Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sam, age 32, owns and runs a dessert shop in Shatin. He has just received a notification that he has won the first prize

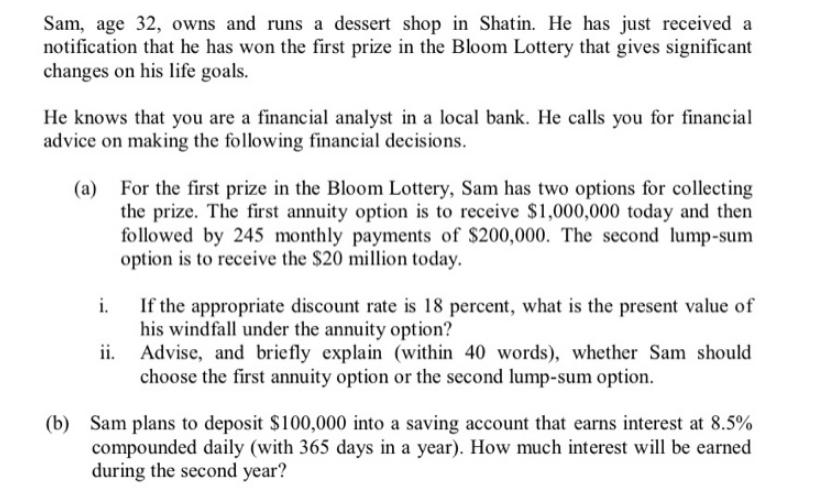

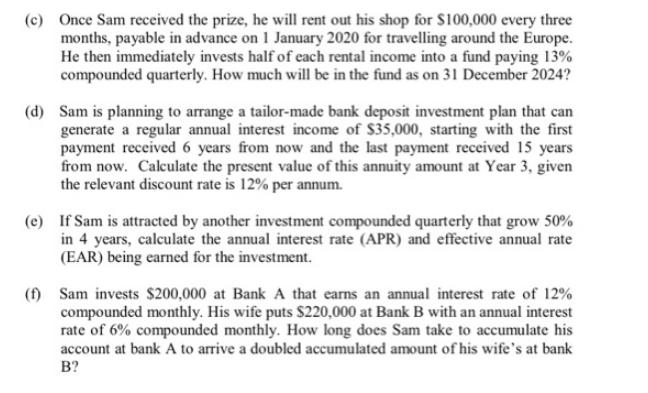

Sam, age 32, owns and runs a dessert shop in Shatin. He has just received a notification that he has won the first prize in the Bloom Lottery that gives significant changes on his life goals. He knows that you are a financial analyst in a local bank. He calls you for financial advice on making the following financial decisions. (a) For the first prize in the Bloom Lottery, Sam has two options for collecting the prize. The first annuity option is to receive $1,000,000 today and then followed by 245 monthly payments of $200,000. The second lump-sum option is to receive the $20 million today. i. If the appropriate discount rate is 18 percent, what is the present value of his windfall under the annuity option? Advise, and briefly explain (within 40 words), whether Sam should choose the first annuity option or the second lump-sum option. (b) Sam plans to deposit $100,000 into a saving account that earns interest at 8.5% compounded daily (with 365 days in a year). How much interest will be earned during the second year? (c) Once Sam received the prize, he will rent out his shop for S100,000 every three months, payable in advance on 1 January 2020 for travelling around the Europe. He then immediately invests half of each rental income into a fund paying 13% compounded quarterly. How much will be in the fund as on 31 December 2024? (d) Sam is planning to arrange a tailor-made bank deposit investment plan that can generate a regular annual interest income of $35,000, starting with the first payment received 6 years from now and the last payment received 15 years from now. Calculate the present value of this annuity amount at Year 3, given the relevant discount rate is 12% per annum. (e) If Sam is attracted by another investment compounded quarterly that grow 50% in 4 years, calculate the annual interest rate (APR) and effective annual rate (EAR) being earned for the investment. (f) Sam invests $200,000 at Bank A that earns an annual interest rate of 12% compounded monthly. His wife puts $220,000 at Bank B with an annual interest rate of 6% compounded monthly. How long does Sam take to accumulate his account at bank A to arrive a doubled accumulated amount of his wife's at bank B?

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a i PV of windfall under annuity option amount received today PV of monthly pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started