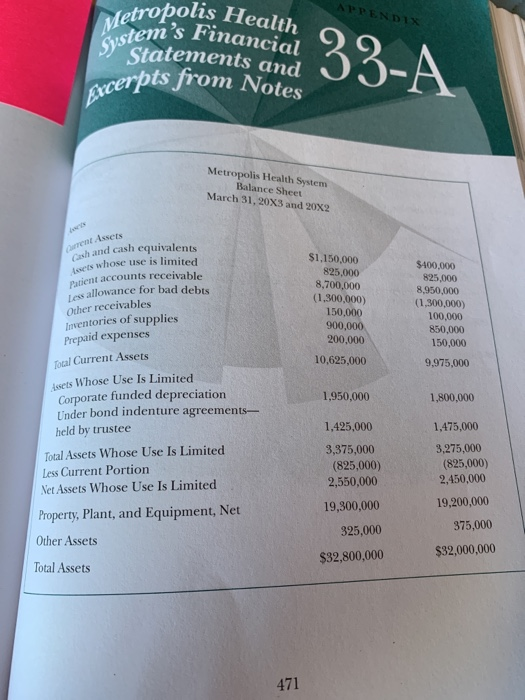

If the allowance for bad statement (a.k.a. statement of revenue and expense) also rises. Think debt expense (a.k.a. provision for doubtful gure of of these two accounts as a pair. Practice Exercise 11-I1: Components of Balance Sheet and Income Statement Refer to Doctors Smith and Brown's balance sheet, where patient a at $40,000. Do you think this figure is net of an allowance for bad debts? accounts receivable is state Assignment Exercise 11-2: Components of Balance Sheet and Income Statement Refer to the Metropolis Health System (MHS) balance sheet and statement of revenue a expense in the MHS Case Study appearing in Chapter 33. Patient accounts receivable of $7,400 is shown as net of $1,300,000 allowance for bad debts (8,700,000 1,300,000 = 7,400,0 (1) What percentage of gross accounts receivable is the allowance for bad debts? (2) If the a ance for bad debts is raised to $1,500,000, where does the extra $200,000 go? Example 11B: Components of Balance Sheet and Income Statement lin Exhibit 11-1 means the property, plant, and equipmer he reserve for depreciation. If the reser Refer to Exhibit 11-1 and Exhibit 11-2's Westside Clinic statements. The "Property, nse on the ir APPENDIX Metropolis Health System's Financial Statements and 33-A Excerpts from Notes Metropolis Health System Balance Sheet March 31, 20X3 and 20X2 Cash and cash cquivalents Assets whose use is limited Patient accounts receivable Les allowance for bad debts Other receivables Inventories of supplies Prepaid expenses Carent Assets $1,150,000 825,000 8,700,000 (1,300,000) 150,000 900,000 200,000 $400,000 825,000 8,950,000 (1,300,000) 100,000 850,000 150,000 10,625,000 Tocal Current Assets 9,975,000 sets Whose Use Is Limited Corporate funded depreciation Under bond indenture agreements- 1,950,000 1,800,000 1,425,000 1,475,000 held by trustee Total Assets Whose Use Is Limited Less Current Portion Net Assets Whose Use Is Limited 3,275,000 (825,000) 2,450,000 3,375,000 (825,000) 2,550,000 19,200,000 19,300,000 Property,Plant, and Equipment, Net 375,000 325,000 Other Assets $32,000,000 $32,800,000 Total Assets 471 If the allowance for bad statement (a.k.a. statement of revenue and expense) also rises. Think debt expense (a.k.a. provision for doubtful gure of of these two accounts as a pair. Practice Exercise 11-I1: Components of Balance Sheet and Income Statement Refer to Doctors Smith and Brown's balance sheet, where patient a at $40,000. Do you think this figure is net of an allowance for bad debts? accounts receivable is state Assignment Exercise 11-2: Components of Balance Sheet and Income Statement Refer to the Metropolis Health System (MHS) balance sheet and statement of revenue a expense in the MHS Case Study appearing in Chapter 33. Patient accounts receivable of $7,400 is shown as net of $1,300,000 allowance for bad debts (8,700,000 1,300,000 = 7,400,0 (1) What percentage of gross accounts receivable is the allowance for bad debts? (2) If the a ance for bad debts is raised to $1,500,000, where does the extra $200,000 go? Example 11B: Components of Balance Sheet and Income Statement lin Exhibit 11-1 means the property, plant, and equipmer he reserve for depreciation. If the reser Refer to Exhibit 11-1 and Exhibit 11-2's Westside Clinic statements. The "Property, nse on the ir APPENDIX Metropolis Health System's Financial Statements and 33-A Excerpts from Notes Metropolis Health System Balance Sheet March 31, 20X3 and 20X2 Cash and cash cquivalents Assets whose use is limited Patient accounts receivable Les allowance for bad debts Other receivables Inventories of supplies Prepaid expenses Carent Assets $1,150,000 825,000 8,700,000 (1,300,000) 150,000 900,000 200,000 $400,000 825,000 8,950,000 (1,300,000) 100,000 850,000 150,000 10,625,000 Tocal Current Assets 9,975,000 sets Whose Use Is Limited Corporate funded depreciation Under bond indenture agreements- 1,950,000 1,800,000 1,425,000 1,475,000 held by trustee Total Assets Whose Use Is Limited Less Current Portion Net Assets Whose Use Is Limited 3,275,000 (825,000) 2,450,000 3,375,000 (825,000) 2,550,000 19,200,000 19,300,000 Property,Plant, and Equipment, Net 375,000 325,000 Other Assets $32,000,000 $32,800,000 Total Assets 471