Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the risk-free rate is 1.5% and the return on the market is 12%, what are the betas and required rate of return on equity

If the risk-free rate is 1.5% and the return on the market is 12%, what are the betas and required rate of return on equity (using the CAPM) for each of the companies?

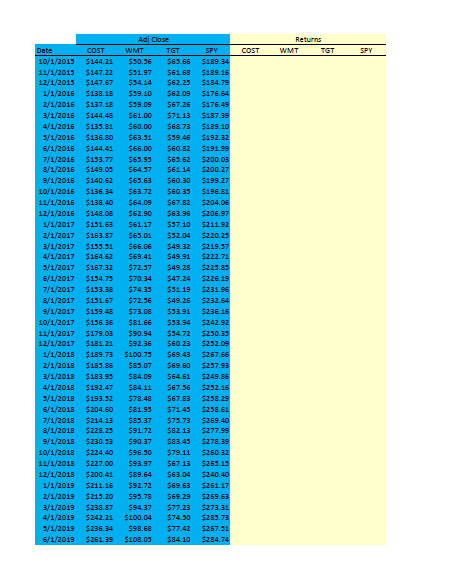

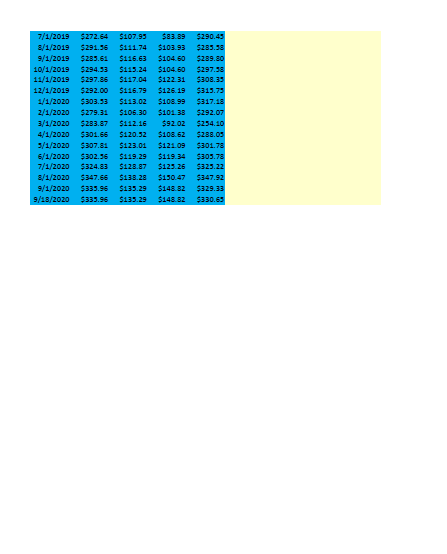

Returns TT TGT SPY 7/1/20198/1/20199/1/201910/1/201911/1/201912/1/20191/1/20202/1/20203/1/20204/1/20209/1/20206/1/20207/1/20208/1/20209/1/20209/18/2020$272.64$291.96$285.61$294.93$297.85$292.00$303.93$279.31$283.87$301.65$307.81$302.96$324.83$347.65$335.96$339.96$107.99$111.74$116.63$115.24$117.04$116.79$113.02$106.30$112.16$120.92$123.01$119.29$128.87$138.28$135.29$135.29$83.89$103.93$104.60$104.60$12231$126.19$108.99$101.38$92.02$108.62$121.09$119.34$125.26$190.47$148.32$143.82$290.45$285.98$289.90$297.95$308.35$319.75$317.18$292.07$254.10$288.05$301.78$305.78$325.22$347.92$329.33$330.65 Returns TT TGT SPY 7/1/20198/1/20199/1/201910/1/201911/1/201912/1/20191/1/20202/1/20203/1/20204/1/20209/1/20206/1/20207/1/20208/1/20209/1/20209/18/2020$272.64$291.96$285.61$294.93$297.85$292.00$303.93$279.31$283.87$301.65$307.81$302.96$324.83$347.65$335.96$339.96$107.99$111.74$116.63$115.24$117.04$116.79$113.02$106.30$112.16$120.92$123.01$119.29$128.87$138.28$135.29$135.29$83.89$103.93$104.60$104.60$12231$126.19$108.99$101.38$92.02$108.62$121.09$119.34$125.26$190.47$148.32$143.82$290.45$285.98$289.90$297.95$308.35$319.75$317.18$292.07$254.10$288.05$301.78$305.78$325.22$347.92$329.33$330.65

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started