if you answered wrong you will get 8 downvotes

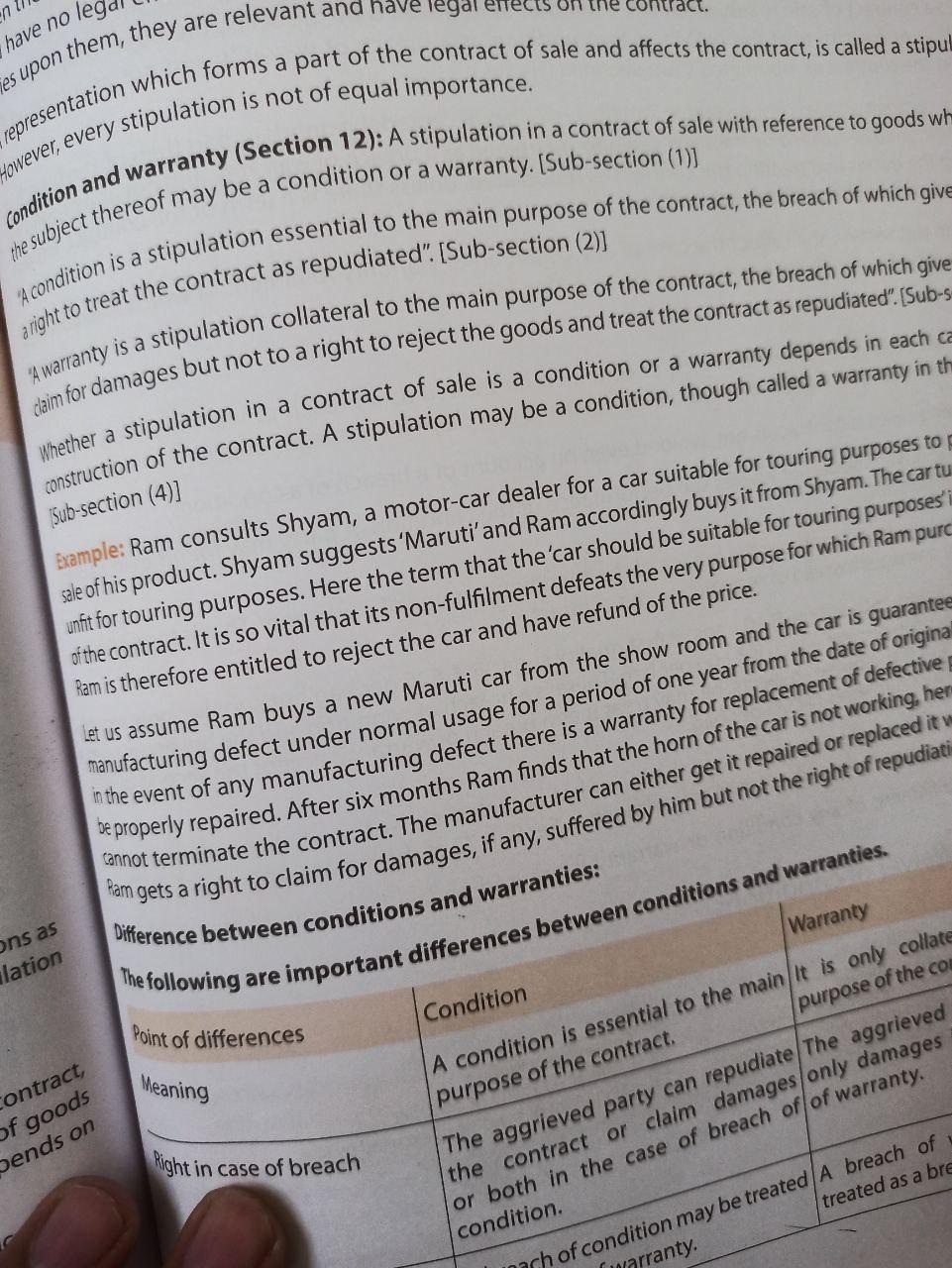

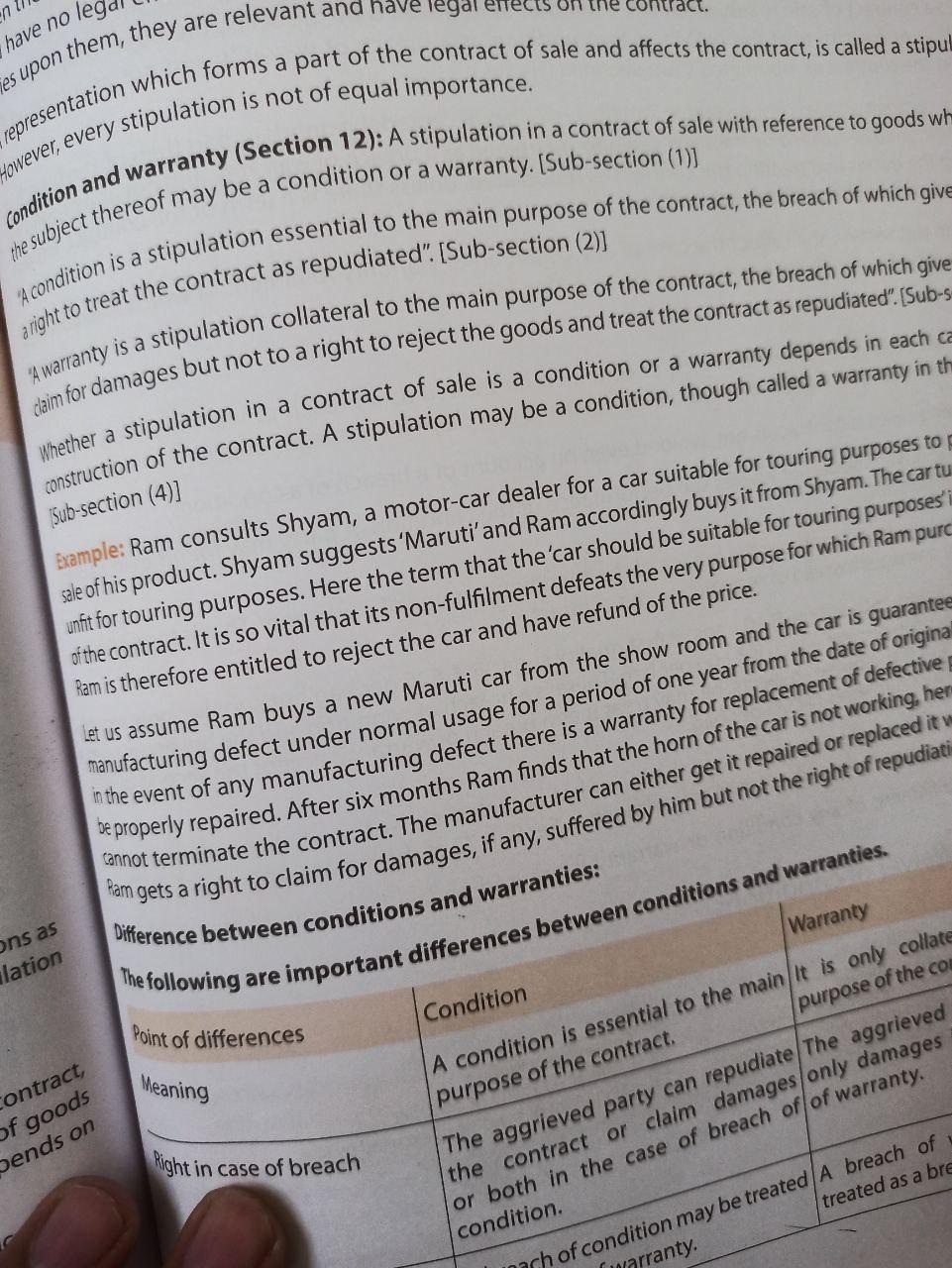

Where a contract of sale is not severable and the buyer has accepted the goods or part thereof, the breaches any condition to be fulfilled by the seller can only be treated as a breach of warranty and not as a ground rejecting the goods and treating the contract as repudiated, unless there is a term of the contract, exp or implied to that effect. [Sub-section (2)]

Nothing in this section shall affect the case of any condition or warranty fulfilment of which is excused law by reason of impossibility or otherwise. [Sub-section (3)]

Analysis:

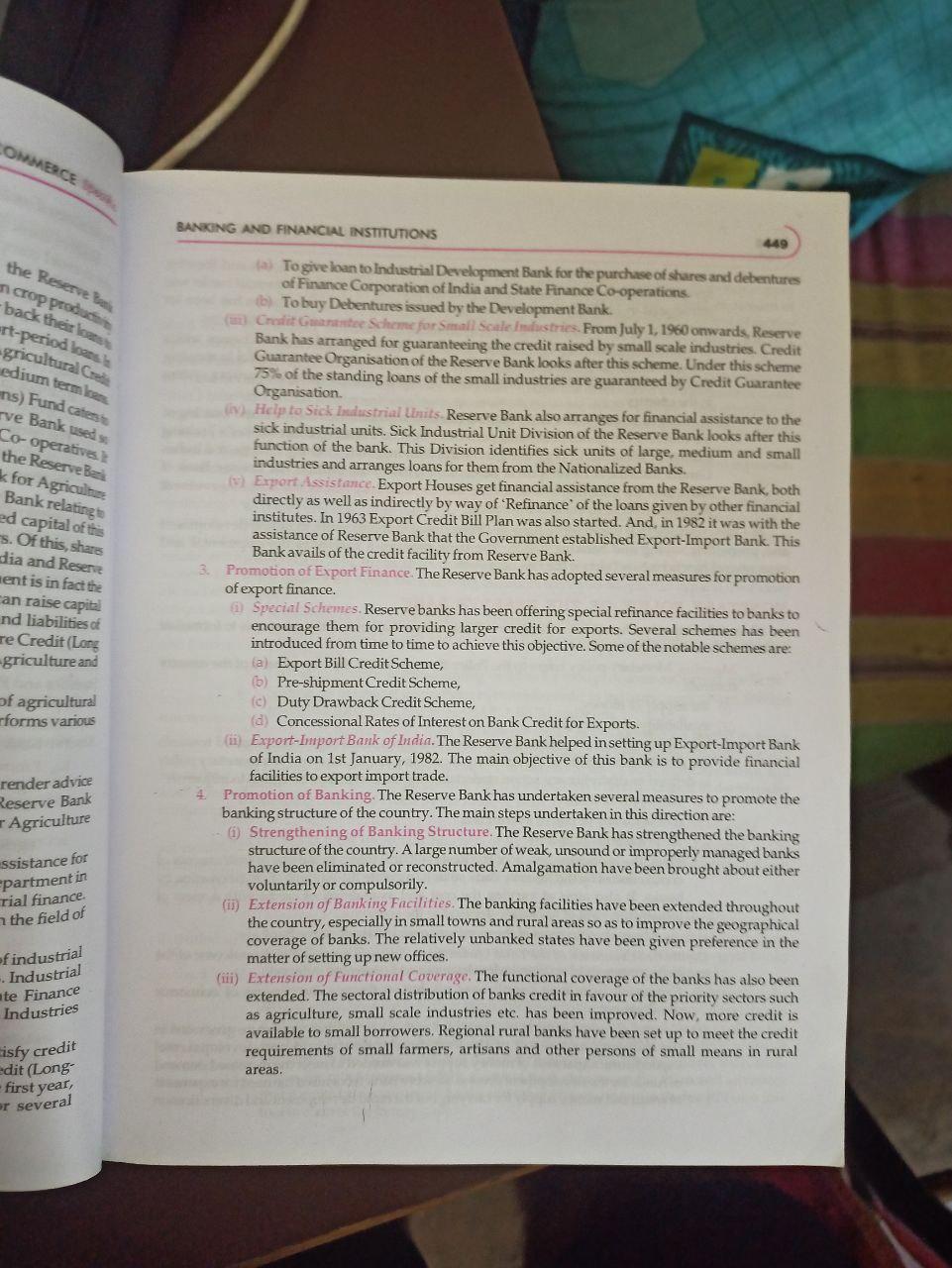

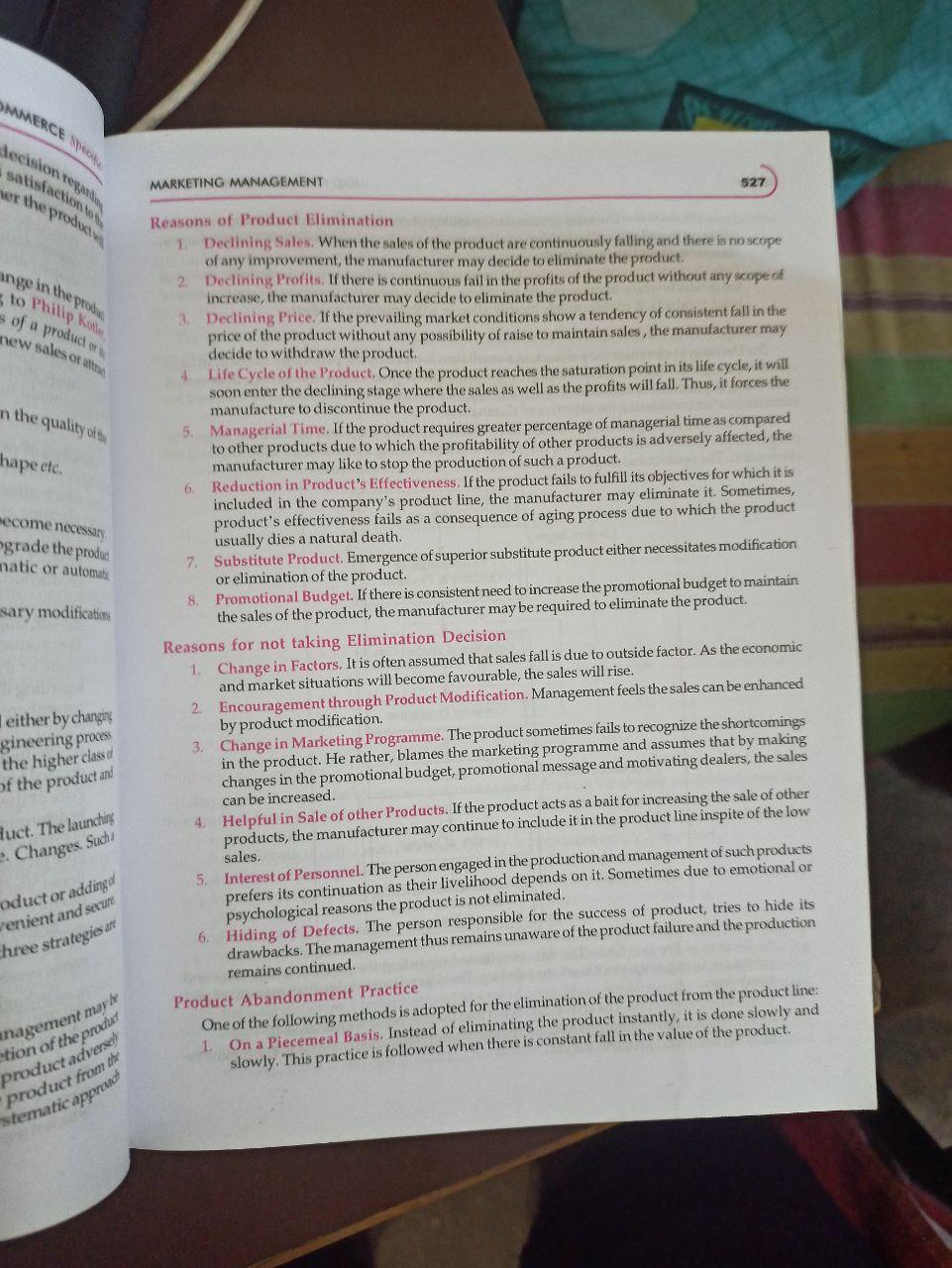

which forms a part of the contract of sale and affects the contract, is called a stipu mor damages but not to a right to Ram consults Shyam, a motor-car dealer for a car suitable for touring purposes to - Shyam suggests 'Maruti' and Ram accordingly buys it from Shyam. The car tu Ram is therefore entitled to reject the car and have refund of the price. inthe event of any manufacturing defect the date of origina se properly repaired. After six months Ram gets a right to claim for damages, if any, suffered by him but not the re ight of the repudiatine purpose of the contract. condition. \begin{tabular}{l} Warranty \\ It is only collat purpose of the co \\ The aggrieved only damages of warranty. \\ \hline \end{tabular} Bank has arranged for guaranteeing the credit raised by small scale industries. Credit Guarantee Organisation of the Reserve Bank looks after this scheme. Under this scheme 75\% of the standing loans of the small industries are guaranteed by Credit Guarantee Organisation. [Ni. Help to Sick I ahastrial Lomis. Reserve Bank also arranges for financial assistance to the sick industrial units. Sick Industrial Unit Division of the Reserve Bank looks after this function of the bank. This Division identifies sick units of large, medium and small industries and arranges loans for them from the Nationalized Banks. (v) Ermort tssistamce. Export Houses get financial assistance from the Reserve Bank, both directly as well as indirectly by way of 'Refinance' of the loans given by other financial institutes. In 1963 Export Credit Bill Plan was also started. And, in 1982 it was with the assistance of Reserve Bank that the Government established Export-Import Bank. This Bankavails of the credit facility from Reserve Bank. 3. Promotion of Export Finance. The Reserve Bank has adopted several measures for promotion of export finance. (ii) Special Schemes. Reserve banks has been offering special refinance facilities to banks to encourage them for providing larger credit for exports. Several schemes has been introduced from time to time to achieve this objective. Some of the notable schemes are: (a) Export Bill Credit Scheme, (b) Pre-shipmentCredit Scheme, (c) Duty Drawback Credit Scheme, (d) Concessional Rates of Interest on Bank Credit for Exports. (ii) Export-Import Bank of India. The Reserve Bank helped in setting up Export-Import Bank of India on 1st January, 1982. The main objective of this bank is to provide financial facilities to export import trade. 4. Promotion of Banking. The Reserve Bankhas undertaken several measures to promote the banking structure of the country. The main steps undertaken in this direction are: (i) Strengthening of Banking Structure. The Reserve Bank has strengthened the banking structure of the country. A large number of weak, unsound or improperly managed banks have been eliminated or reconstructed. Amalgamation have been brought about either voluntarily or compulsorily. (ii) Extension of B anking Facilities. The banking facilities have been extended throughout the country, especially in small towns and rural areas so as to improve the geographical coverage of banks. The relatively unbanked states have been given preference in the matter of setting up new offices. (iii) Extension of Functional Coverage. The functional coverage of the banks has also been extended. The sectoral distribution of banks credit in favour of the priority sectors such as agriculture, small scale industries etc. has been improved. Now, more credit is available to small borrowers. Regional rural banks have been set up to meet the credit requirements of small farmers, artisans and other persons of small means in rural areas. Reasons of Product Elimination 1. Declining Sales. When the sales of the product are continuously falling and there is no scope of any improvement, the manufacturer may decide to eliminate the product. 2. Declining Profits. If there is continuous fail in the profits of the product without any scope of increase, the manufacturer may decide to eliminate the product. 3. Declining Price. If the prevailing market conditions show a tendency of consistent fall in the price of the product without any possibility of raise to maintain sales, the manufacturer may decide to withdraw the product. 4. Life Cycle of the Product. Once the product reaches the saturation point in its life cycle, it will soon enter the declining stage where the sales as well as the profits will fall. Thus, it forces the manufacture to discontinue the product. 5. Managerial Time. If the product requires greater percentage of managerial time as compared to other products due to which the profitability of other products is adversely affected, the manufacturer may like to stop the production of such a product. 6. Reduction in Product's Effectiveness. If the product fails to fulfill its objectives for which it is included in the company's product line, the manufacturer may eliminate it. Sometimes, product's effectiveness fails as a consequence of aging process due to which the product usually dies a natural death. 7. Substitute Product. Emergence of superior substitute product either necessitates modification or elimination of the product. 8. Promotional Budget. If there is consistentneed to increase the promotional budget to maintain the sales of the product, the manufacturer may be required to eliminate the product. Reasons for not taking Elimination Decision 1. Change in Factors. It is often assumed that sales fall is due to outside factor. As the economic and market situations will become favourable, the sales will rise. 2. Encouragement through Product Modification. Management feels the sales can be enhanced by product modification. 3. Change in Marketing Programme. The product sometimes fails to recognize the shortcomings in the product. He rather, blames the marketing programme and assumes that by making changes in the promotional budget, promotional message and motivating dealers, the sales can be increased. 4. Helpful in Sale of other Products. If the product acts as a bait for increasing the sale of other products, the manufacturer may continue to include it in the product line inspite of the low sales. 5. Interest of Personnel. The person engaged in the production and management of such products prefers its continuation as their livelihood depends on it. Sometimes due to emotional or psychological reasons the product is not eliminated. 6. Hiding of Defects. The person responsible for the success of product, tries to hide its drawbacks. The management thus remains unaware of the product failure and the production remains continued. Product Abandonment Practice One of the following methods is adopted for the elimination of the product from the product line: 1. On a Piecemeal Basis. Instead of eliminating the product instantly, it is done slowly and slowly. This practice is followed when there is constant fall in the value of the product. 55: , 2022 ? ti. (SSC 2013; RRB 2016) [SSC 2015 5 " th) - (a) . . (b) . (d) 5 [SSC 2013] (d) [CDS BANKING AND FINANCIAL INSTITUTIONS 471 Greater emphasis is also now being paid on value added services such as credit cards and merchant banking. As a manifestation of increased competition, a number of public and private banks have been setting up ATM's introducing tele-banking, providing specialised services and introducing credit card operations. An additional indication of increased quality competition is in the attempt of banks to seek quality certification ISO 9000 from International Standards organisation. 6. Efficiency. The following indicators are used to judge the extent of improvement in efficiency of the banks: (i) The first efficiency indicator is the proportion of operating cost to working funds. It measures a bank's ability to economise on total costs. With respect to this indicator while the domestic private banks have registered a significant improvement in lowering costs in the reforms period, the cost of both public sector banks and foreign banks have registered an increase. (ii) The second efficiency indicator is the proportion of staff expenditure to working funds. With respect to this indicator the foreign banks have the lowest expenditure while the public sector banks have the highest expenditure. The domestic private sector banks have registered a significant reduction in such expenditure in the reforms period. (iii) Another efficiency indicator is spread or Net Interest margin as percentage of working funds. Spread (Net Interest Margin) is the difference between interest income and interest expenditure by a bank. A higher spread may indicate the fact that a bank may be more capable of mobilizing deposits at low rate of interest or advancing credit at higher interest rates. Foreign banks have the highest spread followed by domestic private banks and then by public sector banks. Such differences could signify dynamic efficiency differences. However, the comparison is not entirely fair because the public sector banks carry a greater burden of lending to the priority sector at subsidised interest rates. NON-PERFORMING ASSET Identification NPA is a classification used by financial institutions that refer to loans that are in jeopardy of default. Once the borrower has failed to make interest or principal payments for 90 days the loan is considered to be a non-performing asset. Non-performing assets are problematic for financial institutions since they depend on interest payments for income. Troublesome pressure from the economy can lead to a sharp increase in non-performing loans and often results in massive write-downs. With a view to moving towards international best practices and to ensure greater transparency, it has been decided to adopt the ' 90 days overdue' norm for identification of NPA, from the year ending March 31, 2004. Accordingly, with effect from March 31, 2004, a non-performing asset ( NPA) shall be a loan or an advance where; Interest and / or installment of principal remain overdue for a period of more than 90 days in respect of a term loan, The account remains 'out of order' for a period of more than 90 days, in respect of an Overdraft/ Cash Credit (OD/CC), The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted, which forms a part of the contract of sale and affects the contract, is called a stipu mor damages but not to a right to Ram consults Shyam, a motor-car dealer for a car suitable for touring purposes to - Shyam suggests 'Maruti' and Ram accordingly buys it from Shyam. The car tu Ram is therefore entitled to reject the car and have refund of the price. inthe event of any manufacturing defect the date of origina se properly repaired. After six months Ram gets a right to claim for damages, if any, suffered by him but not the re ight of the repudiatine purpose of the contract. condition. \begin{tabular}{l} Warranty \\ It is only collat purpose of the co \\ The aggrieved only damages of warranty. \\ \hline \end{tabular} Bank has arranged for guaranteeing the credit raised by small scale industries. Credit Guarantee Organisation of the Reserve Bank looks after this scheme. Under this scheme 75\% of the standing loans of the small industries are guaranteed by Credit Guarantee Organisation. [Ni. Help to Sick I ahastrial Lomis. Reserve Bank also arranges for financial assistance to the sick industrial units. Sick Industrial Unit Division of the Reserve Bank looks after this function of the bank. This Division identifies sick units of large, medium and small industries and arranges loans for them from the Nationalized Banks. (v) Ermort tssistamce. Export Houses get financial assistance from the Reserve Bank, both directly as well as indirectly by way of 'Refinance' of the loans given by other financial institutes. In 1963 Export Credit Bill Plan was also started. And, in 1982 it was with the assistance of Reserve Bank that the Government established Export-Import Bank. This Bankavails of the credit facility from Reserve Bank. 3. Promotion of Export Finance. The Reserve Bank has adopted several measures for promotion of export finance. (ii) Special Schemes. Reserve banks has been offering special refinance facilities to banks to encourage them for providing larger credit for exports. Several schemes has been introduced from time to time to achieve this objective. Some of the notable schemes are: (a) Export Bill Credit Scheme, (b) Pre-shipmentCredit Scheme, (c) Duty Drawback Credit Scheme, (d) Concessional Rates of Interest on Bank Credit for Exports. (ii) Export-Import Bank of India. The Reserve Bank helped in setting up Export-Import Bank of India on 1st January, 1982. The main objective of this bank is to provide financial facilities to export import trade. 4. Promotion of Banking. The Reserve Bankhas undertaken several measures to promote the banking structure of the country. The main steps undertaken in this direction are: (i) Strengthening of Banking Structure. The Reserve Bank has strengthened the banking structure of the country. A large number of weak, unsound or improperly managed banks have been eliminated or reconstructed. Amalgamation have been brought about either voluntarily or compulsorily. (ii) Extension of B anking Facilities. The banking facilities have been extended throughout the country, especially in small towns and rural areas so as to improve the geographical coverage of banks. The relatively unbanked states have been given preference in the matter of setting up new offices. (iii) Extension of Functional Coverage. The functional coverage of the banks has also been extended. The sectoral distribution of banks credit in favour of the priority sectors such as agriculture, small scale industries etc. has been improved. Now, more credit is available to small borrowers. Regional rural banks have been set up to meet the credit requirements of small farmers, artisans and other persons of small means in rural areas. Reasons of Product Elimination 1. Declining Sales. When the sales of the product are continuously falling and there is no scope of any improvement, the manufacturer may decide to eliminate the product. 2. Declining Profits. If there is continuous fail in the profits of the product without any scope of increase, the manufacturer may decide to eliminate the product. 3. Declining Price. If the prevailing market conditions show a tendency of consistent fall in the price of the product without any possibility of raise to maintain sales, the manufacturer may decide to withdraw the product. 4. Life Cycle of the Product. Once the product reaches the saturation point in its life cycle, it will soon enter the declining stage where the sales as well as the profits will fall. Thus, it forces the manufacture to discontinue the product. 5. Managerial Time. If the product requires greater percentage of managerial time as compared to other products due to which the profitability of other products is adversely affected, the manufacturer may like to stop the production of such a product. 6. Reduction in Product's Effectiveness. If the product fails to fulfill its objectives for which it is included in the company's product line, the manufacturer may eliminate it. Sometimes, product's effectiveness fails as a consequence of aging process due to which the product usually dies a natural death. 7. Substitute Product. Emergence of superior substitute product either necessitates modification or elimination of the product. 8. Promotional Budget. If there is consistentneed to increase the promotional budget to maintain the sales of the product, the manufacturer may be required to eliminate the product. Reasons for not taking Elimination Decision 1. Change in Factors. It is often assumed that sales fall is due to outside factor. As the economic and market situations will become favourable, the sales will rise. 2. Encouragement through Product Modification. Management feels the sales can be enhanced by product modification. 3. Change in Marketing Programme. The product sometimes fails to recognize the shortcomings in the product. He rather, blames the marketing programme and assumes that by making changes in the promotional budget, promotional message and motivating dealers, the sales can be increased. 4. Helpful in Sale of other Products. If the product acts as a bait for increasing the sale of other products, the manufacturer may continue to include it in the product line inspite of the low sales. 5. Interest of Personnel. The person engaged in the production and management of such products prefers its continuation as their livelihood depends on it. Sometimes due to emotional or psychological reasons the product is not eliminated. 6. Hiding of Defects. The person responsible for the success of product, tries to hide its drawbacks. The management thus remains unaware of the product failure and the production remains continued. Product Abandonment Practice One of the following methods is adopted for the elimination of the product from the product line: 1. On a Piecemeal Basis. Instead of eliminating the product instantly, it is done slowly and slowly. This practice is followed when there is constant fall in the value of the product. 55: , 2022 ? ti. (SSC 2013; RRB 2016) [SSC 2015 5 " th) - (a) . . (b) . (d) 5 [SSC 2013] (d) [CDS BANKING AND FINANCIAL INSTITUTIONS 471 Greater emphasis is also now being paid on value added services such as credit cards and merchant banking. As a manifestation of increased competition, a number of public and private banks have been setting up ATM's introducing tele-banking, providing specialised services and introducing credit card operations. An additional indication of increased quality competition is in the attempt of banks to seek quality certification ISO 9000 from International Standards organisation. 6. Efficiency. The following indicators are used to judge the extent of improvement in efficiency of the banks: (i) The first efficiency indicator is the proportion of operating cost to working funds. It measures a bank's ability to economise on total costs. With respect to this indicator while the domestic private banks have registered a significant improvement in lowering costs in the reforms period, the cost of both public sector banks and foreign banks have registered an increase. (ii) The second efficiency indicator is the proportion of staff expenditure to working funds. With respect to this indicator the foreign banks have the lowest expenditure while the public sector banks have the highest expenditure. The domestic private sector banks have registered a significant reduction in such expenditure in the reforms period. (iii) Another efficiency indicator is spread or Net Interest margin as percentage of working funds. Spread (Net Interest Margin) is the difference between interest income and interest expenditure by a bank. A higher spread may indicate the fact that a bank may be more capable of mobilizing deposits at low rate of interest or advancing credit at higher interest rates. Foreign banks have the highest spread followed by domestic private banks and then by public sector banks. Such differences could signify dynamic efficiency differences. However, the comparison is not entirely fair because the public sector banks carry a greater burden of lending to the priority sector at subsidised interest rates. NON-PERFORMING ASSET Identification NPA is a classification used by financial institutions that refer to loans that are in jeopardy of default. Once the borrower has failed to make interest or principal payments for 90 days the loan is considered to be a non-performing asset. Non-performing assets are problematic for financial institutions since they depend on interest payments for income. Troublesome pressure from the economy can lead to a sharp increase in non-performing loans and often results in massive write-downs. With a view to moving towards international best practices and to ensure greater transparency, it has been decided to adopt the ' 90 days overdue' norm for identification of NPA, from the year ending March 31, 2004. Accordingly, with effect from March 31, 2004, a non-performing asset ( NPA) shall be a loan or an advance where; Interest and / or installment of principal remain overdue for a period of more than 90 days in respect of a term loan, The account remains 'out of order' for a period of more than 90 days, in respect of an Overdraft/ Cash Credit (OD/CC), The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted