Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the taxpayer is a non-resident citizen, how much is the final withholding tax? if the taxpayer is a resident citizen, how much income is

If the taxpayer is a non-resident citizen, how much is the final withholding tax?

If the taxpayer is a non-resident citizen, how much is the final withholding tax?if the taxpayer is a resident citizen, how much income is subject to regular income tax?

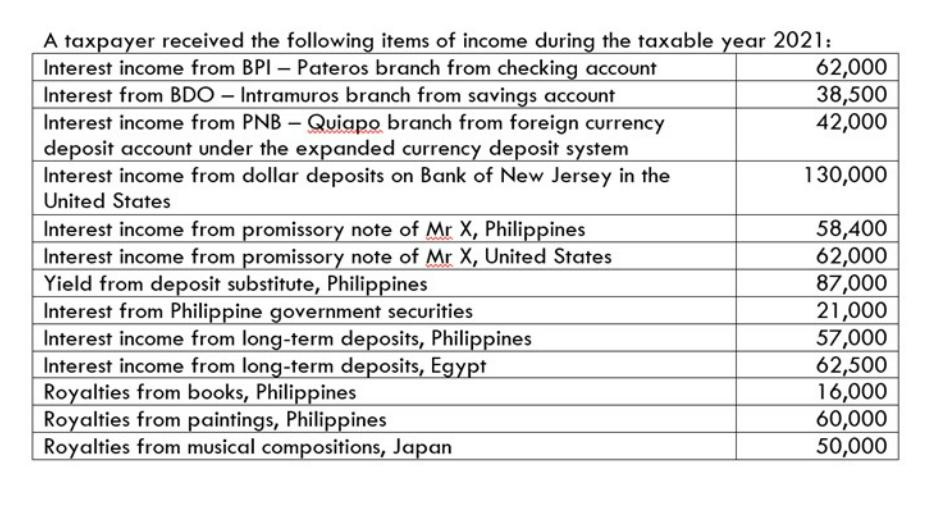

A taxpayer received the following items of income during the taxable year 2021: Interest income from BPI- Pateros branch from checking account Interest from BDO - Intramuros branch from savings account Interest income from PNB - Quiapo branch from foreign currency deposit account under the expanded currency deposit system Interest income from dollar deposits on Bank of New Jersey in the United States Interest income from promissory note of Mr X, Philippines Interest income from promissory note of Mr X, United States Yield from deposit substitute, Philippines Interest from Philippine government securities Interest income from long-term deposits, Philippines Interest income from long-term deposits, Egypt Royalties from books, Philippines Royalties from paintings, Philippines Royalties from musical compositions, Japan 62,000 38,500 42,000 130,000 58,400 62,000 87,000 21,000 57,000 62,500 16,000 60,000 50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Since the taxpayer is a nonresident citizen they are subject to a final withholding tax of 25 on all Philippinesource income This means that they will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started