Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you can make it in Excel, please. II. Problem: Motor Inc., a car manufacturing company, is evaluating the possible acquisition of a hybrid car

If you can make it in Excel, please.

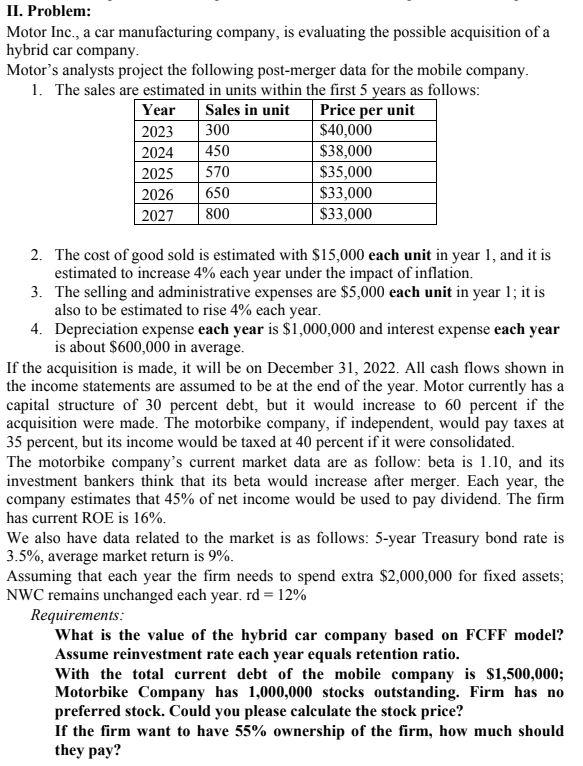

II. Problem: Motor Inc., a car manufacturing company, is evaluating the possible acquisition of a hybrid car company Motor's analysts project the following post-merger data for the mobile company. 1. The sales are estimated in units within the first 5 years as follows: Year Sales in unit Price per unit 2023 300 $40,000 2024 450 $38,000 2025 $35,000 2026 650 $33,000 2027 800 $33,000 570 2. The cost of good sold is estimated with $15,000 each unit in year 1, and it is estimated to increase 4% each year under the impact of inflation. 3. The selling and administrative expenses are $5,000 each unit in year 1; it is also to be estimated to rise 4% each year. 4. Depreciation expense each year is $1,000,000 and interest expense each year is about $600,000 in average. If the acquisition is made, it will be on December 31, 2022. All cash flows shown in the income statements are assumed to be at the end of the year. Motor currently has a capital structure of 30 percent debt, but it would increase to 60 percent if the acquisition were made. The motorbike company, if independent, would pay taxes at 35 percent, but its income would be taxed at 40 percent if it were consolidated. The motorbike company's current market data are as follow: beta is 1.10, and its investment bankers think that its beta would increase after merger. Each year, the company estimates that 45% of net income would be used to pay dividend. The firm has current ROE is 16%. We also have data related to the market is as follows: 5-year Treasury bond rate is 3.5%, average market return is 9%. Assuming that each year the firm needs to spend extra $2,000,000 for fixed assets; NWC remains unchanged each year, rd = 12% Requirements: What is the value of the hybrid car company based on FCFF model? Assume reinvestment rate each year equals retention ratio. With the total current debt of the mobile company is $1,500,000; Motorbike Company has 1,000,000 stocks outstanding. Firm has no preferred stock. Could you please calculate the stock price? If the firm want to have 55% ownership of the firm, how much should they payStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started