if someone could help me with this problem i would appreciate it! im not sure how to so any of it. parts a and b are what i am really struggling with. thank you!

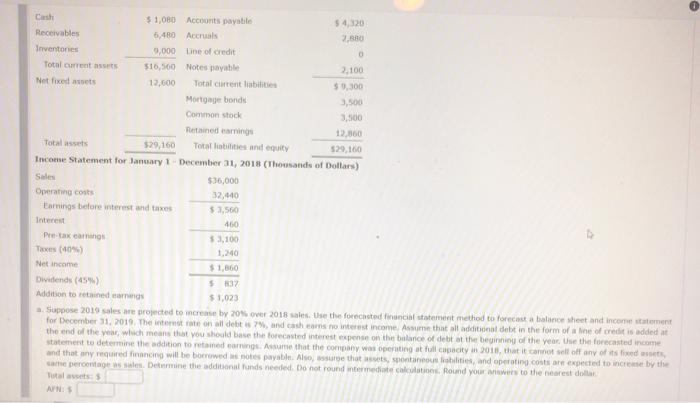

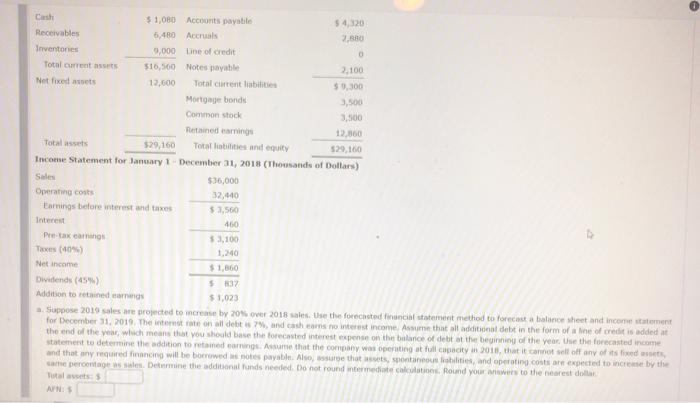

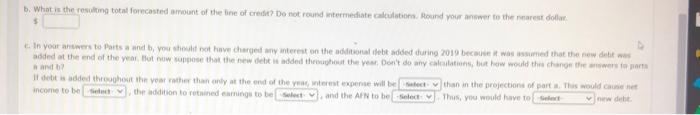

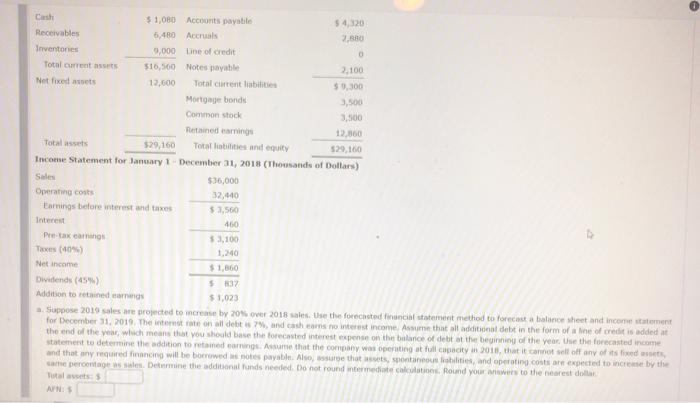

0 2,100 Cash 51,080 Accounts payabile 54,320 Receivables 6,480 Arcus 2,380 Inventones 9,000 Line of credit 0 Total currentes $16,500 Notes payable Net fixed as 12,600 Total current liabilities $ 0,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,060 Total assets $29,160 Total liabilities and equity 529,160 Income Statement for January 1 - December 31, 2018 (Thousands of Dollars) Sales $36,000 Operating costs 32.410 Earnings before interest and taxes 53.560 Interest Pretax cang 53,100 Taxes (46 1,240 Net income $ 1,860 Dividends (453) $ 37 Addition to retained and $1,023 a. Soppose 2019 sales are projected to increase by 20% over 2018 sales. Use the forecasted financial statement method to forecast a balance sheet and income statement for December 31, 2019. The interrate on all debitis and cash cans no interest income. Assume that all additional debt in the form of a line of credit is added at the end of the year, which means that you should be the forecasted interest pres on the balance of debt at the beginning of the year Use the forecasted income statement to determine the addition to retained coming. Assume that the company was operating at full capacity in 2018, that it cannot sell off any of its and that any required financing will be borrowed notes payable. Also sure that assets, spontaneous abilities, and operating costs are expected to increased by the a percentage en Dermine the additional funds needed. Do not round intermediate calculations. Round your answer to the nearest dollar Talaves ANS 460 5. What is the resulting total forecasted arount of the line of crede? Do not found intermediate calculation sound your answer to the newest dota. $ in your answers to Parts and by you should not have charged my interest on the additional debt added during 2019 because it wassumed that the new detit added at the end of the year Bot now that the new debt is added throughout the year, Don't do any can, but how would the channes It debt added throughout the year rather than only at the end of the expense will be than in the projections of parts would come income to the the addition to retained camning to be safety and the An to be select Thus, you would have to new debe