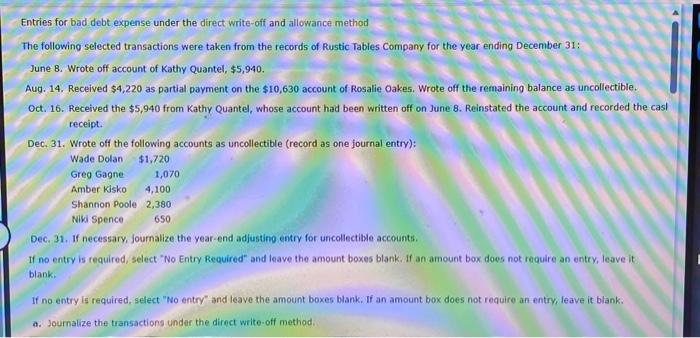

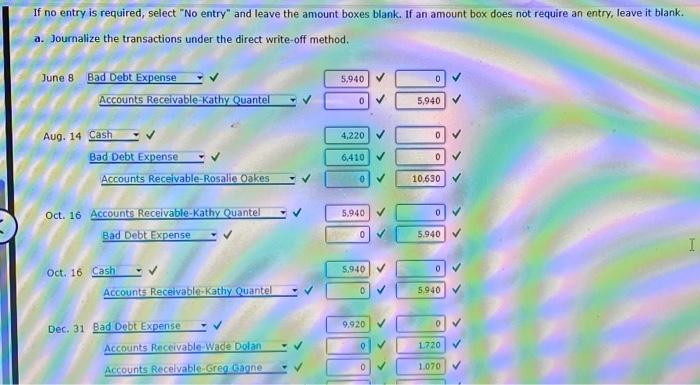

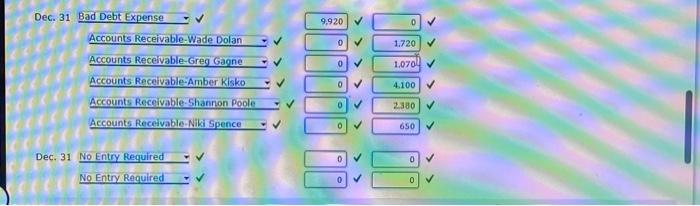

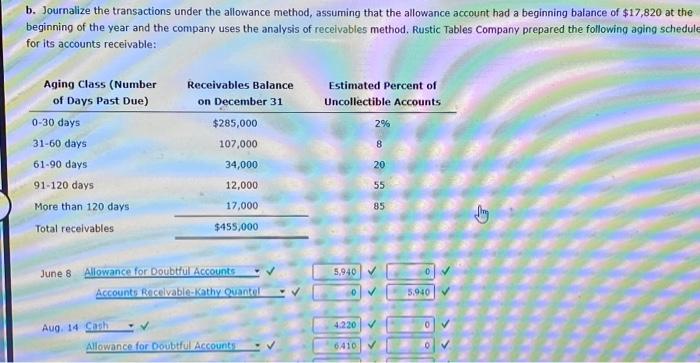

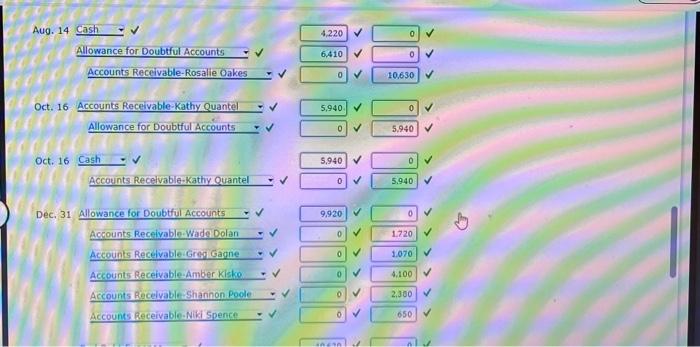

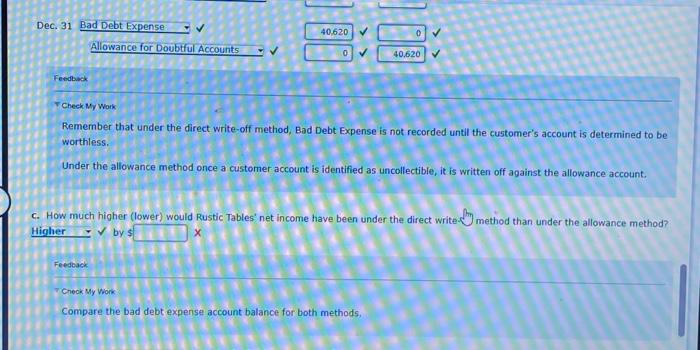

If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. a. Journalize the transactions under the direct write-off method. Dec. 31 Bad Debt Expense Accounts Receivable-Wade Dolan Accounts Recelvable-Greg Gagne v Accounts Receivable:Amber Risko Accounts Recelvable-Shannon Poole v Accounts Receivable-Niki Spence = Dec. 31 No Entry Required v No Entry Required Entries for bad debt expense under the direct write-off and allowance method The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $5,940. Aug. 14. Received $4,220 as partial payment on the $10,630 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $5,940 from Kathy Quantel, whose account had been written off on June 8 . Reinstated the account and recorded the cas! receipt. Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Dec. 31. If necessary, Journalize the year-end adjusting entry for uncollectible accounts. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. a. Journalize the transactions under the direct write-off method. Aug. 14 Cash Allowance for Doubtul Accounts Oct. 16 Accounts Receivable-Kathy Quantel Allowance for Doubtful Accounts Oct. 16 Cash Accounts Recelvable-Kathy Quantel Dec. 31 Allowance for Doubtul Accounts Accounts Receivable-Wade Dolan Accounts Recelvable-Greg Gagne * Accounts Receivable-Amber Kisko Accounts Recelvabieshaninon Poole =v Accounts Receivable-Niki Spence Check My Work Remember that under the direct write-off method, Bad Debt Expense is not recorded until the customer's account is determined to be worthless. Under the allowance method once a customer account is identified as uncollectible, it is written off against the allowance account. by $ x Feedback TCeok My Work Compare the bad debt expense account balance for both methods, b. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $17,820 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedul for its accounts receivable