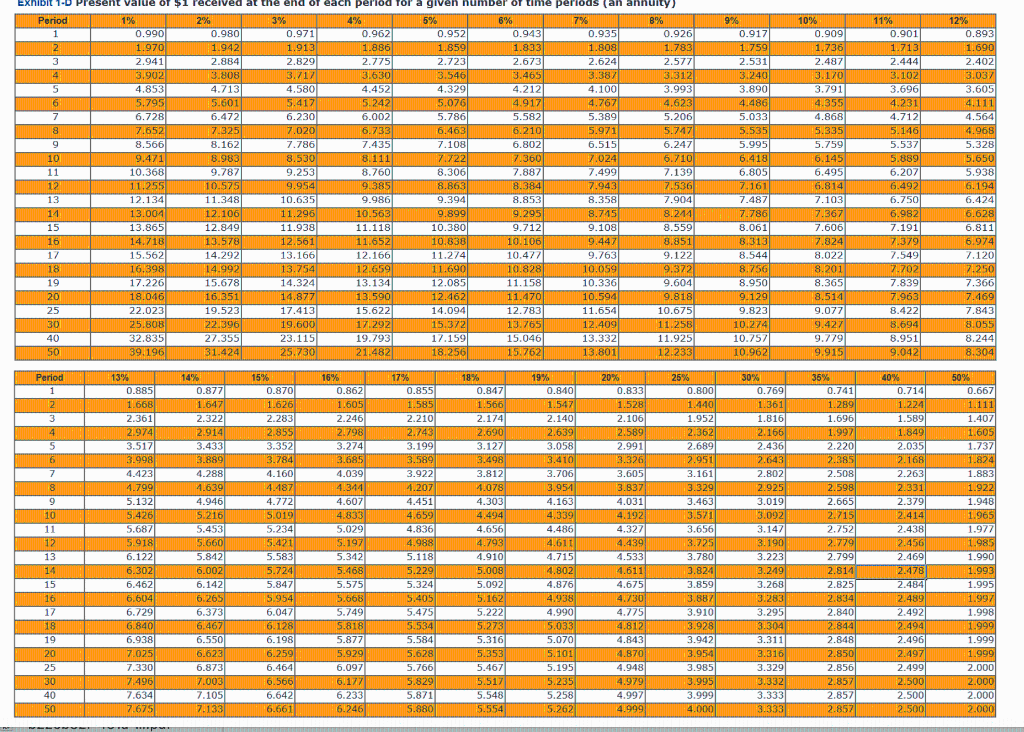

If you borrow $10,000 with an interest rate of 5 percent, to be repaid in five equal yearly payments at the end of the next five years, what would be the amount of each payment? Use Exhibit 1-D. (Round time value factor to 3 decimal places and final answer to 2 decimal places.)

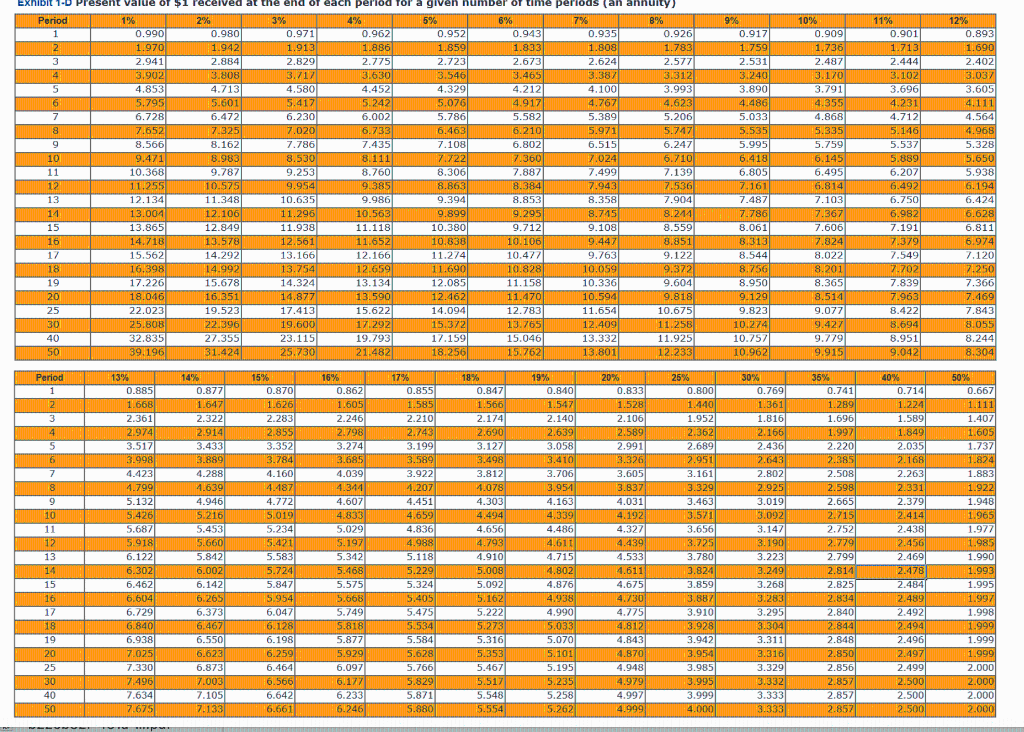

9% 0.917 1.759 2.5311 3.240 3.890 4.486 5.033 5.535 7.435 5.995 exhibit 1-0 Present value of $1 received at the end of each period for a given number of time periods (an annuity) Period 1% 2% 3% 4% 5% 6% 7% 8% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 4 3.902 3.808 3./17 3.630 3.546 3.465 3.387 3.312 4.8531 4.713 4.580 4.452 4.3291 4.212 4.100 3.993 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 7 6.728 6.472 6.230 6.002 5.786 5.5821 5.389 5.206 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 9 8.566 8.162 7.7861 7.108 6.802 6.5151 6.247 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 11 10.3681 9.7871 9.253 8.760 8.306 7.887 7.499 7.139 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 13 12.134 11.3481 10.6351 9.986 8.853 8.358 7.9041 11 13.004 12.106 11.296 10.563 9.899 9.295 8.715 8.214 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 3.851 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 30 25.808 22.3961 19.600 17.292 15.3721 13.705 12.409 11.256 40 32.835 27.3551 23.115 19.793 17.159 15.046 13.332 11.925 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.8681 5.335 5.7591 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 9.0771 9.427 9.779 9.915 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 9.823 10.274 10.757 10.962 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 8.422 8.694 8.9511 9.042 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 16.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 8.244 8.304 9.394 Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 518 19 20 25 30 40 50 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.330 7.496 7.634 7.675 14% 0.8771 1.6471 2.322 2.914 3.4331 3.8891 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 7.105 7.133 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.1601 4.187 4.772 5.019 5.234 5.421 5.583 5.724 5.847 15.954 6.047 6.128 6.198 6.259 6.464 6.566 6.642 6.661 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 17% 0.855 1.585 2.210 2.743 3.1991 3.589 3.922 4.207 4.451 4.659 4.8361 4.988 5.118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 5.766 5.829 5.871 5.880 18% 0.8471 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.467 5.517 5.548 5.554 19% 0.840 1.547 2.140 2.639 3.058 13.410 3.706 3.951 4.163 4.339 4.486 4.611 4.715 4.802 4.876 4.938 4.9901 5.033 5.070 5.101 5.195 5.235 5.258 5.262 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.843 4.870 4.948 4.979 4.997 4.999 25% 0.800 1.440 1.952 2.362 2.689 2.951 3.161 3.329 3.463 3.571 3.656 3.725 3.780 3.824 3.859 13.887 3.910 3.928 3.942 3.954 3.985 3.995 3.999 4.000 30% 0.769 1.361 1.816 2.166 2.4361 2.643 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.283 3.295 3.304 3.311 3.316 3.329 3.332 3.3331 3.333 35% 0.741 1.289 1.696 1.997 2.220 2.385 2.508 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 2.856 2.857 2.857 2.8571 40% 0.714 1.224 1.5891 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.4691 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.500 2.500 2.500 50% 0.66 1.111 1.407 1.605 1.737 1.824 1.883 1.922 1.948 1.965 1.977 1.985 1.990 1.993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 6.097 6.177 6.233 6.246 FEN