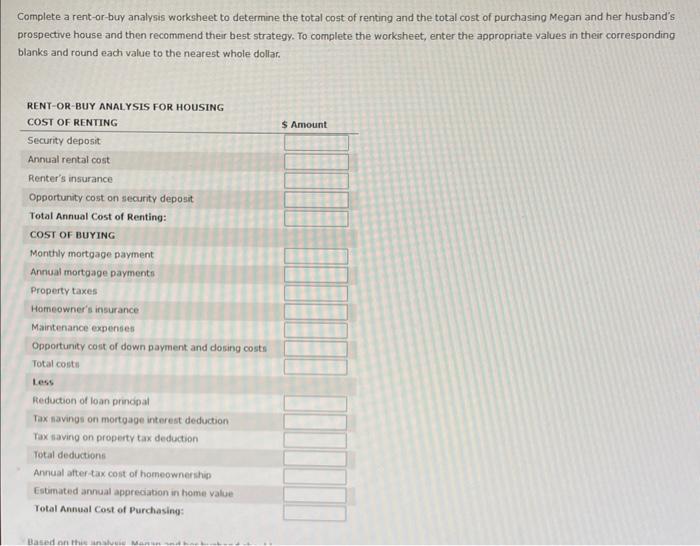

- If they rent, the builder will require monthly rental payments of $1,100 and a security deposit equal to two months of rent. - Since they want to be protected against the possible loss of their possessions, they will purchase a renters' policy of $200 every six months, while a more comprehensive homeowners' policy will cost 0.5% of the home's value per year. - Money used to fund the unit's security deposit could otherwise be invested to earn 3% per year after taxes. Funds expended for a home's down payment and dosing costs also incur an opportunity cont. - If the unit is purchased, it will cost $175,000 and will require a 20% down payment. The loan will carry an interest rate of 6%, a term of 30 years, and monthly payments of $839. The dosing costs associated with the unit's mortgage will be $3,500. - The property taxes and the maintenance and repair expenses on the unit are estimated to be 3% and 1% of the unit's total price, respectively. - Your ordinary income is taxed at the rate of 28%, and youll be willing to itemize your tax deductions in the event that you purchase your new home. - Financial publications report that home values are expected to increase by 3% this year due to inflation. Complete a rent-or-buy analysis worksheet to determine the total cost of renting and the totai cost of purchasing Megan and her husband's prospective house and then recommend their best strategy. To complete the worksheet, enter the appropriate values in their corresponding blanks and round each value to the nearest whole dollar: - If they rent, the builder will require monthly rental payments of $1,100 and a security deposit equal to two months of rent. - Since they want to be protected against the possible loss of their possessions, they will purchase a renters' policy of $200 every six months, while a more comprehensive homeowners' policy will cost 0.5% of the home's value per year. - Money used to fund the unit's security deposit could otherwise be invested to earn 3% per year after taxes. Funds expended for a home's down payment and dosing costs also incur an opportunity cont. - If the unit is purchased, it will cost $175,000 and will require a 20% down payment. The loan will carry an interest rate of 6%, a term of 30 years, and monthly payments of $839. The dosing costs associated with the unit's mortgage will be $3,500. - The property taxes and the maintenance and repair expenses on the unit are estimated to be 3% and 1% of the unit's total price, respectively. - Your ordinary income is taxed at the rate of 28%, and youll be willing to itemize your tax deductions in the event that you purchase your new home. - Financial publications report that home values are expected to increase by 3% this year due to inflation. Complete a rent-or-buy analysis worksheet to determine the total cost of renting and the totai cost of purchasing Megan and her husband's prospective house and then recommend their best strategy. To complete the worksheet, enter the appropriate values in their corresponding blanks and round each value to the nearest whole dollar