Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If they can all be in separate The payroll register of Big House Cleaning Company showed total employee earnings of $4,500 for the payroll period

If they can all be in separate

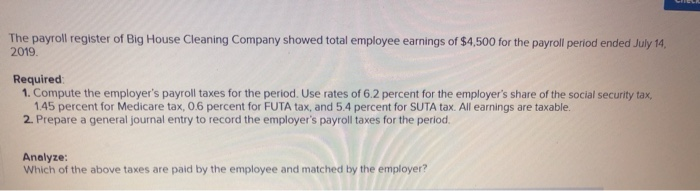

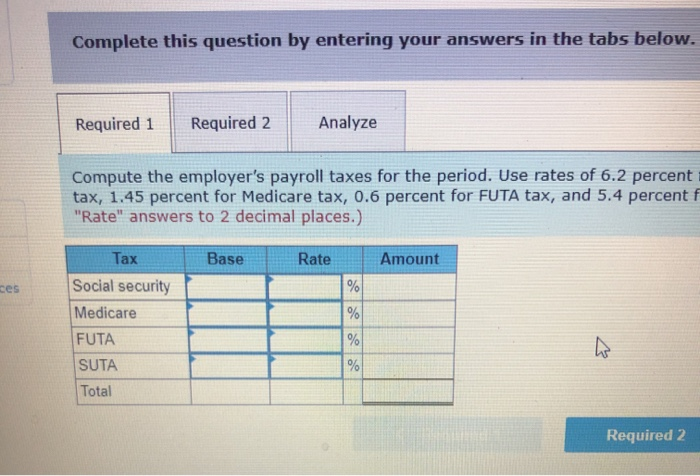

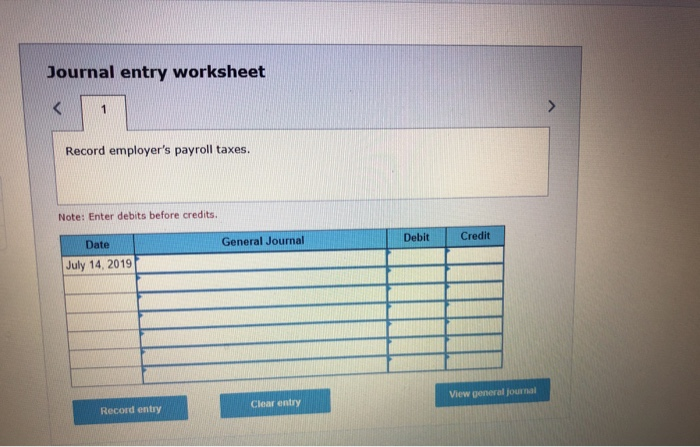

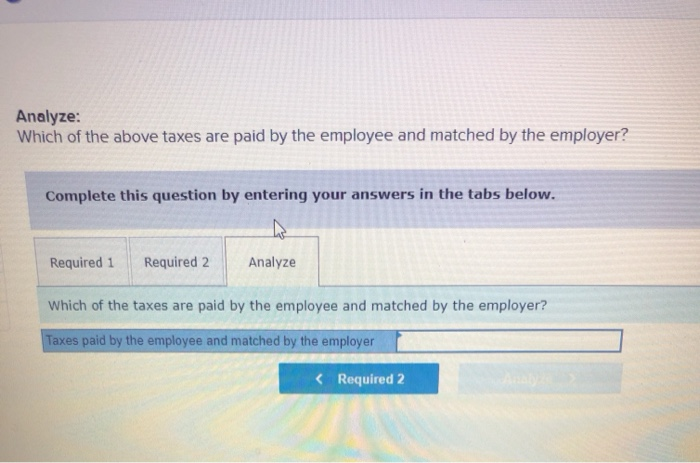

The payroll register of Big House Cleaning Company showed total employee earnings of $4,500 for the payroll period ended July 14, 2019. Required: 1. Compute the employer's payroll taxes for the period. Use rates of 6.2 percent for the employer's share of the social security tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent for SUTA tax. All earnings are taxable. 2. Prepare a general journal entry to record the employer's payroll taxes for the period, Analyze Which of the above taxes are paid by the employee and matched by the employer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Analyze Compute the employer's payroll taxes for the period. Use rates of 6.2 percent tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent f "Rate" answers to 2 decimal places.) Base Rate Amount ces Tax Social security Medicare FUTA SUTA Total % % % % Required 2 Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started