Question

If the risk-free rate is 2%, how would you invest your wealth of $1000 if you want to be mean-variance efficient and your total amount

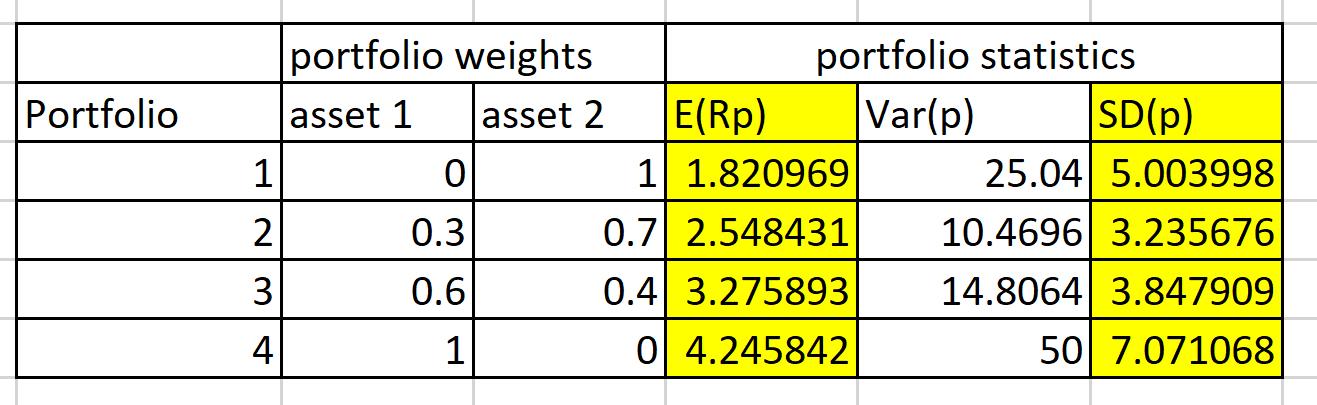

If the risk-free rate is 2%, how would you invest your wealth of $1000 if you want to be mean-variance efficient and your total amount of risk should not exceed 6%, as measured by the standard deviation?

Show the detailed calculation process.

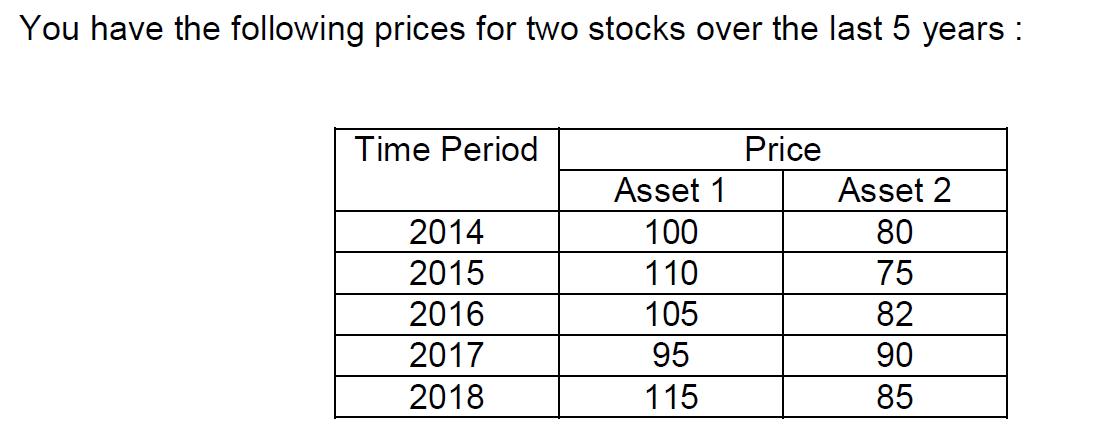

You have the following prices for two stocks over the last 5 years : Time Period 2014 2015 2016 2017 2018 Asset 1 100 110 105 95 115 Price Asset 2 80 75 82 90 85

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The optimal portfolio for meanvariance efficiency and a risk of not exceeding 6 is portfolio 3 with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Berk, DeMarzo, Harford

2nd edition

132148234, 978-0132148238

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App