- If S & S Air (the example in your outline) is not happy with growing revenue at 7.9% year-over-year, what options does it have to increase its revenue growth? Use the information of growth rates and the Dupont method to inform your answer.

I do not need help with the problems in the pictures, just the question above, thanks!

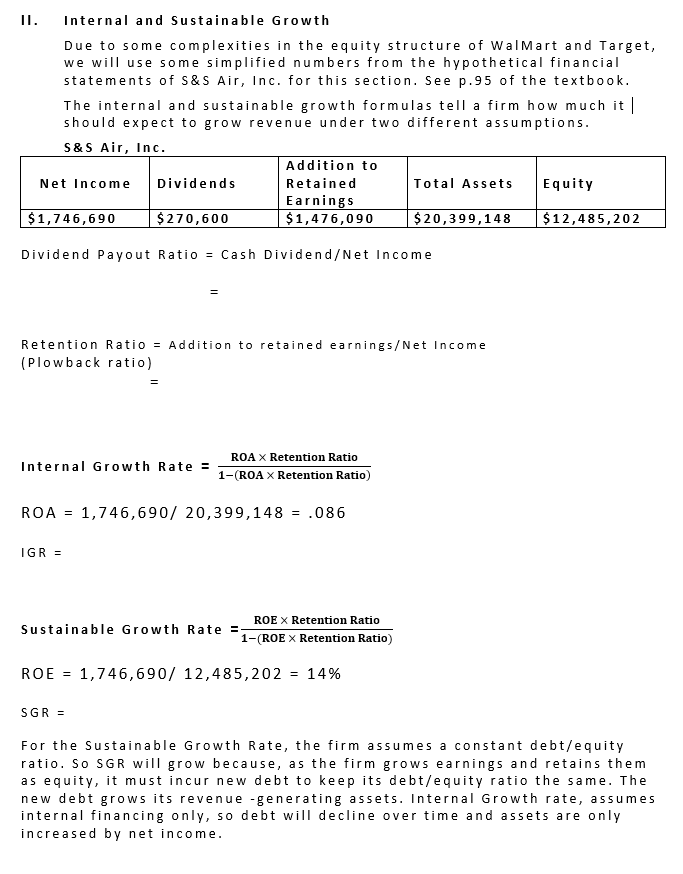

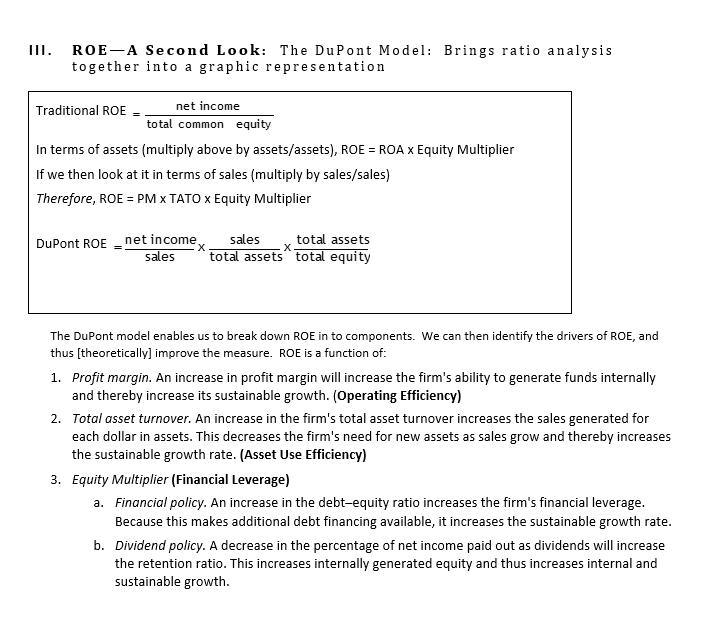

II. Internal and Sustainable Growth Due to some complexities in the equity structure of Walmart and Target, we will use some simplified numbers from the hypothetical financial statements of S&S Air, Inc. for this section. See p.95 of the textbook. The internal and sustainable growth formulas tell a firm how much it | should expect to grow revenue under two different assumptions. S&S Air, Inc. Addition to Net Income Dividends Retained Total Assets Equity Earnings $1,746,690 $ 270,600 $1,476,090 $ 20,399,148 $12,485,202 Dividend Payout Ratio = Cash Dividend/Net Income Retention Ratio = Addition to retained earnings/Net Income (Plowback ratio) Internal Growth Rate = ROA X Retention Ratio 1-(ROA X Retention Ratio) ROA = 1,746,690/ 20,399,148 = .086 IGRE Sustainable Growth Rate =- ROE X Retention Ratio 1-(ROE X Retention Ratio) ROE = 1,746,690/ 12,485,202 = 14% SGR = For the sustainable Growth Rate, the firm assumes a constant debt/equity ratio. So SGR will grow because, as the firm grows earnings and retains them as equity, it must incur new debt to keep its debt/equity ratio the same. The new debt grows its revenue -generating assets. Internal Growth rate, assumes internal financing only, so debt will decline over time and assets are only increased by net income. III. ROE-A Second Look: The DuPont Model: Brings ratio analysis together into a graphic representation Traditional ROE net income total common equity In terms of assets (multiply above by assets/assets), ROE = ROA X Equity Multiplier If we then look at it in terms of sales (multiply by sales/sales) Therefore, ROE = PM X TATO X Equity Multiplier DuPont ROE net income sales sales total assets total assets total equity The DuPont model enables us to break down ROE in to components. We can then identify the drivers of ROE, and thus (theoretically] improve the measure. ROE is a function of: 1. Profit margin. An increase in profit margin will increase the firm's ability to generate funds internally and thereby increase its sustainable growth. (Operating Efficiency) 2. Total asset turnover. An increase in the firm's total asset turnover increases the sales generated for each dollar in assets. This decreases the firm's need for new assets as sales grow and thereby increases the sustainable growth rate. (Asset Use Efficiency) 3. Equity Multiplier (Financial Leverage) a. Financial policy. An increase in the debt-equity ratio increases the firm's financial leverage. Because this makes additional debt financing available, it increases the sustainable growth rate. b. Dividend policy. A decrease in the percentage of net income paid out as dividends will increase the retention ratio. This increases internally generated equity and thus increases internal and sustainable growth. II. Internal and Sustainable Growth Due to some complexities in the equity structure of Walmart and Target, we will use some simplified numbers from the hypothetical financial statements of S&S Air, Inc. for this section. See p.95 of the textbook. The internal and sustainable growth formulas tell a firm how much it | should expect to grow revenue under two different assumptions. S&S Air, Inc. Addition to Net Income Dividends Retained Total Assets Equity Earnings $1,746,690 $ 270,600 $1,476,090 $ 20,399,148 $12,485,202 Dividend Payout Ratio = Cash Dividend/Net Income Retention Ratio = Addition to retained earnings/Net Income (Plowback ratio) Internal Growth Rate = ROA X Retention Ratio 1-(ROA X Retention Ratio) ROA = 1,746,690/ 20,399,148 = .086 IGRE Sustainable Growth Rate =- ROE X Retention Ratio 1-(ROE X Retention Ratio) ROE = 1,746,690/ 12,485,202 = 14% SGR = For the sustainable Growth Rate, the firm assumes a constant debt/equity ratio. So SGR will grow because, as the firm grows earnings and retains them as equity, it must incur new debt to keep its debt/equity ratio the same. The new debt grows its revenue -generating assets. Internal Growth rate, assumes internal financing only, so debt will decline over time and assets are only increased by net income. III. ROE-A Second Look: The DuPont Model: Brings ratio analysis together into a graphic representation Traditional ROE net income total common equity In terms of assets (multiply above by assets/assets), ROE = ROA X Equity Multiplier If we then look at it in terms of sales (multiply by sales/sales) Therefore, ROE = PM X TATO X Equity Multiplier DuPont ROE net income sales sales total assets total assets total equity The DuPont model enables us to break down ROE in to components. We can then identify the drivers of ROE, and thus (theoretically] improve the measure. ROE is a function of: 1. Profit margin. An increase in profit margin will increase the firm's ability to generate funds internally and thereby increase its sustainable growth. (Operating Efficiency) 2. Total asset turnover. An increase in the firm's total asset turnover increases the sales generated for each dollar in assets. This decreases the firm's need for new assets as sales grow and thereby increases the sustainable growth rate. (Asset Use Efficiency) 3. Equity Multiplier (Financial Leverage) a. Financial policy. An increase in the debt-equity ratio increases the firm's financial leverage. Because this makes additional debt financing available, it increases the sustainable growth rate. b. Dividend policy. A decrease in the percentage of net income paid out as dividends will increase the retention ratio. This increases internally generated equity and thus increases internal and sustainable growth