Answered step by step

Verified Expert Solution

Question

1 Approved Answer

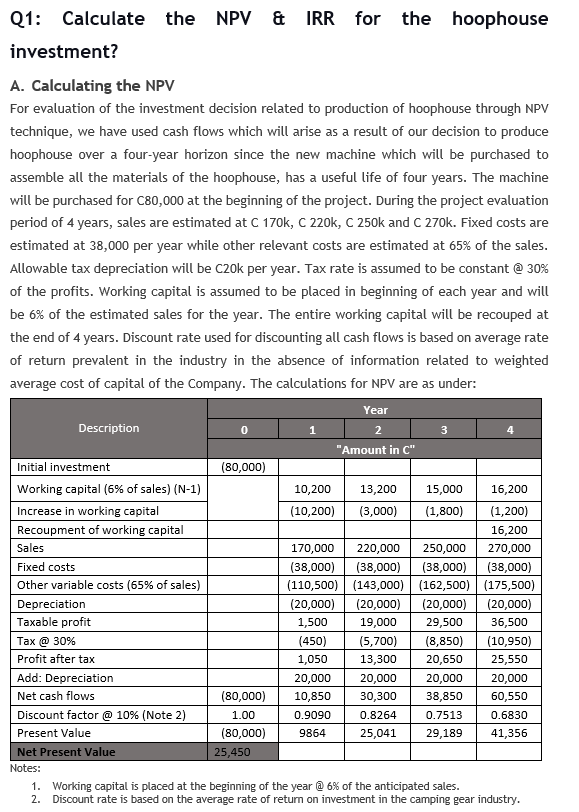

If the plant manager proposed an alternative use of the C80,000 that would generate net after-tax cash flows of C33,000 each year for the subsequent

If the plant manager proposed an alternative use of the C80,000 that would generate net after-tax cash flows of C33,000 each year for the subsequent four years.

?How does this alternative compare to the hoophouse project based on NPV and IRR metrics?

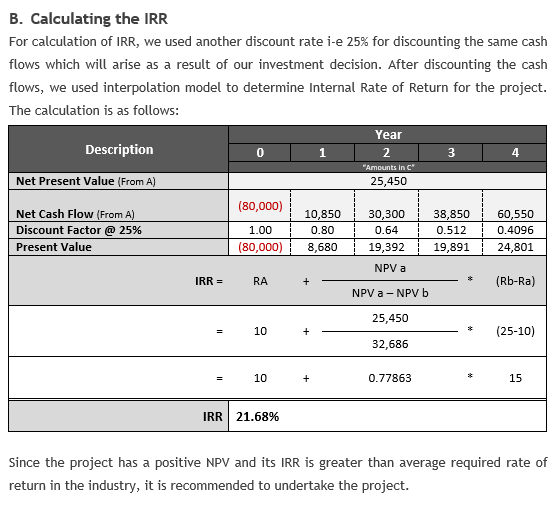

B. Calculating the IRR For calculation of IRR, we used another discount rate i-e 25% for discounting the same cash flows which will arise as a result of our investment decision. After discounting the cash flows, we used interpolation model to determine Internal Rate of Return for the project. The calculation is as follows: Description Year 0 2 3 "Amounts in C Net Present Value (From A) 25,450 Net Cash Flow (From A) Discount Factor @ 25% Present Value (80,000) 10,850 30,300 38,850 60,550 1.00 0.80 0.64 0.512 0.4096 (80,000) 8,680 19,392 19,891 24,801 NPV a IRR = RA + (Rb-Ra) NPV a - NPV b 25,450 = 10 (25-10) 32,686 = 10 + 0.77863 15 IRR 21.68% Since the project has a positive NPV and its IRR is greater than average required rate of return in the industry, it is recommended to undertake the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compare the alternative use of C80000 generating net aftertax cash flows of C33000 each year for four years with the hoophouse project we can analy...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started