Current Portion 2170 Vacation payable 2180 El Payable 2185 CPP Payable 2190 Federal Income Tax Payable 2230 WCB Payable 2234 Medical Insurance Payable 2370 HST Charged on Sales 2375 HST Paid on Purchases 2630 Mortgage Payable 2640 Loans from Owners 3500 Common shares 3560 Retained Earnings - Previous Year 4110 Residential - New Projects 4125 Residential - Repairs 4440 Interest Revenue 4460 Miscellaneous Revenue 5020 Materials 5190 Subcontracts 5300 Freight Expense 5410 Wages & Salaries 5420 El Expense 0.00 380.40 0.00 1,257.24 2,354.21 0.00 0.00 449.46 0.00 0.00 0.00 10,612.50 21,808.31 0.00 0.00 49,600.97 0.00 74,000.00 0.00 2,000.00 0.00 0.00 0.00 119,107.06 0.00 31,850.00 0.00 0.00 0.00 0.00 67,219.53 0.00 0.00 20,313.40 1,358.00 24,764.88 0.00 0.00 380.17 0.00 0.00 0.00 5430 CPP Expense 5440 WCB Expense 5464 Medical Insurance Expense 5610 Accounting & Legal 5613 Administration Wages 5615 Advertising & Promotions 5625 Business Fees & Licenses 5640 Courier & Postage 5660 Depreciation Expense 5680 Income Taxes 5685 Insurance 5690 Interest & Bank Charges 5695 Interest on Long Term Debt 5700 Office Supplies 5720 Property Taxes 5730 Motor Vehicle Expenses 5740 Miscellaneous Expenses 5760 Rent 5765 Repair & Maintenance 5780 Telephone 5784 Travel & Entertainment 946.42 681.61 0.00 3,200.00 12,209.80 5,700.00 0.00 0.00 3,134.16 0.00 1,725.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 105.00 0.00 529.83 0.00 0.00 0.00 167.27 105.00 1,466.93 0.00 0.00 0.00 0.00 0.00 0.00 0.00 445.92 0.00 61.69 0.00 5790 Utilities 624.33 0.00 366,056.79 366,056.79