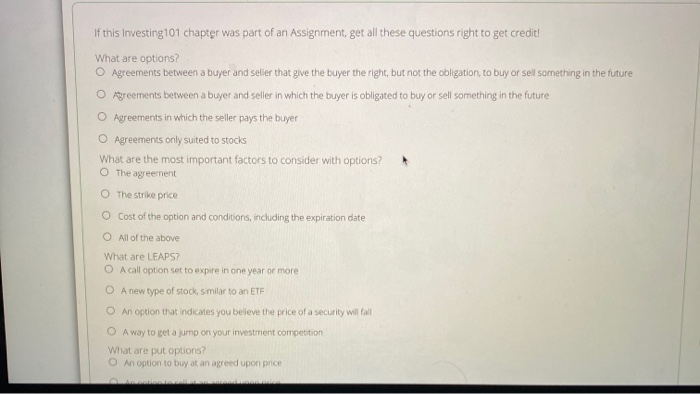

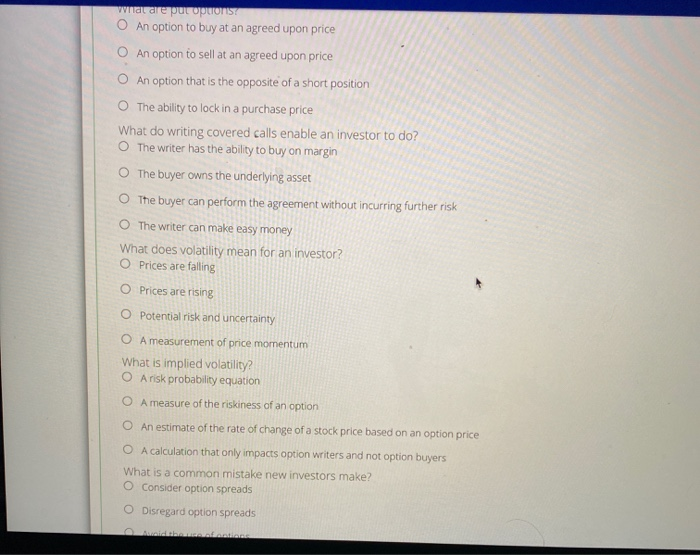

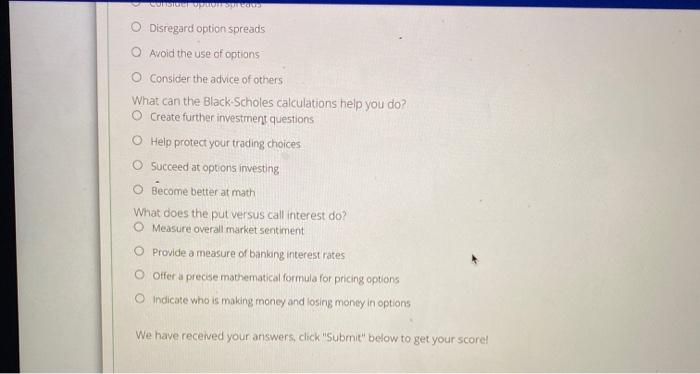

If this investing101 chapter was part of an Assignment, get all these questions right to get credit! What are options? O Agreements between a buyer and seller that give the buyer the right, but not the obligation, to buy or sell something in the future O Agreements between a buyer and seller in which the buyer is obligated to buy or sell something in the future O Agreements in which the seller pays the buyer O Agreements only suited to stocks What are the most important factors to consider with options? O The agreement The strike price O Cost of the option and conditions, including the expiration date O All of the above What are LEAPS? O A call option set to expire in one year or more O A new type of stock, similar to an ETF O An option that indicates you believe the price of a security will fall A way to get a jump on your investment competition What are put options? An option to buy at an agreed upon price what are put options O An option to buy at an agreed upon price An option to sell at an agreed upon price O An option that is the opposite of a short position The ability to lock in a purchase price What do writing covered calls enable an investor to do? The writer has the ability to buy on margin The buyer owns the underlying asset The buyer can perform the agreement without incurring further risk The writer can make easy money What does volatility mean for an investor? O Prices are falling O Prices are rising O Potential risk and uncertainty O A measurement of price momentum What is implied volatility? O A risk probability equation O A measure of the riskiness of an option O An estimate of the rate of change of a stock price based on an option price O A calculation that only impacts option writers and not option buyers What is a common mistake new investors make? O Consider option spreads O Disregard option spreads CONSIGLT OSTOS O Disregard option spreads Avoid the use of options O Consider the advice of others What can the Black-Scholes calculations help you do? O Create further investment questions Help protect your trading choices O Succeed at options investing o Become better at math What does the put versus call interest do? O Measure overall market sentiment Provide a measure of banking interest rates O Offer a precise mathematical formula for pricing options Indicate who is making money and losing money in options We have received your answers, click "Submit" below to get your score