IF THE IMAGE IS TOO SMALL, PLEASE ENLARGE THE PAGE BY CLICKING CONTROL BOTTON AND SCROLLING YOUR MOUSE WHEEL FORWARD TO ZOOM IN THE PAGE!!!

IF THE IMAGE IS TOO SMALL, PLEASE ENLARGE THE PAGE BY CLICKING CONTROL BOTTON AND SCROLLING YOUR MOUSE WHEEL FORWARD TO ZOOM IN THE PAGE!!!

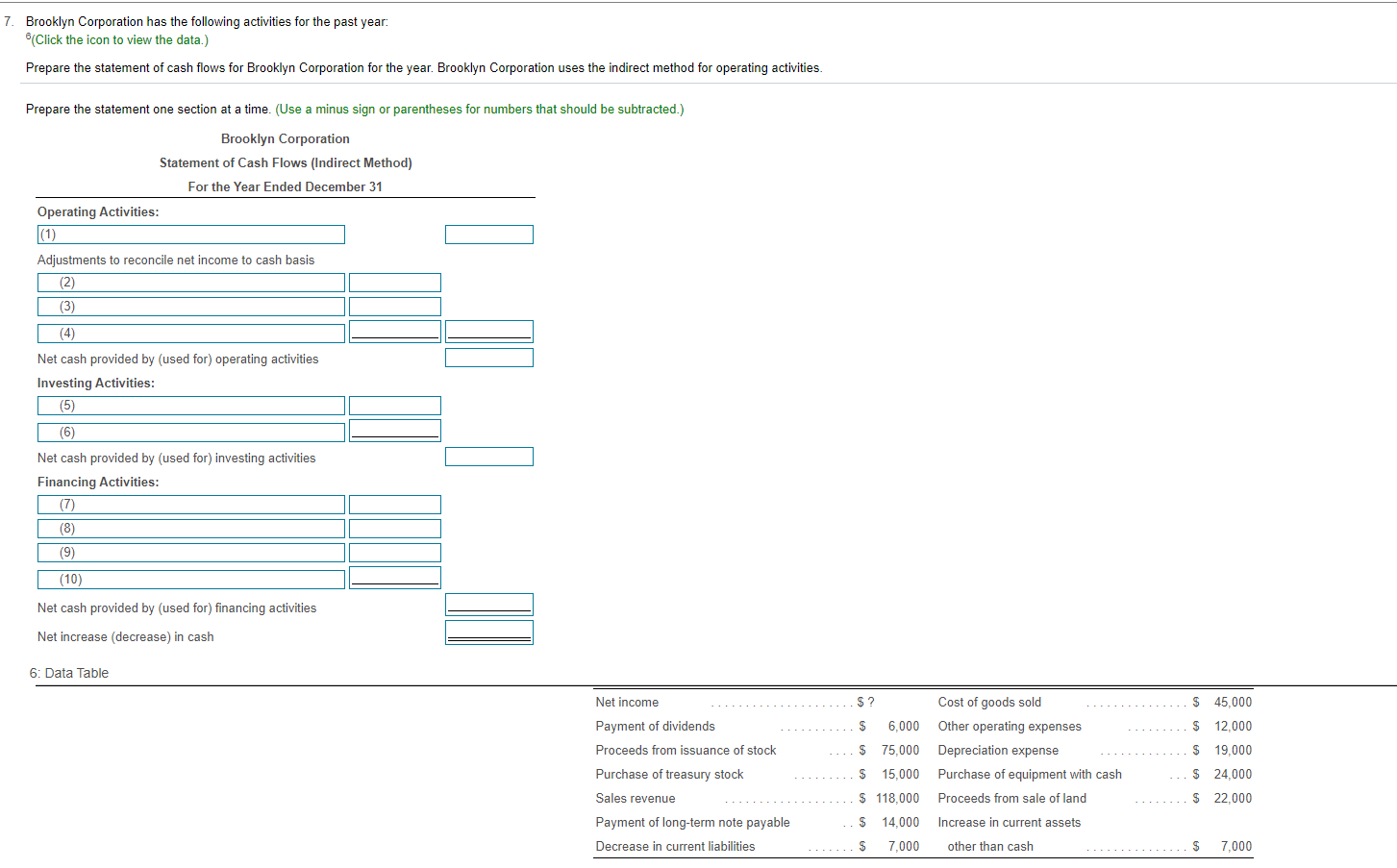

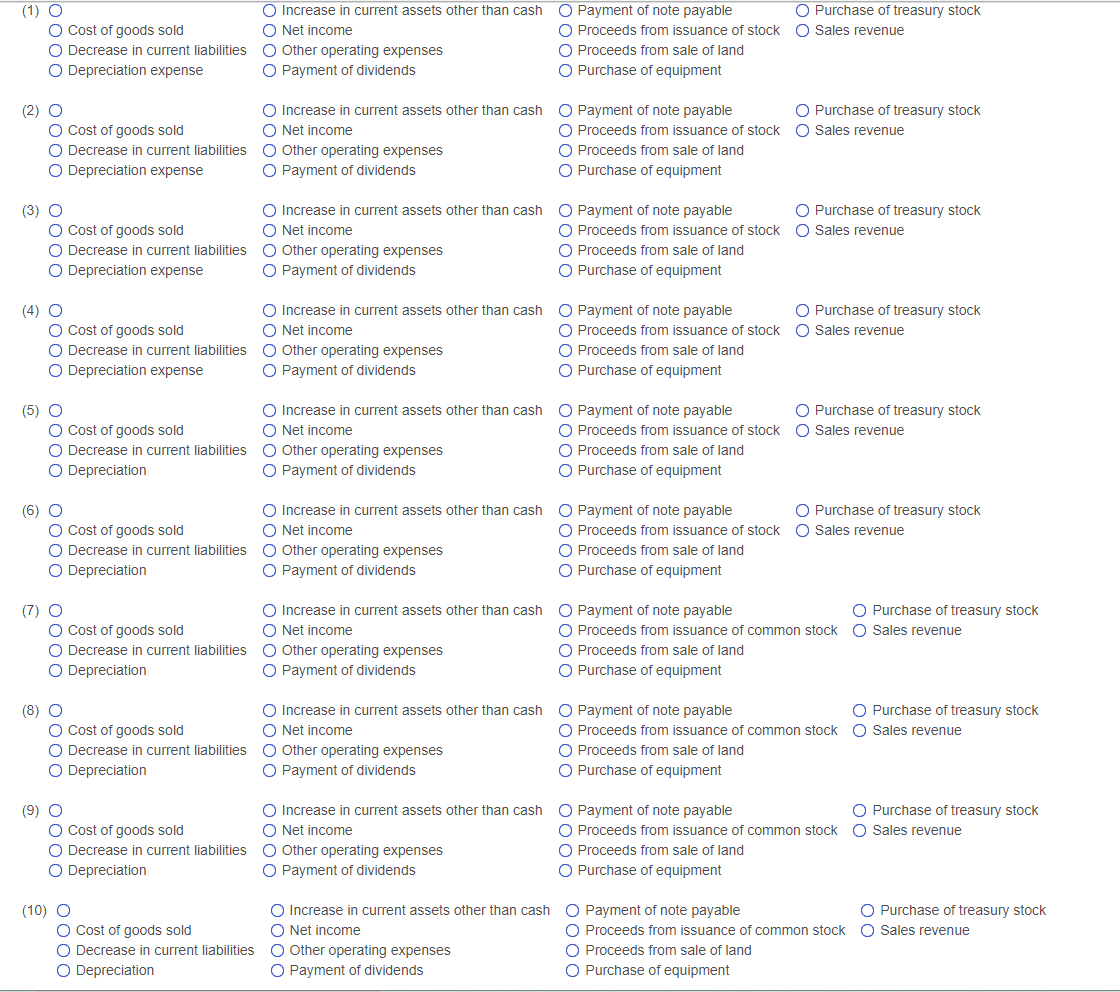

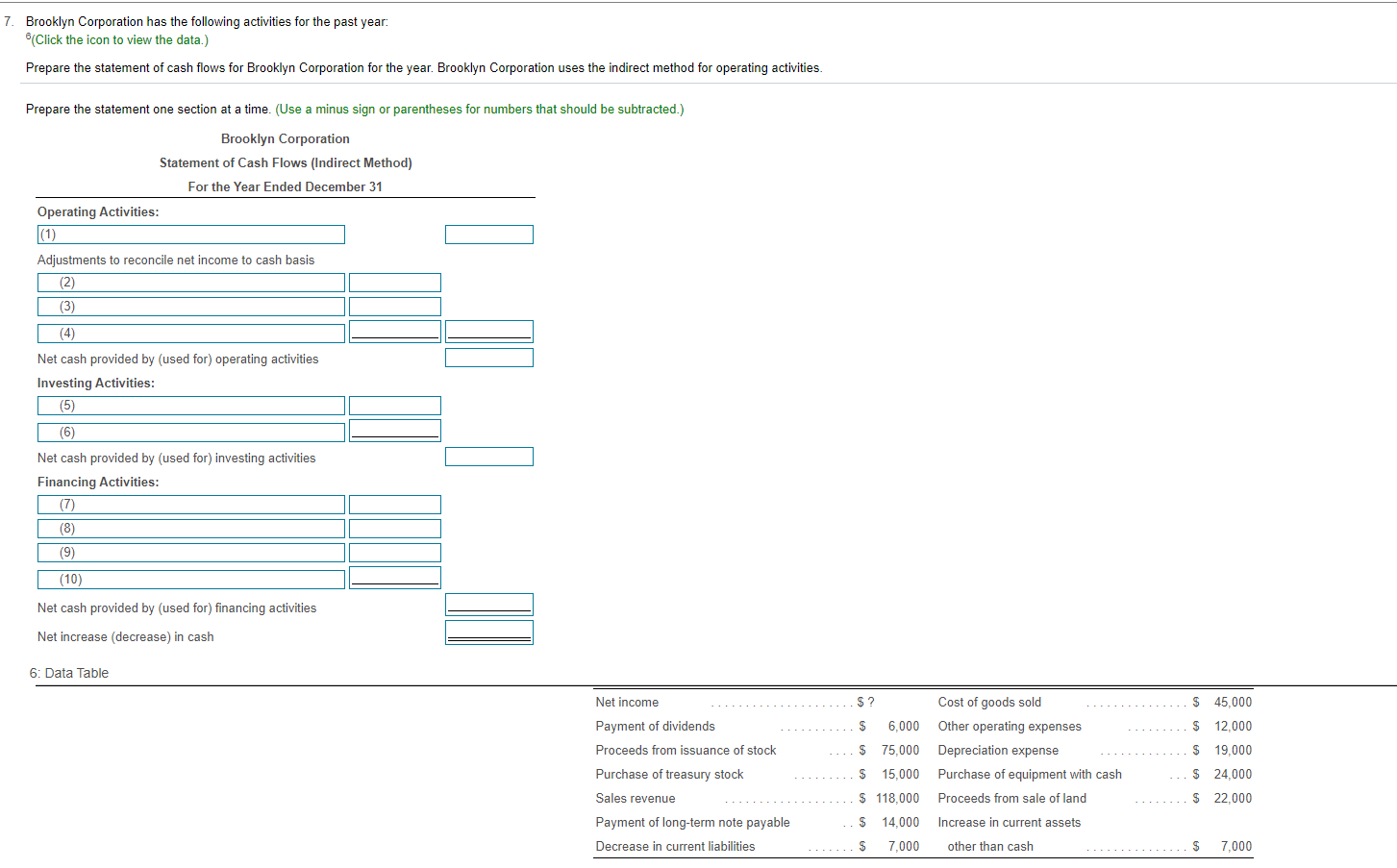

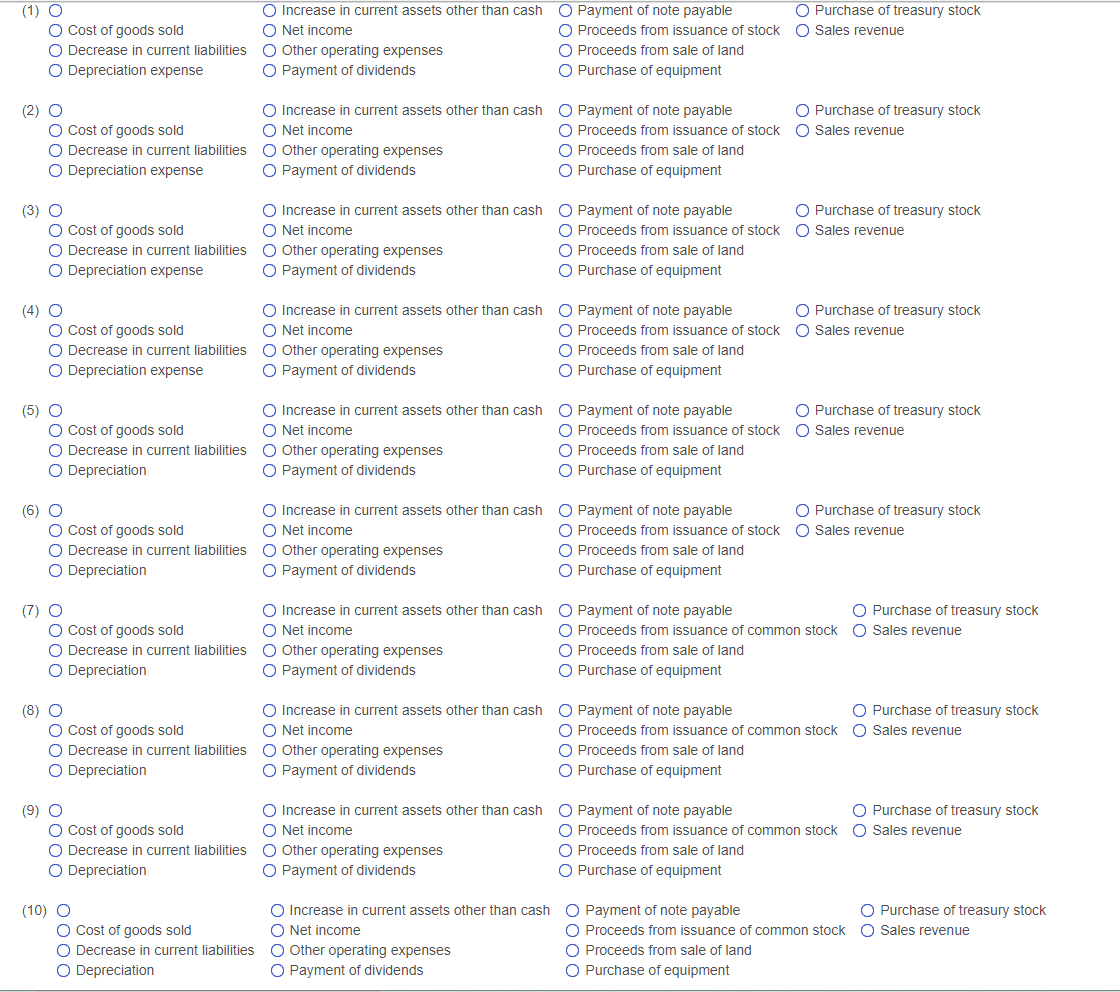

7. Brooklyn Corporation has the following activities for the past year: (Click the icon to view the data.) Prepare the statement of cash flows for Brooklyn Corporation for the year. Brooklyn Corporation uses the indirect method for operating activities. Prepare the statement one section at a time. (Use a minus sign or parentheses for numbers that should be subtracted) Brooklyn Corporation Statement of Cash Flows (Indirect Method) For the Year Ended December 31 Operating Activities: (1) Adjustments to reconcile net income to cash basis (2) (3) (4) Net cash provided by used for) operating activities Investing Activities: (5) (6) Net cash provided by (used for) investing activities Financing Activities: (7) (8) (9) (10) Net cash provided by (used for) financing activities Net increase (decrease) in cash 6: Data Table $? S 45,000 $ 6,000 S 12.000 $ 19,000 Net income Payment of dividends Proceeds from issuance of stock Purchase of treasury stock Sales revenue Payment of long-term note payable Decrease in current liabilities $ 75,000 $ 15,000 Cost of goods sold Other operating expenses Depreciation expense Purchase of equipment with cash Proceeds from sale of land Increase in current assets $ 24,000 $ 118,000 $ 22,000 $ 14,000 7,000 other than cash ............... $ 7,000 O Purchase of treasury stock O Sales revenue (1) O O Cost of goods sold O Decrease in current liabilities O Depreciation expense O Increase in current assets other than cash O Net income O Other operating expenses O Payment of dividends O Payment of note payable O Proceeds from issuance of stock O Proceeds from sale of land O Purchase of equipment O Purchase of treasury stock O Sales revenue (2) O O Cost of goods sold O Decrease in current liabilities O Depreciation expense O Increase in current assets other than cash O Net income O Other operating expenses O Payment of dividends O Payment of note payable O Proceeds from issuance of stock O Proceeds from sale of land Purchase of equipment (3) O O Cost of goods sold O Decrease in current liabilities O Depreciation expense O Increase in current assets other than cash O Net income O Other operating expenses O Payment of dividends O Payment of note payable O Purchase of treasury stock O Proceeds from issuance of stock O Sales revenue O Proceeds from sale of land O Purchase of equipment O Purchase of treasury stock O Sales revenue (4) O O Cost of goods sold O Decrease in current liabilities O Depreciation expense O Increase in current assets other than cash O Net income O Other operating expenses O Payment of dividends O Payment of note payable O Proceeds from issuance of stock O Proceeds from sale of land O Purchase of equipment (5) O O Cost of goods sold O Decrease in current liabilities O Depreciation O Increase in current assets other than cash O Net income O Other operating expenses O Payment of dividends O Payment of note payable O Purchase of treasury stock O Proceeds from issuance of stock O Sales revenue O Proceeds from sale of land Purchase of equipment (6) O O Increase in current assets other than cash O Cost of goods sold O Net income O Decrease in current liabilities Other operating expenses O Depreciation O Payment of dividends O Payment of note payable O Purchase of treasury stock O Proceeds from issuance of stock O Sales revenue O Proceeds from sale of land O Purchase of equipment O Purchase of treasury stock O Sales revenue (7) O O Cost of goods sold O Decrease in current liabilities O Depreciation O Increase in current assets other than cash O Net income Other operating expenses O Payment of dividends O Payment of note payable O Proceeds from issuance of common stock O Proceeds from sale of land O Purchase of equipment (8) O Cost of goods sold O Decrease in current liabilities O Depreciation O Increase in current assets other than cash O Net income O Other operating expenses O Payment of dividends O Payment of note payable O Purchase of treasury stock O Proceeds from issuance of common stock O Sales revenue O Proceeds from sale of land O Purchase of equipment O Purchase of treasury stock O Sales revenue (9) O O Cost of goods sold O Decrease in current liabilities Depreciation O Increase in current assets other than cash O Net income O Other operating expenses O Payment of dividends O Payment of note payable O Proceeds from issuance of common stock O Proceeds from sale of land O Purchase of equipment O Purchase of treasury stock O Sales revenue (10) O O Cost of goods sold O Decrease in current liabilities Depreciation O Increase in current assets other than cash O Net income Other operating expenses O Payment of dividends O Payment of note payable O Proceeds from issuance of common stock O Proceeds from sale of land O Purchase of equipment