If the Bowie plant is sold, those operations will need to shift to the main Largo facility. The CEO is proposing to acquire robotics-based sorting

If the Bowie plant is sold, those operations will need to shift to the main Largo facility. The CEO is proposing to acquire robotics-based sorting and distribution equipment to facilitate more cost-effective operations (and be able to handle the increased workload) at Largo.

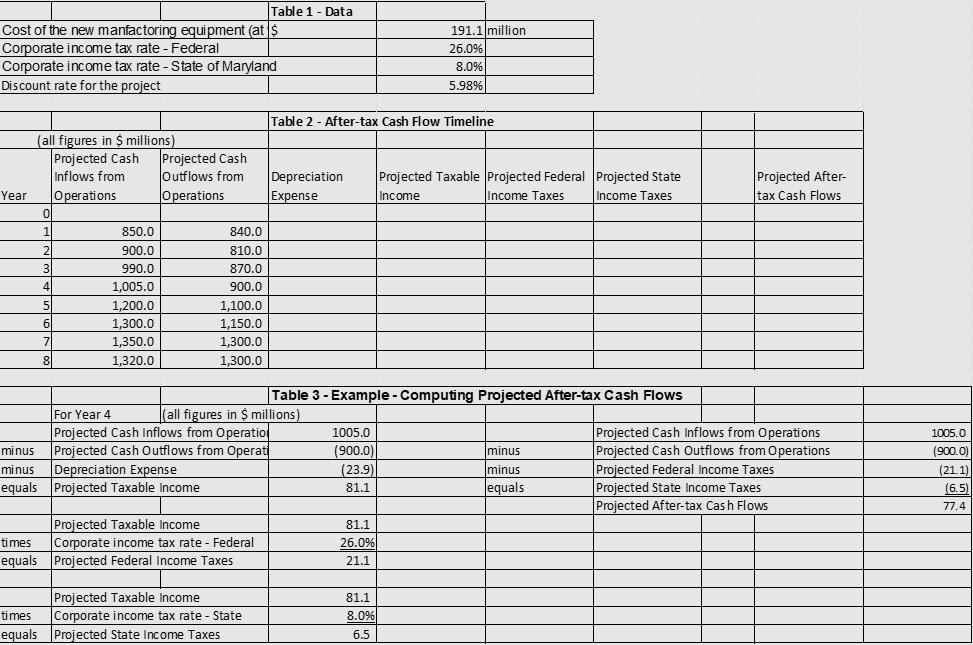

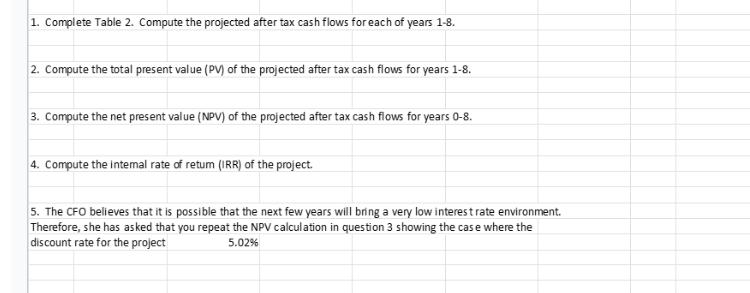

The CFO has asked you to evaluate the cash flow projections associated with the equipment purchase proposal and recommend whether the purchase should go forward. Table 2 shows projections of the cash inflows and outflows that would occur during the first eight years using the new equipment.

Keep the following in mind:

- Depreciation. The equipment will be depreciated using the straight-line method over eight years. The projected salvage value is $0.

- Taxes. The CFO estimates that company operations as a whole will be profitable on an ongoing basis. As a result, any accounting loss on this specific project will provide a tax benefit in the year of the loss.

Cost of the new manfactoring equipment (at $ Corporate income tax rate - Federal Corporate income tax rate - State of Maryland Discount rate for the project Year (all figures in $ millions) Projected Cash Inflows from Operations ol 1 times equals 2 3 4 5 6 7 81 850.0 900.0 990.0 1,005.0 1,200.0 1,300.0 1,350.0 1,320.0 Projected Cash Outflows from Operations minus minus equals Projected Taxable income 840.0 810.0 870.0 900.0 1,100.0 1,150.0 1,300.0 1,300.0 Table 1 - Data Projected Taxable Income Corporate income tax rate - Federal Projected Federal Income Taxes Projected Taxable income times Corporate income tax rate - State equals Projected State Income Taxes For Year 4 (all figures in $ millions) Projected Cash Inflows from Operatio Projected Cash Outflows from Operati Depreciation Expense Table 2 - After-tax Cash Flow Timeline Depreciation Projected Taxable Projected Federal Projected State Expense Income Taxes Income Taxes Income Table 3 - Example - Computing Projected After-tax Cash Flows 1005.0 (900.0) 191.1 million 26.0% 8.0% 5.98% (23.9) 81.1 81.1 26.0% 21.1 81.1 8.0% 6.5 minus minus equals Projected After- tax Cash Flows Projected Cash Inflows from Operations Projected Cash Outflows from Operations Projected Federal Income Taxes Projected State Income Taxes Projected After-tax Cash Flows 1005.0 (900.0) (21.1) (6.5) 77.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The current worth of incomes the NPV utilizing the two rebate rates as well as the inside pace of re... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards