Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the market price of Al-Jinan Companys share in 2020 is $180, then the ratio of the share price to the realized earnings per share

If the market price of Al-Jinan Companys share in 2020 is $180, then the ratio of the share price to the realized earnings per share is: *

18

10

0.055

0.10

The net profit margin of Al-Jinan Company for the year 2020 is: *

0.164

0.328

0.35

0.128

The trading ratio for Al-Jinan Company for the year 2020 is: *

1.733

1.083

0.916

0.923

The quick turnover ratio for Al-Jinan Company for the year 2019 is: *

1.428

1

1.285

1.142

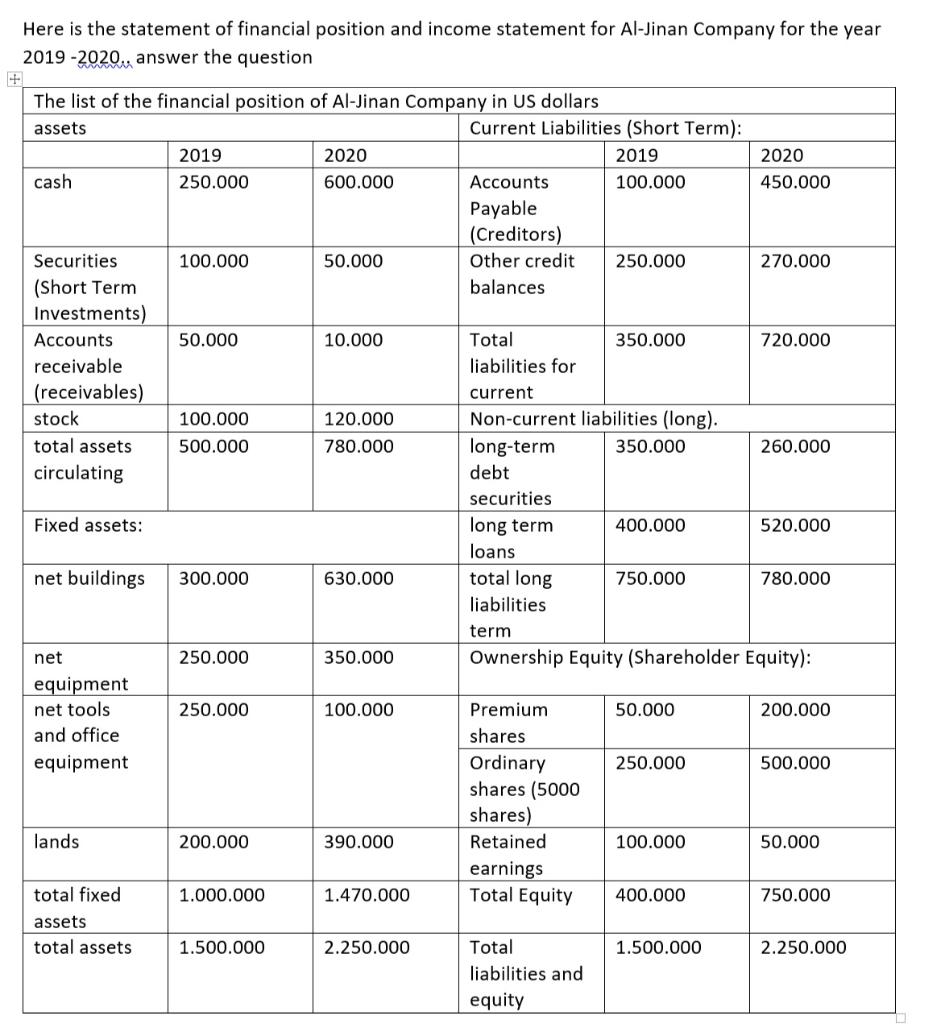

Here is the statement of financial position and income statement for Al-Jinan Company for the year 2019-2020., answer the question + The list of the financial position of Al-Jinan Company in US dollars assets Current Liabilities (Short Term): 2019 2020 2019 2020 cash 250.000 600.000 Accounts 100.000 450.000 Payable (Creditors) Securities 100.000 50.000 Other credit 250.000 270.000 (Short Term balances Investments) Accounts 50.000 10.000 Total 350.000 720.000 receivable liabilities for (receivables) current stock 100.000 120.000 Non-current liabilities (long). total assets 500.000 780.000 long-term 350.000 260.000 circulating debt securities Fixed assets: long term 400.000 520.000 loans net buildings 300.000 630.000 total long 750.000 780.000 liabilities term net 250.000 350.000 Ownership Equity (Shareholder Equity): equipment net tools 250.000 100.000 Premium 50.000 200.000 and office shares equipment Ordinary 250.000 500.000 shares (5000 shares) lands 200.000 390.000 Retained 100.000 50.000 earnings total fixed 1.000.000 1.470.000 Total Equity 400.000 750.000 assets total assets 1.500.000 2.250.000 Total 1.500.000 2.250.000 liabilities and equity Here is the statement of financial position and income statement for Al-Jinan Company for the year 2019-2020., answer the question + The list of the financial position of Al-Jinan Company in US dollars assets Current Liabilities (Short Term): 2019 2020 2019 2020 cash 250.000 600.000 Accounts 100.000 450.000 Payable (Creditors) Securities 100.000 50.000 Other credit 250.000 270.000 (Short Term balances Investments) Accounts 50.000 10.000 Total 350.000 720.000 receivable liabilities for (receivables) current stock 100.000 120.000 Non-current liabilities (long). total assets 500.000 780.000 long-term 350.000 260.000 circulating debt securities Fixed assets: long term 400.000 520.000 loans net buildings 300.000 630.000 total long 750.000 780.000 liabilities term net 250.000 350.000 Ownership Equity (Shareholder Equity): equipment net tools 250.000 100.000 Premium 50.000 200.000 and office shares equipment Ordinary 250.000 500.000 shares (5000 shares) lands 200.000 390.000 Retained 100.000 50.000 earnings total fixed 1.000.000 1.470.000 Total Equity 400.000 750.000 assets total assets 1.500.000 2.250.000 Total 1.500.000 2.250.000 liabilities and equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started