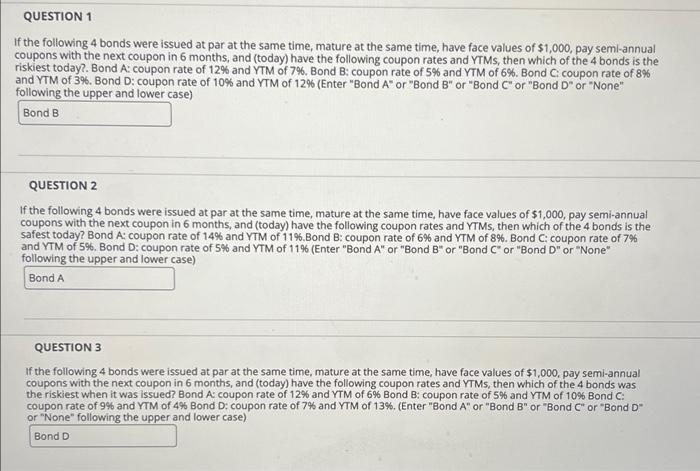

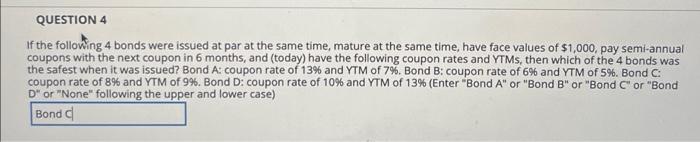

If the following 4 bonds were issued at par at the same time, mature at the same time, have face values of $1,000, pay seml-annual coupons with the next coupon in 6 months, and (today) have the following coupon rates and YTMs, then which of the 4 bonds is the riskiest today?. Bond A: coupon rate of 12% and YTM of 7%. Bond B: coupon rate of 5% and YTM of 6%. Bond C: coupon rate of 8% and YTM of 3%. Bond D: coupon rate of 10% and YTM of 12% (Enter "Bond A" or "Bond B" or "Bond C" or "Bond D" or "None" following the upper and lower case) QUESTION 2 If the following 4 bonds were issued at par at the same time, mature at the same time, have face values of $1,000, pay semi-annual coupons with the next coupon in 6 months, and (today) have the following coupon rates and YTMs, then which of the 4 bonds is the safest today? Bond A: coupon rate of 14% and YTM of 11%.Bond B: coupon rate of 6% and YTM of 8%. Bond C: coupon rate of 7% and YTM of 5\%. Bond D: coupon rate of 5\% and YTM of 11% (Enter "Bond A" or "Bond B" or "Bond C" or "Bond D" or "None" following the upper and lower case) QUESTION 3 If the following 4 bonds were issued at par at the same time, mature at the same time, have face values of $1,000, pay semi-annual coupons with the next coupon in 6 months, and (today) have the following coupon rates and YTMs, then which of the 4 bonds was coupon rate of 9% and YTM of 4% Bond D: coupon rate of 7% and YTM of 13%. (Enter "Bond A" or "Bond B" or "Bond C" or "Bond D" or "None" following the upper and lower case) If the following 4 bonds were issued at par at the same time, mature at the same time, have face values of $1,000, pay semi-annual coupons with the next coupon in 6 months, and (today) have the following coupon rates and YTMs, then which of the 4 bonds was the safest when it was issued? Bond A: coupon rate of 13% and YTM of 7%. Bond B: coupon rate of 6% and YTM of 5%. Bond C: coupon rate of 8% and YTM of 9\%. Bond D: coupon rate of 10% and YTM of 13% (Enter "Bond A" or "Bond B" or "Bond C" or "Bond D" or "None" following the upper and lower case)