Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the 6-year spot rate is 8.28%/year then what is the 6-year continuously-compounded interest rate in percent per year to two decimal places? Given the

If the 6-year spot rate is 8.28%/year then what is the 6-year continuously-compounded interest rate in percent per year to two decimal places?

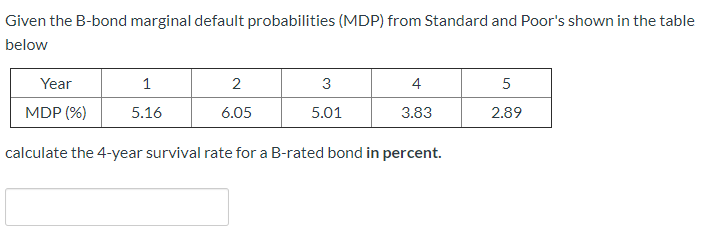

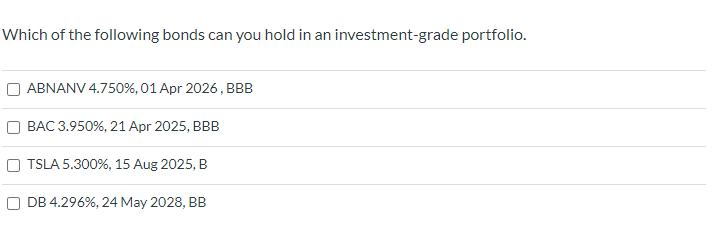

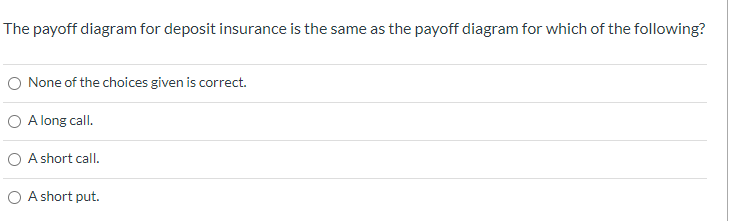

Given the B-bond marginal default probabilities (MDP) from Standard and Poor's shown in the table below 1 2 3 5 Year MDP (%) 4 3.83 5.16 6.05 5.01 2.89 calculate the 4-year survival rate for a B-rated bond in percent. Which of the following bonds can you hold in an investment-grade portfolio. ABNANV 4.750%, 01 Apr 2026, BBB BAC 3.950%, 21 Apr 2025, BBB TSLA 5.300%, 15 Aug 2025, B DB 4.296%, 24 May 2028, BB The payoff diagram for deposit insurance is the same as the payoff diagram for which of the following? None of the choices given is correct. O A long call. O A short call. O A short putStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started