IF THE IMAGE IS TOO SMALL, PLEASE ENLARGE THE PAGE BY CLICKING CONTROL BOTTON AND SCROLLING YOUR MOUSE WHEEL FORWARD TO ZOOM IN THE PAGE!!!

IF THE IMAGE IS TOO SMALL, PLEASE ENLARGE THE PAGE BY CLICKING CONTROL BOTTON AND SCROLLING YOUR MOUSE WHEEL FORWARD TO ZOOM IN THE PAGE!!!

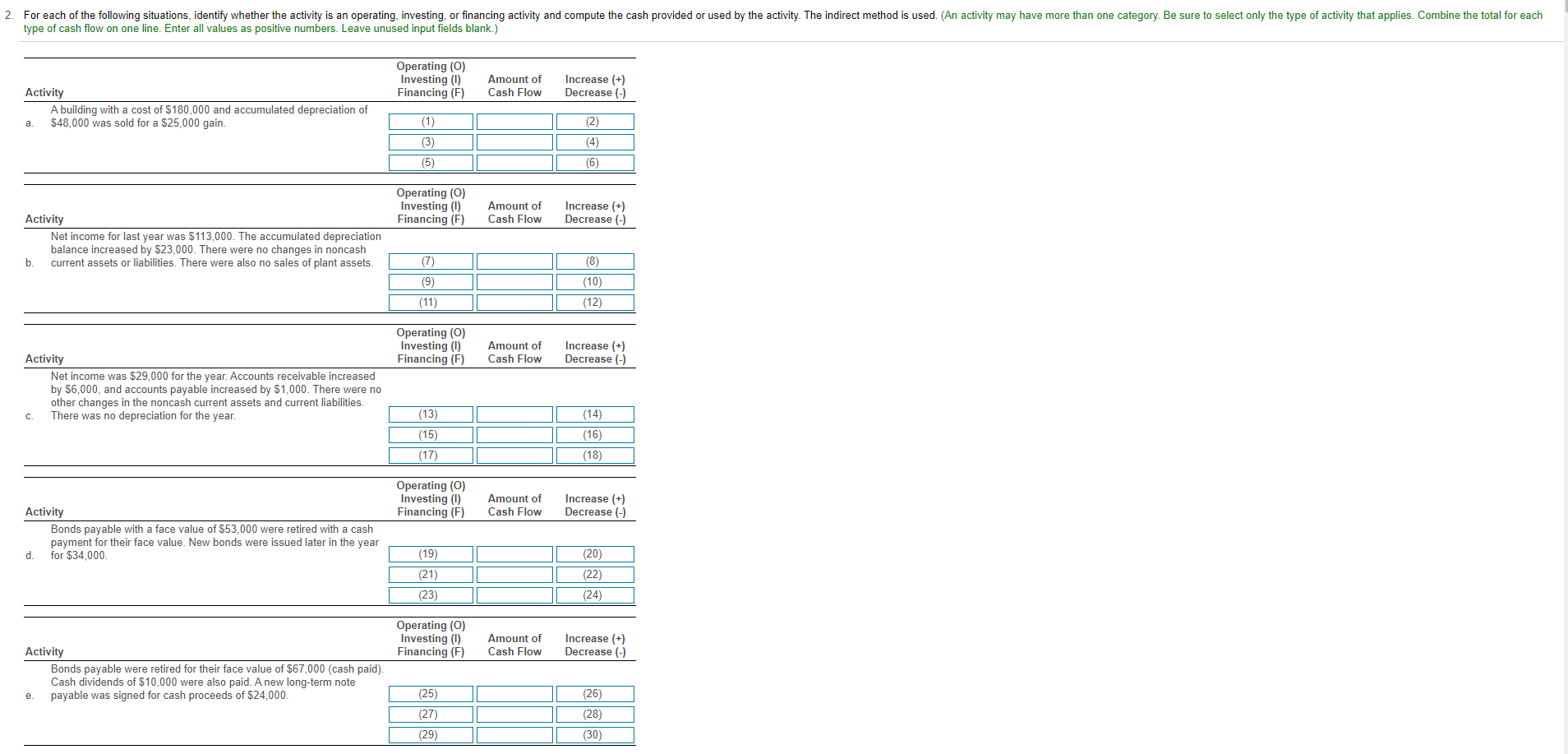

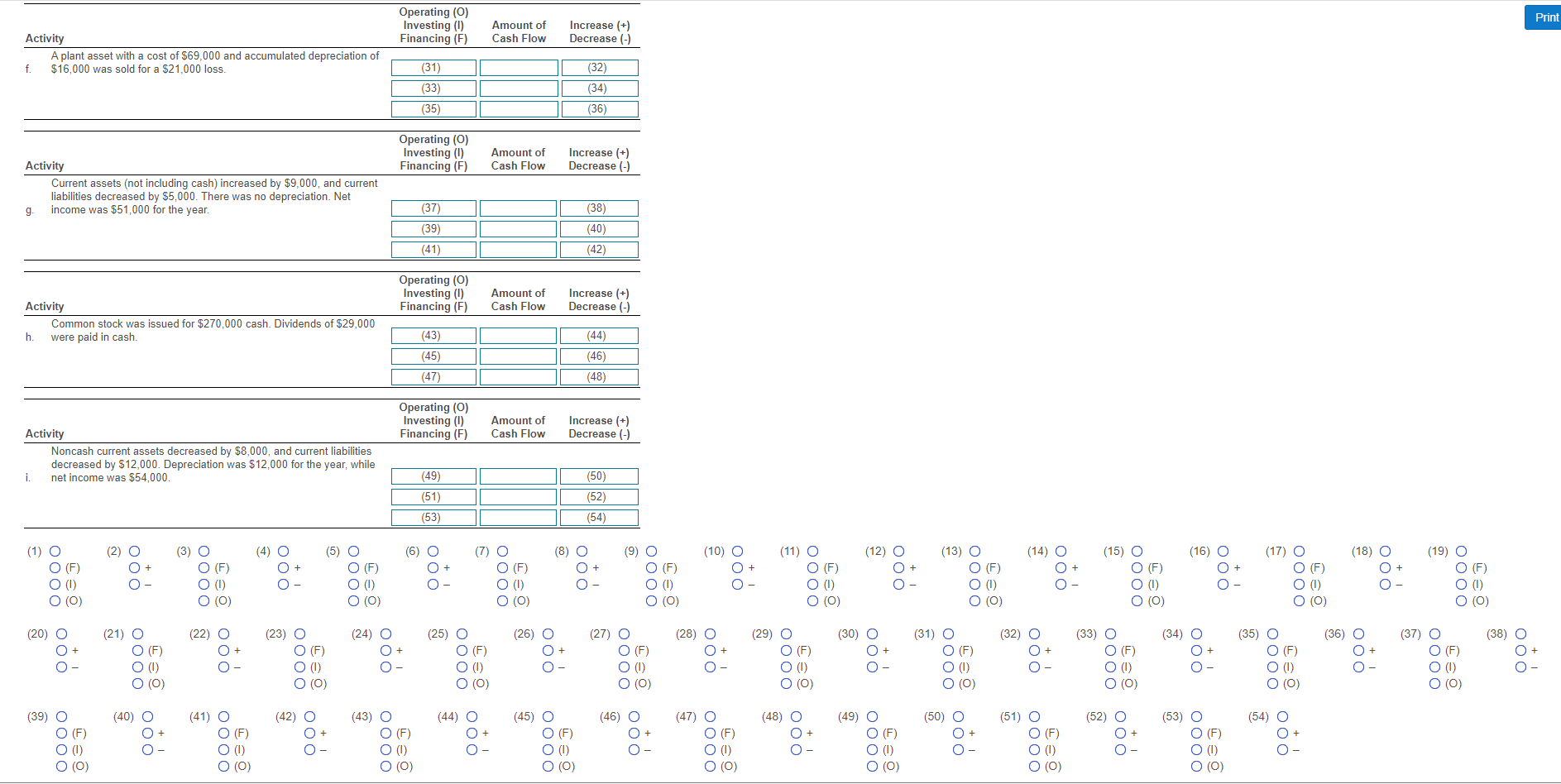

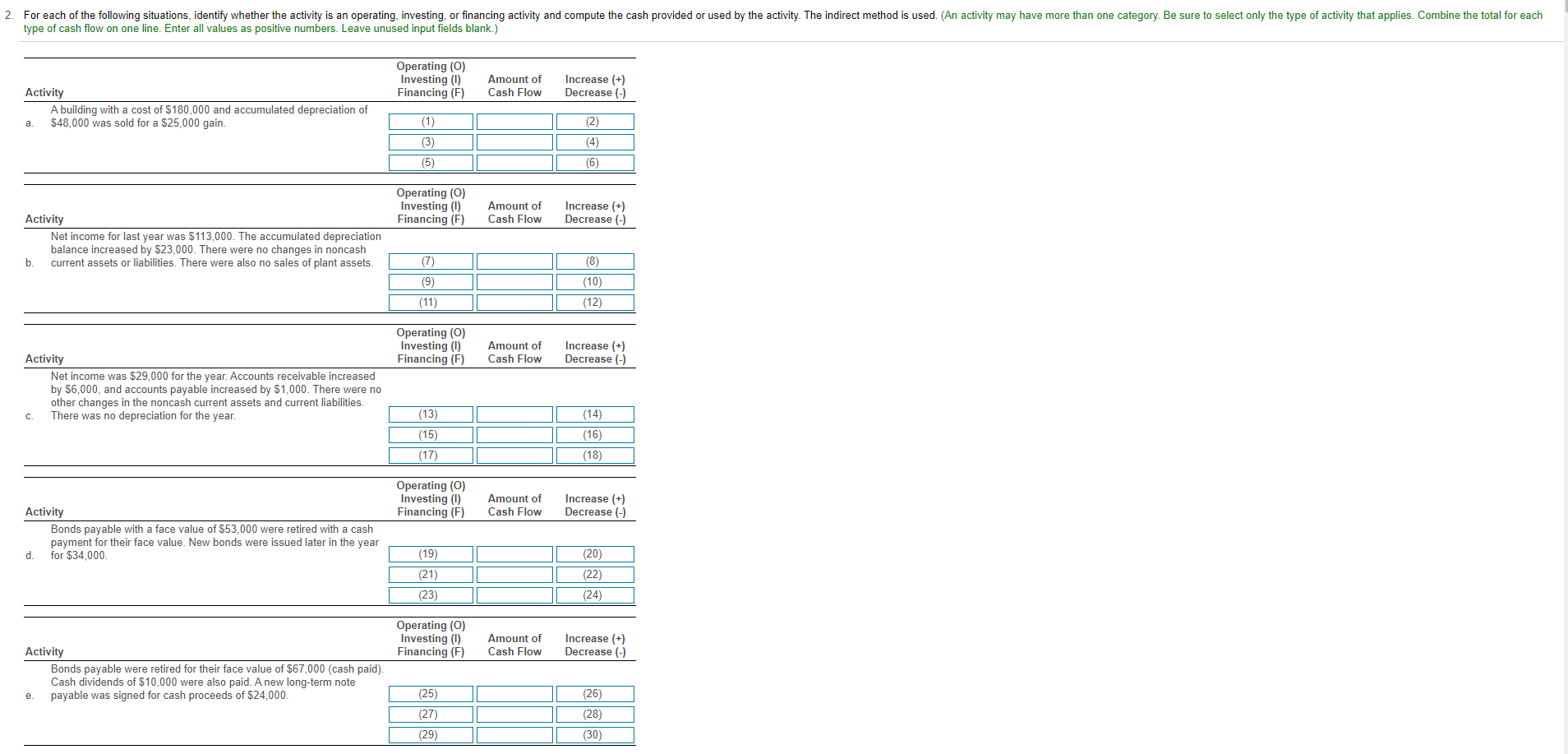

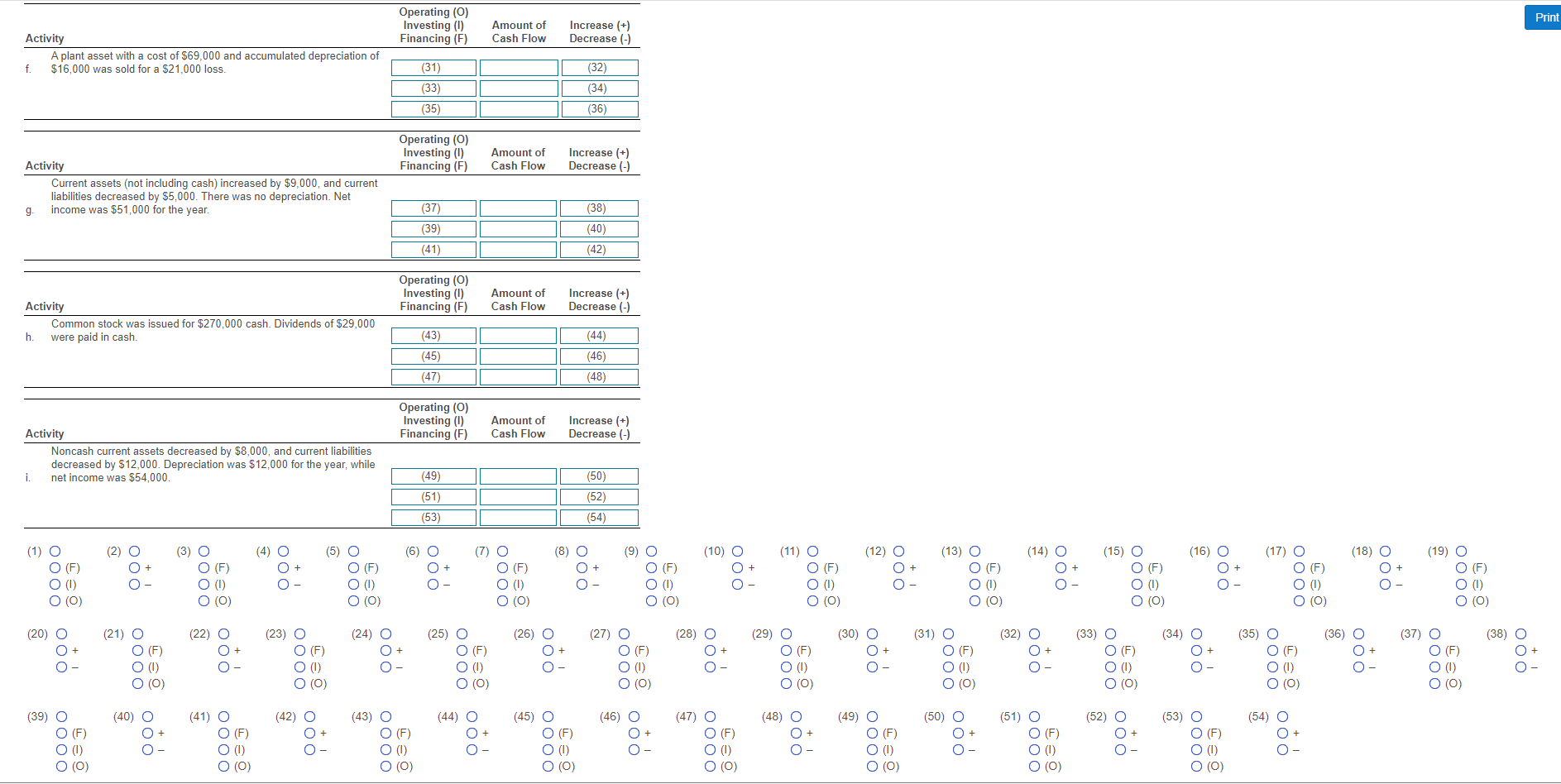

2. For each of the following situations, identify whether the activity is an operating, investing, or financing activity and compute the cash provided or used by the activity. The indirect method is used. (An activity may have more than one category. Be sure to select only the type of activity that applies. Combine the total for each type of cash flow on one line. Enter all values as positive numbers. Leave unused input fields blank.) Operating (0) Investing (0) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity A building with a cost of $180,000 and accumulated depreciation of $48,000 was sold for a $25,000 gain. a. (1) (2) (3) (4) (5) (6) Operating (0) Investing (0) Financing (F) Activity Amount of Cash Flow Increase (+) Decrease (-) Net income for last year was $113,000. The accumulated depreciation balance increased by $23,000. There were no changes in noncash current assets or liabilities. There were also no sales of plant assets. b. (7) (8) (9) (10) (11) (12) Operating (0) Investing (0) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity Net income was $29,000 for the year. Accounts receivable increased by $6,000, and accounts payable increased by $1,000. There were no other changes in the noncash current assets and current liabilities. There was no depreciation for the year. . (13) (14) (15) (16) (17) (18) Operating (0) Investing (0) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity Bonds payable with a face value of $53,000 were retired with a cash payment for their face value. New bonds were issued later in the year d. for $34,000 (19) (20) (21) (22) (23) (24) Operating (0) Investing (0) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity Bonds payable were retired for their face value of $67,000 (cash paid). Cash dividends of $10,000 were also paid. A new long-term note payable was signed for cash proceeds of $24,000 e. (25) (27) (29) (26) (28) (30) Print Operating (0) Investing (1) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity A plant asset with a cost of $69,000 and accumulated depreciation of f. $16,000 was sold for a $21,000 loss. (31) (33) (35) (32) (34) (36) Operating (0) Investing (1) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity Current assets (not including cash) increased by $9,000, and current liabilities decreased by $5,000. There was no depreciation. Net g income was $51,000 for the year. (37) (38) (40) (39) (41) (42) Operating (0) Investing (0) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity Common stock was issued for $270,000 cash. Dividends of $29,000 h were paid in cash. (43) (44) (46) (45) (47) (48) Operating (0) Investing (0) Financing (F) Amount of Cash Flow Increase (+) Decrease (-) Activity Noncash current assets decreased by $8,000, and current liabilities decreased by $12,000. Depreciation was $12,000 for the year, while i. net income was $54,000 (50) (49) (51) (53) (52) (54) (2) (3) O (4) a (5) (6) O (8) a (10) O (12) a (14) (16) O (18) O (19) (1) O O (F) O (1) O (0) O (F) O() O (O) 0000 (7) O O (F) (0) 0 (0) (9) O (F) O (1) O (O) (11) O OF O (0) O (0) (13) O O (F) O (0 0 (0) 090 (15) O OF O (0) O (O) (17) O OF 0 (0) O (O) O (0) (0) O (0) | + (20) O (24) O (26) (30) O (32) O (34) O (36) O (22) a O + (38) O (21) O O (F O (0) O (0) (28) O O + (23) O O (F) O( O (0) (25) O O (F) O (1) O (O) 000 (27) O O (F) O (0) O (0) (29) O O (F) OO 0 (0) 000 (31) O O (F) O (0 O (O) (33) O O (F) O(0) O (0) 000 (35) O O (F) OO O (0) | + (37) O (F) OO O (0) 0000 OST ooo O (39) O (40) O (42) a (44) O (45) O (46) O (48) O (49) O (50) O (51) O (52) O (54) O (41) O O (F) O (1) O (O) 000 (43) O O (F) OO O (0) 000 (47) O O (F) OO O (O) ooo. (53) O O (F) O (0) O (O) 000 O (1) O (0) O (0) O (0) O(0) O (O)