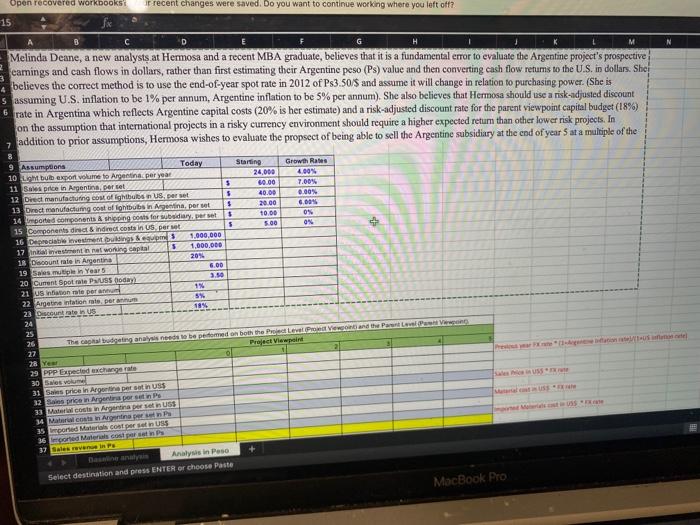

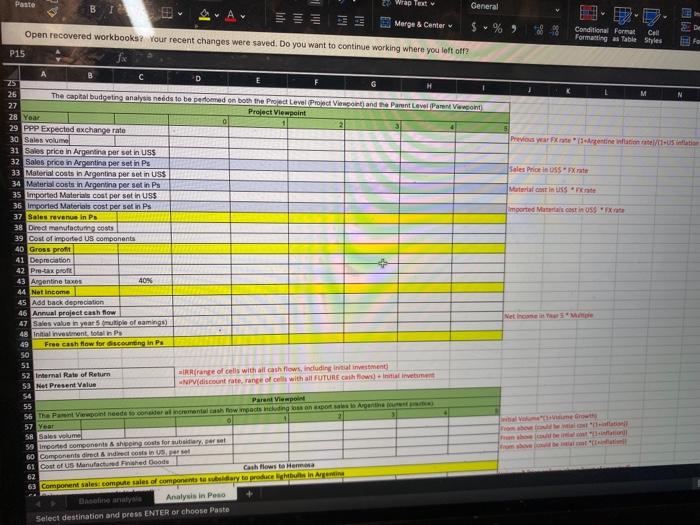

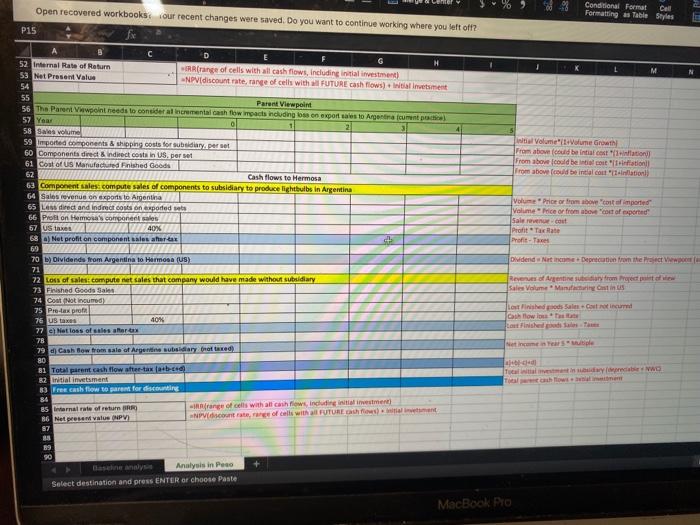

If recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks 15 Today A Melinda Deane, a new analysts at Hermosa and a recent MBA graduate, believes that it is a fundamental error to evaluate the Argentine project's prospective N eamings and cash flows in dollars, rather than first estimating their Argentine peso (Ps) value and then converting cash flow returns to the U.S. in dollars. She believes the correct method is to use the end-of-year spot rate in 2012 of Ps3.50$ and assume it will change in relation to purchasing power. (She is Sassuming U.S. inflation to be 1% per annum, Argentine inflation to be 5% per annum). She also believes that Hermosa should use a risk-adjusted discount 6 rate in Argentina which reflects Argentine capital costs (20% is her estimate) and a risk-adjusted discount rate for the parent viewpoint capital budget (18%) on the assumption that international projects in a risky currency environment should require a higher expected return than other lower risk projects. In 7 addition to prior assumptions, Hermosa wishes to evaluate the propsect of being able to sell the Argentine subsidiary at the end of years at a multiple of the 8 9 Assumptions Starting Growth Rates 10 LI but ex volume to Argentina per year 24,000 40 11 Sie price in Argentina, persel $ 60.00 7.00 12 Dre manufacturing cost of igbubs US per set $ 40.00 0.00% 13 Direct manufacturing cost of ontbus in Aunina, per set $ 20.00 6.00 14 ported components & shing costs for subsidiary part 5 10.00 0% 15 Components direct & Indirect costs in US pert 5 500 0% 16 Decibe vestimentos em 1,000,000 17 nanti at working capital 5 1,000,000 18 Discount rate in Argentina 20% 19 Sales multiple in Years 6.00 20 Current Spot PUSS Doday 3.50 1% 21 us on ne per SN 22 Aretinentation rate per 23 Discount iston US 24 25 26 The car budgeting analysis needs to be some on both the Prevent the Past 27 Project Viewpoint 23 Yes Perustel 29 PPP Expected exchange rate 30 Sales volume USS 31 Sans price in Argentina per set in US 32 Bricon Argentina per set in Ps 33 Material costs in Argentina per sein US$ 34 Materialist in Argentina per MUS 35 Lmported Materials control in USS 36 ore Materials cost per sets 39 Sales venin e Analysis in Peso Select destination and press ENTER or choose Paste MacBook Pro Paste Wrap Ten General . E Merge & Center $ - %) Open recovered workbookst Your recent changes were saved. Do you want to continue working where you left off? Conditional Format Call Formatting as Table Styles fo P15 Preved warrante infante/Clusi Sales Prici SSFX rate Material continente imported Marcos SSX rata B C D 25 26 The capital budeating analysis needs to be performed on both the Project Level Project Venon) and Parunt Lavel Partioint 27 28 Year Project Viewpoint 29 PPP Expected exchange rate 30 Sales volume 31 Sales price in Argentina per set in US$ 32 Sales price in Argentina per set in Ps 33 Material costs in Argentina per set in USS 34 Material costs in Argentina per set in Pa 35 Imported Materials cost per set in US$ 36 Imported Materials cost per set in Ps 37 Sales revenue in Pa 38 Direct manufacturing costs 39 Cost of worted US components 40 Gross profit 41 Depreciation 42 Pro-tax proft 43 Argentine taxes 40% 44 Net Income 45 Asd back depreciation 46 Annual project cash flow 47 Sales value in year mutiple of camins 48 Initial investment, totalins 49 Free cash flow for discounting in Pa SO 51 52 Internal Rate of Return IRR range of cells with all cash flows, including investment 53 Net Present Value NPV(discount rate range of cells with all FUTURE Chow) - Initiativement 56 55 Parent Viewpoint 56 The Parent Viewpoint need to control incrementalash now acts medings on the Agent 57 Year SR Sales volume 59 mon components & shoping costs for superat 60 Components direct in costs in 61 Cost of Us Manufactured boods Cash flows to Hera 62 63 Component sales compute sales of components a diary to produce in Dienste Analysis in Peso Netice Veroh Select destination and press ENTER or choose Paste Open recovered workbooks our recent changes were saved. Do you want to continue working where you left off? % Conditional Format Cell Formatting Table Styles P15 M Volume Volume Growth From abowould be intactation From above could be incontration From above could be initial controllation C 52 Internal Rate of Return IRR range of cells with all cash flows, including initial investment) 53 Net Present Value NPV(discount rate, range of cells with FUTURE cash flows) Internetsment 54 55 Para Viewpoint 56 The Parent Vwwpoint needs to consider al incremental cash flow impacts including loss on export sales to Argentina cumint poche 57 Year 58 Ses volume 59 Imported components & shipping costs for subeldiary.per set 60 Components direct & Indirect contain US. per set 61 Cost of Us Manufactured Finished Goods 52 Cash flows to Hermosa 63 Component Sales: compute sales of components to subsidiary to produce lightbulbs in Argentina 64 Salos venus on exports to Argentina 65 Lssdirect and indirect costs on exported to 66 Proton Hemo's component sales 67 US taxes 40% 68 a) Net profit on component les aforear 69 70 ) Dividends from Argentina to Hermosa (US) 71 72 Loss of sales: compute net sales that company would have made without subsidiary 73 Finished Goods Sales 74 Cost (Not incurred 75 Pro-tax prof 76 US taxes 40% 77 Netloss of sales tarda 78 79 Cash flow from sale of Argentine subsidiary trattamed) 80 81 Total parent cash flow after-tax abc 82 initial inement 83 Free cash flow to preferisconti BS Barnar ofretum range of cells with all cathews, including initial investment) 36 Net penale NPV) NPV contattare of calls with all FUTURE) 67 Vou Prior or from above conto imported Volume Price or from above out of exported Sale recout Pratit Tax Rate Profit-Taxes Dividend Nic. Depection from the con Revenues Argentine story from Forect pe o Sales Volume Mancing Castinus Lost Finished pods Sales Concur can lowote Last finished as a Neticaments de Tocalitati diary 89 90 Dashne analys Analysis in Pa Select destination and press ENTER or choose Paste MacBook Pro If recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks 15 Today A Melinda Deane, a new analysts at Hermosa and a recent MBA graduate, believes that it is a fundamental error to evaluate the Argentine project's prospective N eamings and cash flows in dollars, rather than first estimating their Argentine peso (Ps) value and then converting cash flow returns to the U.S. in dollars. She believes the correct method is to use the end-of-year spot rate in 2012 of Ps3.50$ and assume it will change in relation to purchasing power. (She is Sassuming U.S. inflation to be 1% per annum, Argentine inflation to be 5% per annum). She also believes that Hermosa should use a risk-adjusted discount 6 rate in Argentina which reflects Argentine capital costs (20% is her estimate) and a risk-adjusted discount rate for the parent viewpoint capital budget (18%) on the assumption that international projects in a risky currency environment should require a higher expected return than other lower risk projects. In 7 addition to prior assumptions, Hermosa wishes to evaluate the propsect of being able to sell the Argentine subsidiary at the end of years at a multiple of the 8 9 Assumptions Starting Growth Rates 10 LI but ex volume to Argentina per year 24,000 40 11 Sie price in Argentina, persel $ 60.00 7.00 12 Dre manufacturing cost of igbubs US per set $ 40.00 0.00% 13 Direct manufacturing cost of ontbus in Aunina, per set $ 20.00 6.00 14 ported components & shing costs for subsidiary part 5 10.00 0% 15 Components direct & Indirect costs in US pert 5 500 0% 16 Decibe vestimentos em 1,000,000 17 nanti at working capital 5 1,000,000 18 Discount rate in Argentina 20% 19 Sales multiple in Years 6.00 20 Current Spot PUSS Doday 3.50 1% 21 us on ne per SN 22 Aretinentation rate per 23 Discount iston US 24 25 26 The car budgeting analysis needs to be some on both the Prevent the Past 27 Project Viewpoint 23 Yes Perustel 29 PPP Expected exchange rate 30 Sales volume USS 31 Sans price in Argentina per set in US 32 Bricon Argentina per set in Ps 33 Material costs in Argentina per sein US$ 34 Materialist in Argentina per MUS 35 Lmported Materials control in USS 36 ore Materials cost per sets 39 Sales venin e Analysis in Peso Select destination and press ENTER or choose Paste MacBook Pro Paste Wrap Ten General . E Merge & Center $ - %) Open recovered workbookst Your recent changes were saved. Do you want to continue working where you left off? Conditional Format Call Formatting as Table Styles fo P15 Preved warrante infante/Clusi Sales Prici SSFX rate Material continente imported Marcos SSX rata B C D 25 26 The capital budeating analysis needs to be performed on both the Project Level Project Venon) and Parunt Lavel Partioint 27 28 Year Project Viewpoint 29 PPP Expected exchange rate 30 Sales volume 31 Sales price in Argentina per set in US$ 32 Sales price in Argentina per set in Ps 33 Material costs in Argentina per set in USS 34 Material costs in Argentina per set in Pa 35 Imported Materials cost per set in US$ 36 Imported Materials cost per set in Ps 37 Sales revenue in Pa 38 Direct manufacturing costs 39 Cost of worted US components 40 Gross profit 41 Depreciation 42 Pro-tax proft 43 Argentine taxes 40% 44 Net Income 45 Asd back depreciation 46 Annual project cash flow 47 Sales value in year mutiple of camins 48 Initial investment, totalins 49 Free cash flow for discounting in Pa SO 51 52 Internal Rate of Return IRR range of cells with all cash flows, including investment 53 Net Present Value NPV(discount rate range of cells with all FUTURE Chow) - Initiativement 56 55 Parent Viewpoint 56 The Parent Viewpoint need to control incrementalash now acts medings on the Agent 57 Year SR Sales volume 59 mon components & shoping costs for superat 60 Components direct in costs in 61 Cost of Us Manufactured boods Cash flows to Hera 62 63 Component sales compute sales of components a diary to produce in Dienste Analysis in Peso Netice Veroh Select destination and press ENTER or choose Paste Open recovered workbooks our recent changes were saved. Do you want to continue working where you left off? % Conditional Format Cell Formatting Table Styles P15 M Volume Volume Growth From abowould be intactation From above could be incontration From above could be initial controllation C 52 Internal Rate of Return IRR range of cells with all cash flows, including initial investment) 53 Net Present Value NPV(discount rate, range of cells with FUTURE cash flows) Internetsment 54 55 Para Viewpoint 56 The Parent Vwwpoint needs to consider al incremental cash flow impacts including loss on export sales to Argentina cumint poche 57 Year 58 Ses volume 59 Imported components & shipping costs for subeldiary.per set 60 Components direct & Indirect contain US. per set 61 Cost of Us Manufactured Finished Goods 52 Cash flows to Hermosa 63 Component Sales: compute sales of components to subsidiary to produce lightbulbs in Argentina 64 Salos venus on exports to Argentina 65 Lssdirect and indirect costs on exported to 66 Proton Hemo's component sales 67 US taxes 40% 68 a) Net profit on component les aforear 69 70 ) Dividends from Argentina to Hermosa (US) 71 72 Loss of sales: compute net sales that company would have made without subsidiary 73 Finished Goods Sales 74 Cost (Not incurred 75 Pro-tax prof 76 US taxes 40% 77 Netloss of sales tarda 78 79 Cash flow from sale of Argentine subsidiary trattamed) 80 81 Total parent cash flow after-tax abc 82 initial inement 83 Free cash flow to preferisconti BS Barnar ofretum range of cells with all cathews, including initial investment) 36 Net penale NPV) NPV contattare of calls with all FUTURE) 67 Vou Prior or from above conto imported Volume Price or from above out of exported Sale recout Pratit Tax Rate Profit-Taxes Dividend Nic. Depection from the con Revenues Argentine story from Forect pe o Sales Volume Mancing Castinus Lost Finished pods Sales Concur can lowote Last finished as a Neticaments de Tocalitati diary 89 90 Dashne analys Analysis in Pa Select destination and press ENTER or choose Paste MacBook Pro