Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If possible, I could use help with this set of problems. GREATLY appreciated!!!!!!! Horseshoe Casino is considering converting the Avenue at Terminal Tower into a

If possible, I could use help with this set of problems. GREATLY appreciated!!!!!!!

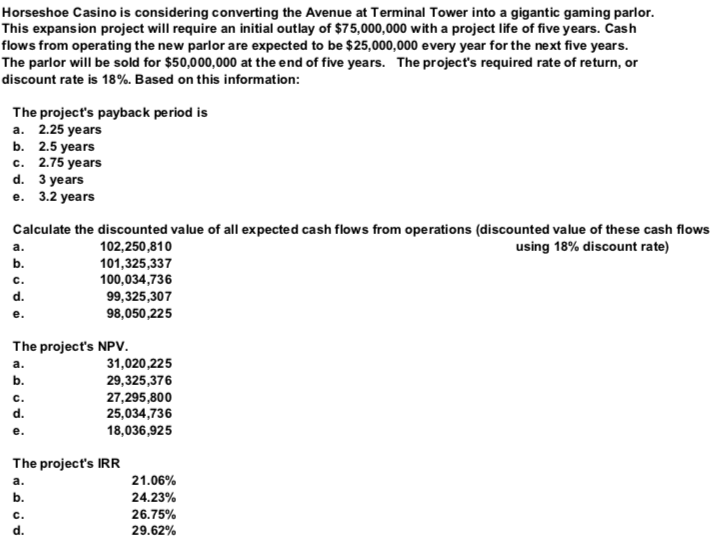

Horseshoe Casino is considering converting the Avenue at Terminal Tower into a gigantic gaming parlor. This expansion project will require an initial outlay of $75,000, 000 with a project life of five years. Cash flows from operating the new parlor are expected to be $25,000,000 every year for the next five years. The parlor will be sold for $50,000,000 at the end of five years. The project's required rate of return, or discount rate is 18%. Based on this information: The project's payback period is . 2.25 years b. 2.5 years . 2.75 years d. 3 years . 3.2 years Calculate the discounted value of all expected cash flows from operations (discounted value of the se cash flows 102,250,810 101,325,337 100,034,736 99,325,307 98,050,225 using 18% discount rate) . b. c. d. The project's NPV. 31,020,225 29,325,376 27,295,800 25,034,736 18,036,925 . b. C. d. . The project's IRR 21.06% . b. 24.23% 26.75% C. d. 29.62%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started