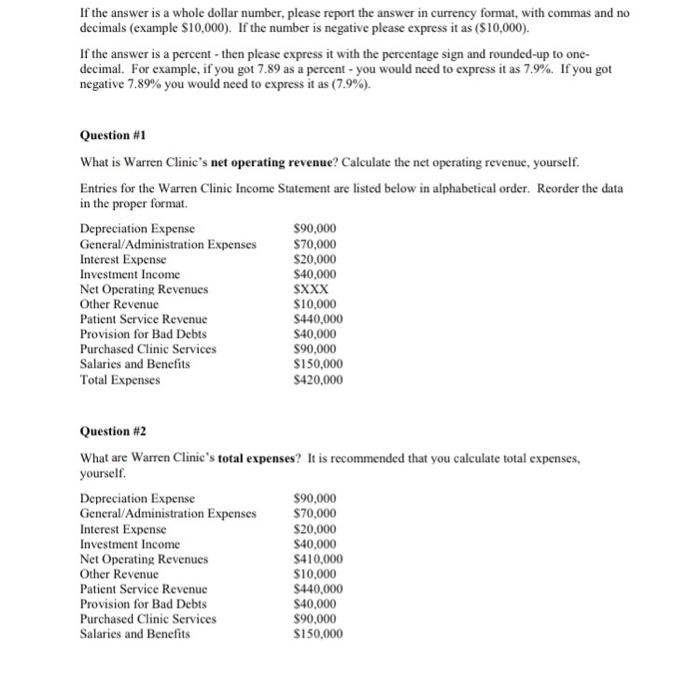

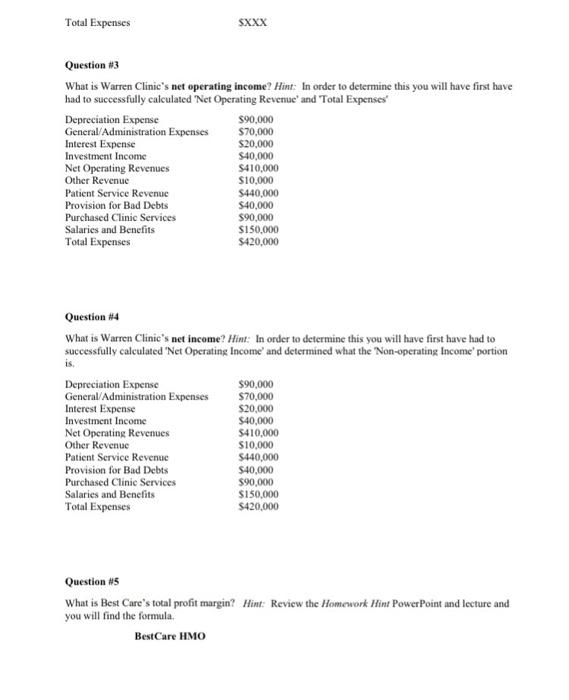

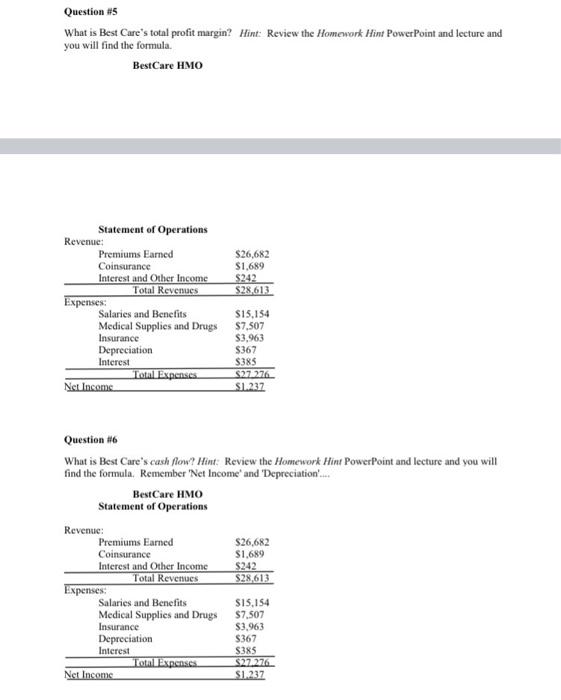

If the answer is a whole dollar number, please report the answer in currency format, with commas and no decimals (example $10,000). If the number is negative please express it as ($10,000). If the answer is a percent - then please express it with the percentage sign and rounded-up to one- decimal. For example, if you got 7.89 as a percent - you would need to express it as 7.9%. If you got negative 7.89% you would need to express it as (7.9%). Question #1 What is Warren Clinic's net operating revenue? Calculate the net operating revenue, yourself. Entries for the Warren Clinic Income Statement are listed below in alphabetical order. Reorder the data in the proper format Depreciation Expense $90,000 General/Administration Expenses $70,000 Interest Expense $20,000 Investment Income $40,000 Net Operating Revenues SXXX Other Revenue $10,000 Patient Service Revenue $440,000 Provision for Bad Debts $40,000 Purchased Clinic Services $90,000 Salaries and Benefits $150,000 Total Expenses $420,000 Question #2 What are Warren Clinic's total expenses? It is recommended that you calculate total expenses, yourself Depreciation Expense $90,000 General Administration Expenses $70,000 Interest Expense $20,000 Investment Income $40,000 Net Operating Revenues $410,000 Other Revenue $10,000 Patient Service Revenue $440,000 Provision for Bad Debts $40,000 Purchased Clinic Services $90,000 Salaries and Benefits $150,000 Total Expenses SXXX Question 3 What is Warren Clinic's net operating income? Hint: In order to determine this you will have first have had to successfully calculated "Net Operating Revenue' and Total Expenses' Depreciation Expense 90,000 General Administration Expenses $70,000 Interest Expense $20,000 Investment Income $40,000 Net Operating Revenues $410,000 Other Revenue $10,000 Patient Service Revenue S440,000 Provision for Bad Debts S40,000 Purchased Clinic Services $90,000 Salaries and Benefits $150,000 Total Expenses $420,000 Question 14 What is Warren Clinic's net income? Hint: In order to determine this you will have first have had to successfully calculated "Net Operating Income and determined what the 'Non-operating Income' portion Depreciation Expense General/Administration Expenses Interest Expense Investment Income Net Operating Revenues Other Revenue Patient Service Revenue Provision for Bad Debts Purchased Clinic Services Salaries and Benefits Total Expenses $90,000 $70,000 $20,000 $40,000 $410,000 S10,000 $440,000 $40,000 $90,000 $150.000 $420,000 Question #5 What is Best Care's total profit margin? Hint: Review the Homework Hint PowerPoint and lecture and you will find the formula BestCare HMO Question #5 What is Best Care's total profit margin? Hint: Review the Homework Hint PowerPoint and lecture and you will find the formula BestCare HMO $26,682 $1,689 $242 $28,613 Statement of Operations Revenue: Premiums Earned Coinsurance Interest and Other Income Total Revenues Expenses Salaries and Benefits Medical Supplies and Drugs Insurance Depreciation Interest Total Expenses Net Income $15,154 $7,507 $3.963 $367 $385 $27.276 SL.237 Question #6 What is Best Care's cash flow? Hint Review the Homework Hint PowerPoint and lecture and you will find the formula. Remember 'Net Income' and 'Depreciation'... BestCare HMO Statement of Operations Revenue: Premiums Earned $26,682 Coinsurance $1,689 Interest and Other Income $242 Total Revenues $28,613 Expenses: Salaries and Benefits SIS,154 Medical Supplies and Drugs $7.507 Insurance $3.963 Depreciation $367 Interest $385 Total Expenses $27.276 Net Income S1.237