Answered step by step

Verified Expert Solution

Question

1 Approved Answer

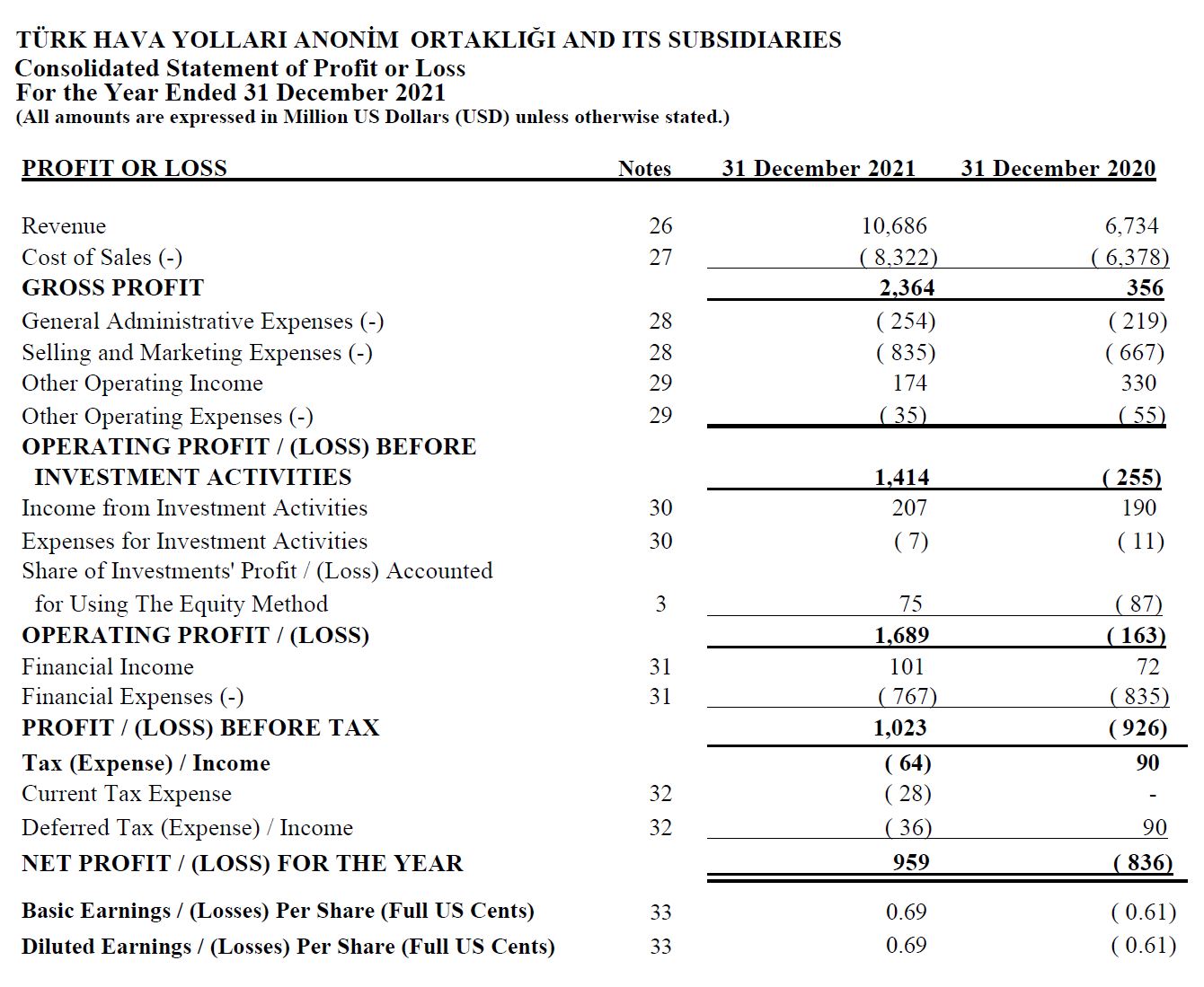

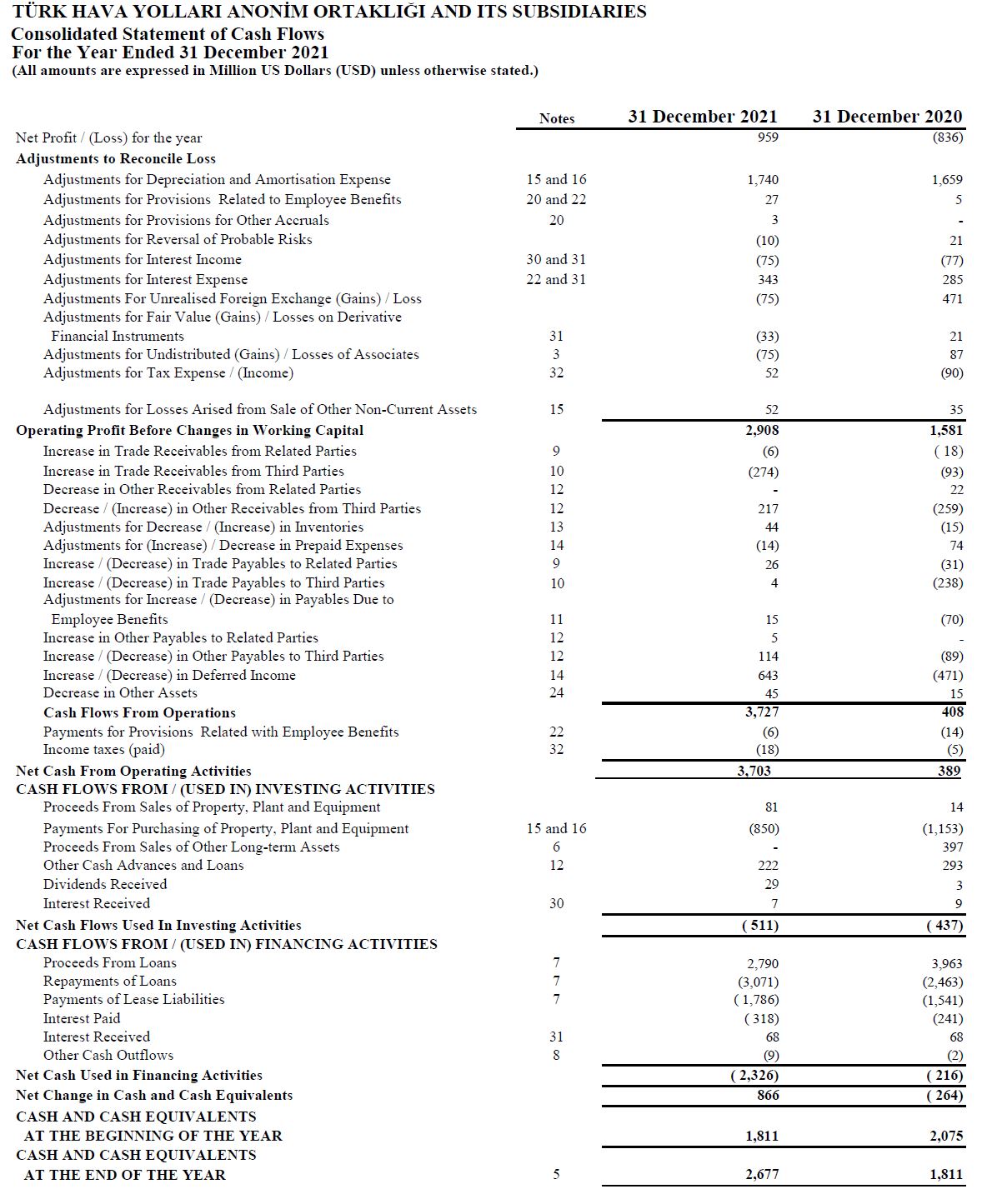

If the Company recognized $200 (in millions) more depreciation expense than currently recorded, what would be the change to Net cash provided by operating activities?

If the Company recognized $200 (in millions) more depreciation expense than currently recorded, what would be the change to Net cash provided by operating activities?

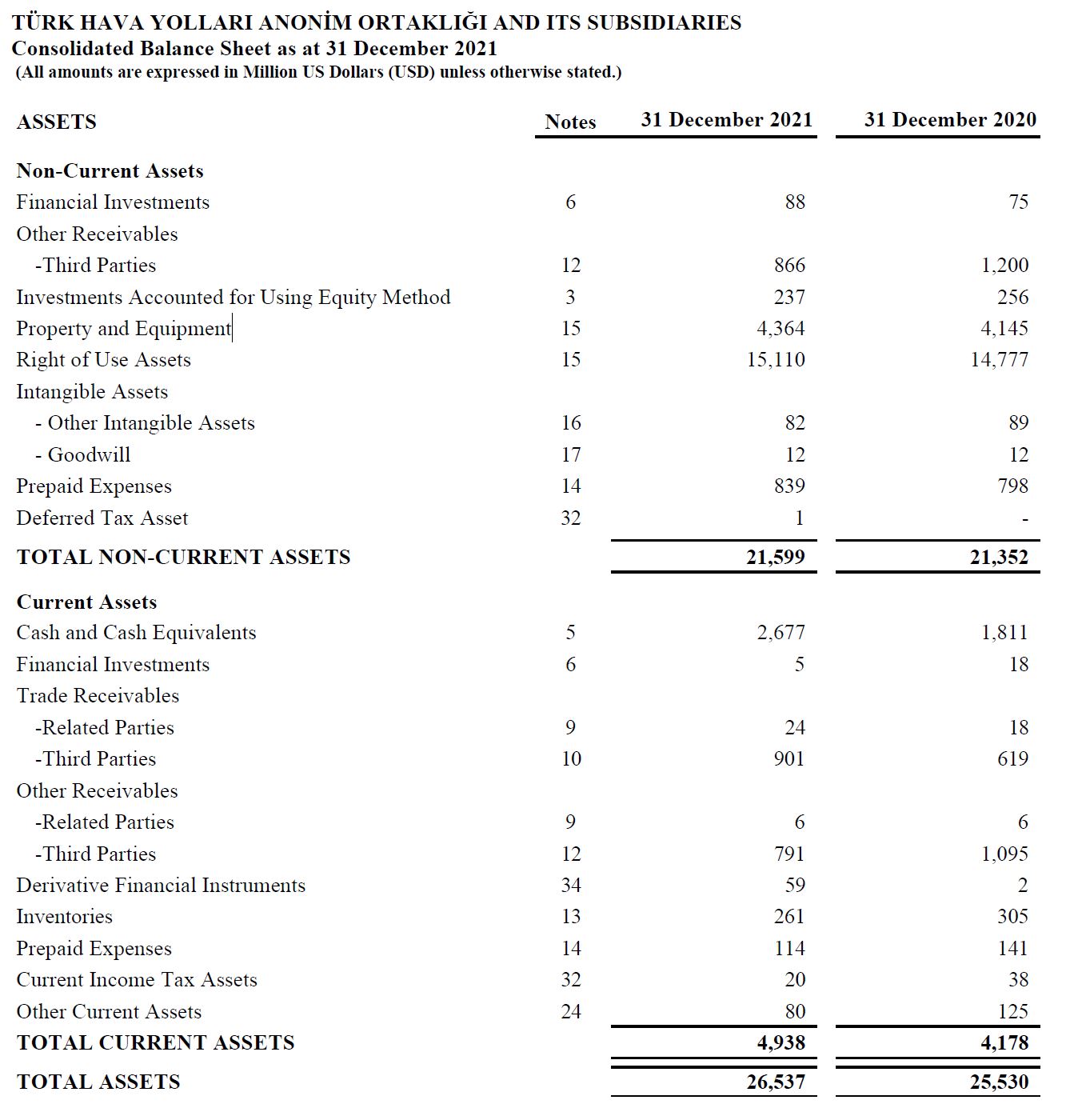

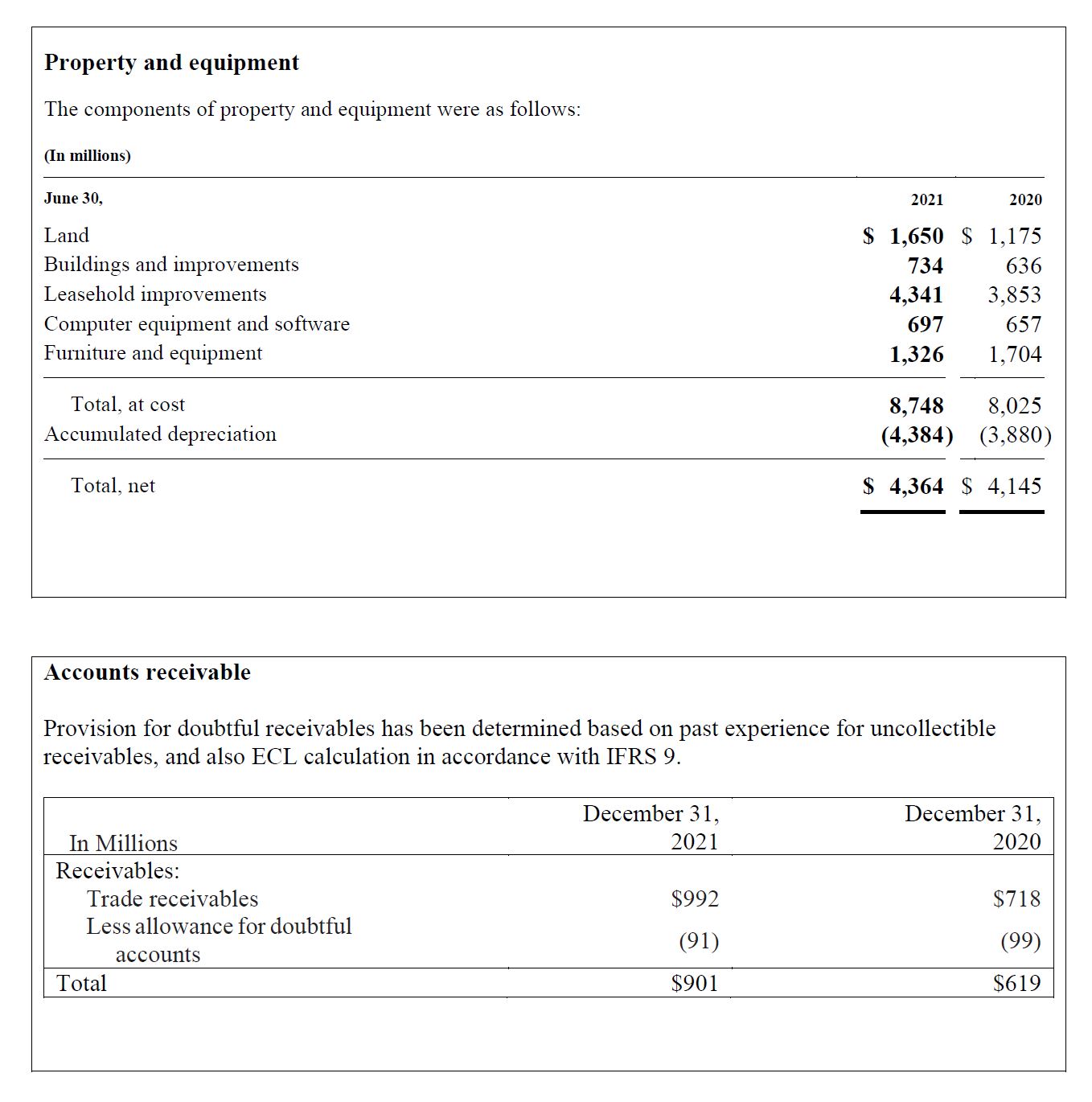

TRK HAVA YOLLARI ANONM ORTAKLII AND ITS SUBSIDIARIES Consolidated Balance Sheet as at 31 December 2021 (All amounts are expressed in Million US Dollars (USD) unless otherwise stated.) ASSETS Non-Current Assets Financial Investments Other Receivables Notes 31 December 2021 31 December 2020 16 88 88 75 75 -Third Parties Investments Accounted for Using Equity Method Property and Equipment 15 Right of Use Assets 2355 12 866 1,200 237 256 4,364 4,145 15 15,110 14,777 Intangible Assets - Other Intangible Assets - Goodwill Prepaid Expenses Deferred Tax Asset 32 6712 16 82 89 17 12 12 14 839 798 1 TOTAL NON-CURRENT ASSETS 21,599 21,352 Current Assets Cash and Cash Equivalents Financial Investments Trade Receivables 56 2.677 1,811 5 18 -Related Parties -Third Parties Other Receivables -Related Parties -Third Parties Derivative Financial Instruments Inventories Prepaid Expenses 16 9 10 901 24 18 619 9 923 6 6 12 791 1,095 34 59 2 13 261 305 14 114 141 Current Income Tax Assets 32 20 38 Other Current Assets 24 80 125 TOTAL CURRENT ASSETS 4,938 4,178 TOTAL ASSETS 26,537 25,530

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started