If someone could help me with this that would be awesome. Thank you

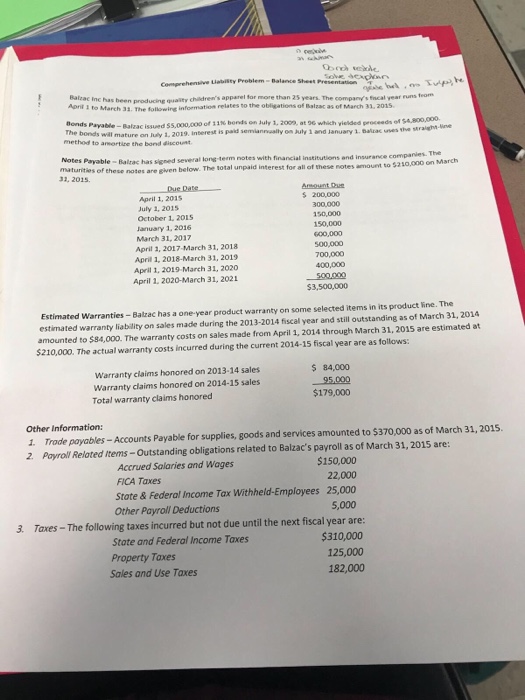

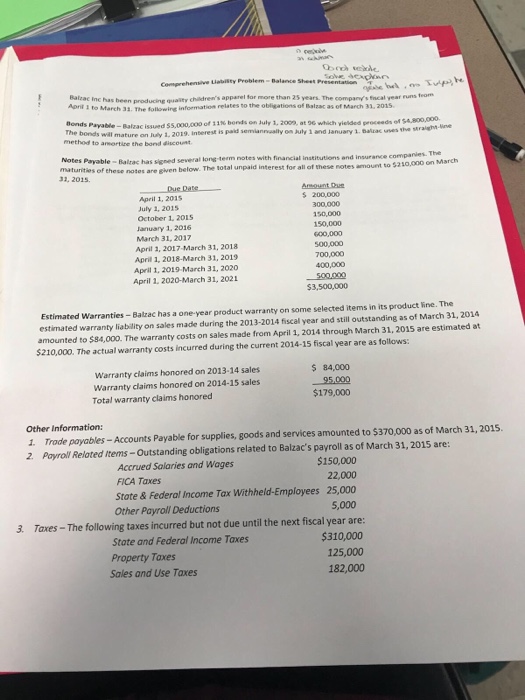

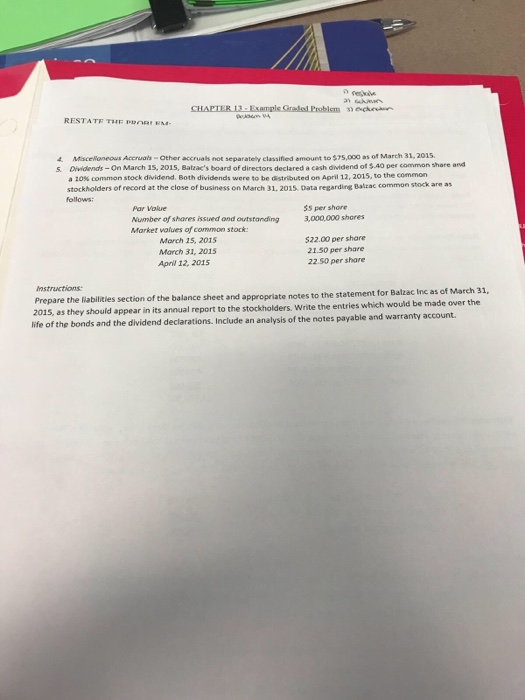

iebitity Problem- Balance Sheet Presenatione he Balzac inc has been producine quality children's apparel for more than 25 years. The company's fincal year runs The fullowie information relates to the obligations of Balrac as of March 31, 201s. onds Payable-Balzac issued SS.000,00 on 1 % bonds on July 1. 2009, at % which yielded proceeds of The bonds will mature on luly 1, 2019. Inberest is paikd semlannually on buly 1 and January 1. Balzac unes method to amortine the bond diucount the straight-ne Notes Payable - maturities of these notes are given Balrac has signed several long-term notes with financial institution s and insurance companies. The below. The total unpaid interest for all of these notes amount to $210,000on 33, 2015 DueDate 5 200,000 300,000 150,000 150,000 600,000 00,000 700,000 400,000 April 1, 2015 July 1, 201s October 1, 2015 January 1, 2016 March 31,2017 April 1, 2017-March 31, 2018 April 1, 2018-March 31, 2019 April 1, 2019-March 31, 2020 April 1. 2020-March 31, 2021 $3,500,000 Estimated Warranties - Balzac has a one- year product warranty on some selected items in its product ine. The estimated warranty liability on sales made during the 2013-2014 fiscal year and still outstanding as of March 31, 2014 amounted to $84,000. The warranty costs on sales made from April 1, 2014 through March 31, 2015 are estimated at $210,000. The actual warranty costs incurred during the current 2014-15 fiscal year are as follows: Warranty claims honored on 2013-14 sales Warranty claims honored on 2014-15 sales Total warranty claims honored 84,000 -95,000 $179,000 Other Information: 1. Trade payables-Accounts 2 Poyroll Reloted tems-Outstanding obligations related to Balzac's payroll as of March 31, 2015 are Payable for supplies, oods and services amounted to $370,000as of March 31, 2015. $150,000 22,000 State & Federal Income Tax Withheld-Employees 25,000 5,000 Accrued Salaries and Wages FICA Taxes Other Payroll Deductions State and Federal Income Taxes Property Taxes Sales and Use Taxes e next fiscal year are: $310,000 125,000 182,000 iebitity Problem- Balance Sheet Presenatione he Balzac inc has been producine quality children's apparel for more than 25 years. The company's fincal year runs The fullowie information relates to the obligations of Balrac as of March 31, 201s. onds Payable-Balzac issued SS.000,00 on 1 % bonds on July 1. 2009, at % which yielded proceeds of The bonds will mature on luly 1, 2019. Inberest is paikd semlannually on buly 1 and January 1. Balzac unes method to amortine the bond diucount the straight-ne Notes Payable - maturities of these notes are given Balrac has signed several long-term notes with financial institution s and insurance companies. The below. The total unpaid interest for all of these notes amount to $210,000on 33, 2015 DueDate 5 200,000 300,000 150,000 150,000 600,000 00,000 700,000 400,000 April 1, 2015 July 1, 201s October 1, 2015 January 1, 2016 March 31,2017 April 1, 2017-March 31, 2018 April 1, 2018-March 31, 2019 April 1, 2019-March 31, 2020 April 1. 2020-March 31, 2021 $3,500,000 Estimated Warranties - Balzac has a one- year product warranty on some selected items in its product ine. The estimated warranty liability on sales made during the 2013-2014 fiscal year and still outstanding as of March 31, 2014 amounted to $84,000. The warranty costs on sales made from April 1, 2014 through March 31, 2015 are estimated at $210,000. The actual warranty costs incurred during the current 2014-15 fiscal year are as follows: Warranty claims honored on 2013-14 sales Warranty claims honored on 2014-15 sales Total warranty claims honored 84,000 -95,000 $179,000 Other Information: 1. Trade payables-Accounts 2 Poyroll Reloted tems-Outstanding obligations related to Balzac's payroll as of March 31, 2015 are Payable for supplies, oods and services amounted to $370,000as of March 31, 2015. $150,000 22,000 State & Federal Income Tax Withheld-Employees 25,000 5,000 Accrued Salaries and Wages FICA Taxes Other Payroll Deductions State and Federal Income Taxes Property Taxes Sales and Use Taxes e next fiscal year are: $310,000 125,000 182,000