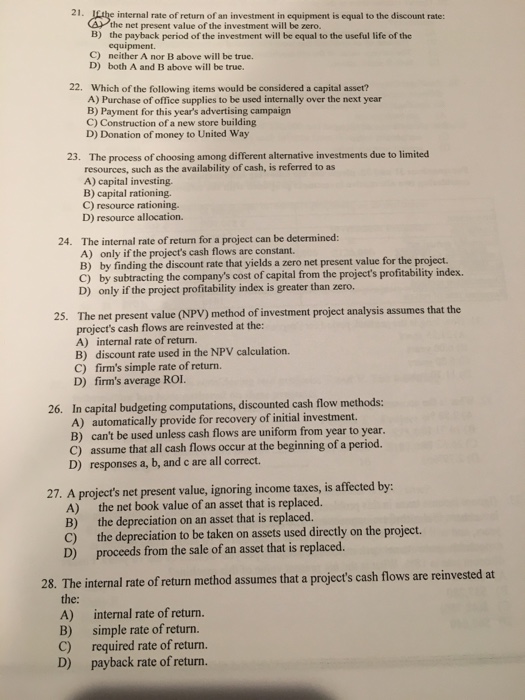

If the internal rate of return of an investment in equipment is equal to the discount rate: the net present value of the investment will be zero. the payback period of the investment will be equal to the useful life of the equipment. neither A nor B above will he true. both A and B above will be true. Which of the following items would be considered a capital asset? Purchase of office supplies to be used internally over the next year Payment for this year's advertising campaign Construction of a new store building Donation of money to United Way The process of choosing among different alternative investments due to limited resources, such as the availability of cash, is referred to as capital investing. capital rationing. resource rationing. resource allocation. The internal rate of return for a project can be determined: only if the project's cash flows are constant. by finding the discount rate that yields a zero net present value for the project. by subtracting the company's cost of capital from the project's profitability index. only if the project profitability index is greater than zero. The net present value (NPV) method of investment project analysis assumes that the project's cash flows arc reinvested at the: internal rate of return. discount rate used in the NPV calculation. firm's simple rate of return. firm's average ROI. In capital budgeting computations, discounted cash flow methods: automatically provide for recovery of initial investment. can't be used unless cash flows are uniform from year to year. assume that all cash flows occur at the beginning of a period. responses a, b, and care all correct. A project's net present value, ignoring income taxes, is affected by: the net book value of an asset that is replaced. the depreciation on an asset that is replaced. the depreciation to be taken on assets used directly on the project. proceeds from the sale of an asset that is replaced. The internal rate of return method assumes that a project's cash flows are reinvested at the: internal rate of return. simple rate of return. required rate of return. payback rate of return