Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you can only help me with 1 question then I really need number 6!! please!! If you can help me with the others then

If you can only help me with 1 question then I really need number 6!! please!! If you can help me with the others then numbers 3-8 please!! Thank you so much

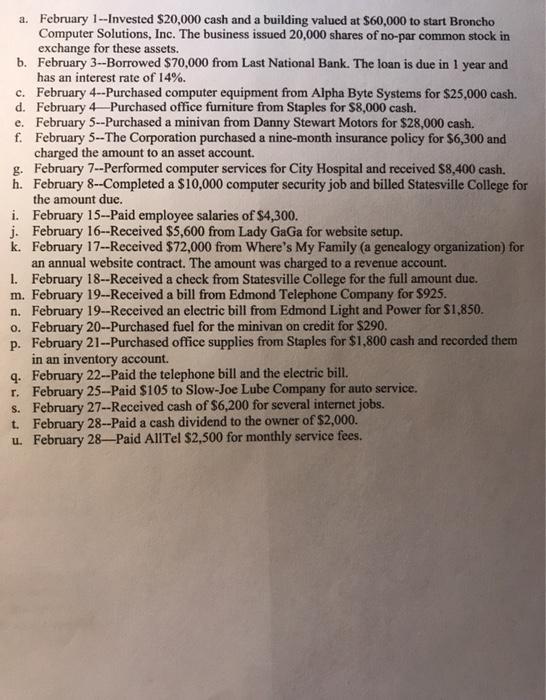

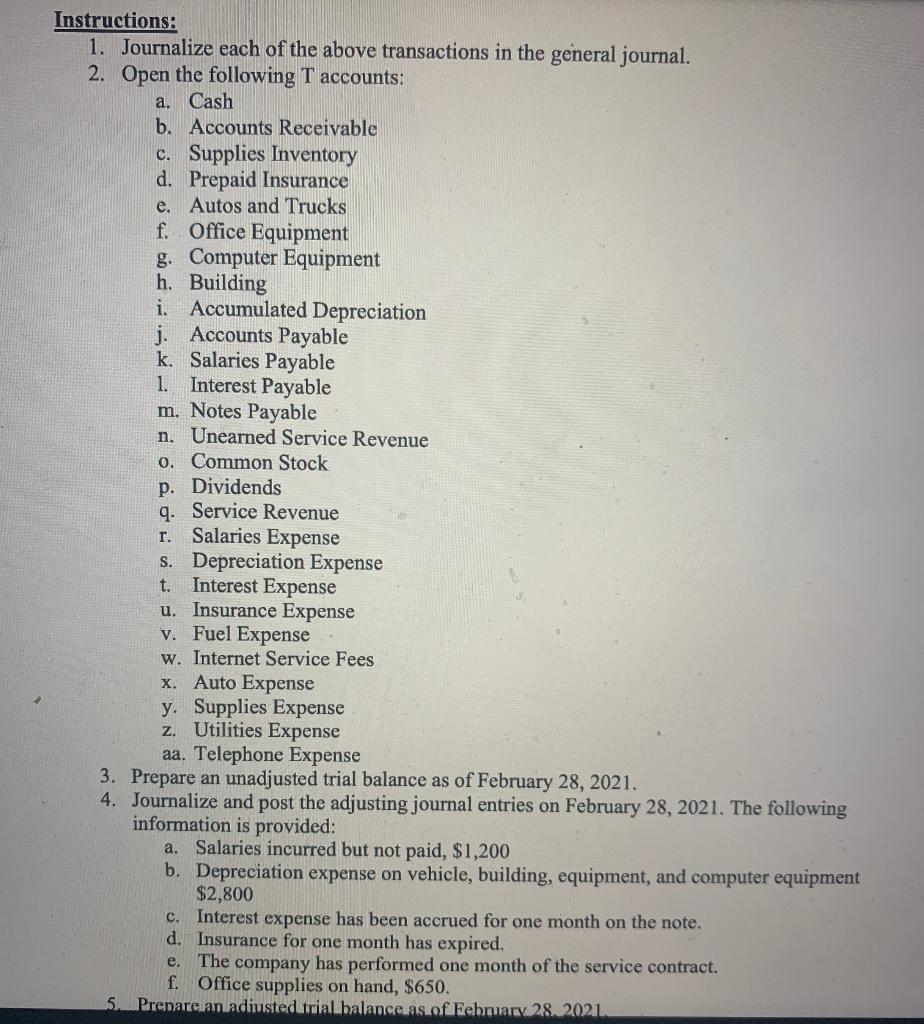

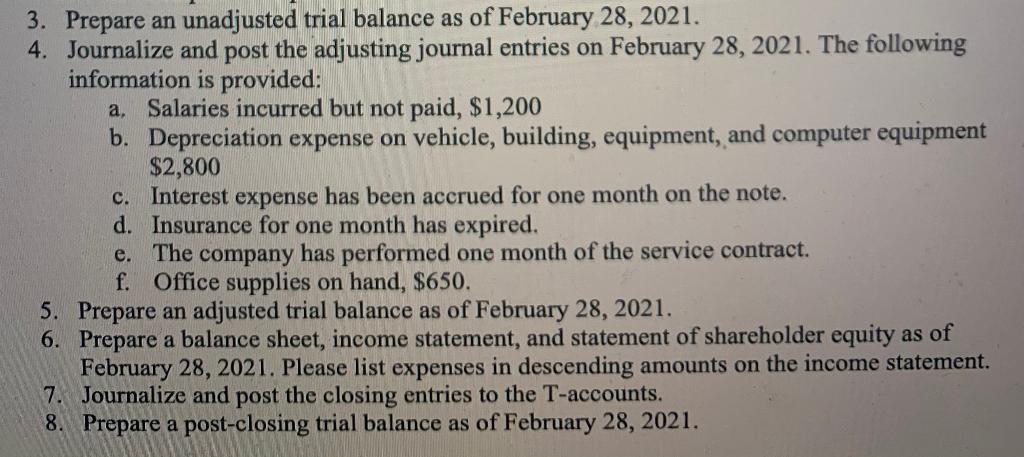

a. February 1 --Invested $20,000 cash and a building valued at $60,000 to start Broncho Computer Solutions, Inc. The business issued 20,000 shares of no-par common stock in exchange for these assets. b. February 3--Borrowed $70,000 from Last National Bank. The loan is due in 1 year and has an interest rate of 14%. c. February 4--Purchased computer equipment from Alpha Byte Systems for $25,000 cash. d. February 4Purchased office furniture from Staples for $8,000 cash. e. February 5--Purchased a minivan from Danny Stewart Motors for $28,000 cash. f. February 5--The Corporation purchased a nine-month insurance policy for $6,300 and charged the amount to an asset account. g. February 7--Performed computer services for City Hospital and received $8,400 cash. h. February 8--Completed a $10,000 computer security job and billed Statesville College for the amount due. i. February 15--Paid employee salaries of $4,300. j. February 16--Received $5,600 from Lady GaGa for website setup. k. February 17--Received $72,000 from Where's My Family (a genealogy organization) for an annual website contract. The amount was charged to a revenue account. 1. February 18--Received a check from Statesville College for the full amount due. m. February 19--Received a bill from Edmond Telephone Company for $925. n. February 19--Received an electric bill from Edmond Light and Power for $1,850. 0. February 20--Purchased fuel for the minivan on credit for $290. p. February 21--Purchased office supplies from Staples for $1,800 cash and recorded them in an inventory account. 4. February 22--Paid the telephone bill and the electric bill. 1. February 25--Paid $105 to Slow-Joe Lube Company for auto service. S. February 27--Received cash of $6,200 for several internet jobs. t. February 28--Paid a cash dividend to the owner of $2,000. u. February 28-Paid AllTel $2,500 for monthly service fees. Instructions: 1. Journalize each of the above transactions in the general journal. 2. Open the following T accounts: a. Cash b. Accounts Receivable c. Supplies Inventory d. Prepaid Insurance e. Autos and Trucks f. Office Equipment g. Computer Equipment h. Building i. Accumulated Depreciation j. Accounts Payable k. Salaries Payable 1. Interest Payable m. Notes Payable n. Unearned Service Revenue Common Stock p. Dividends q. Service Revenue Salaries Expense s. Depreciation Expense t. Interest Expense u. Insurance Expense v. Fuel Expense w. Internet Service Fees X. Auto Expense y. Supplies Expense Z. Utilities Expense aa. Telephone Expense 3. Prepare an unadjusted trial balance as of February 28, 2021. 4. Journalize and post the adjusting journal entries on February 28, 2021. The following information is provided: a. Salaries incurred but not paid, $1,200 b. Depreciation expense on vehicle, building, equipment, and computer equipment $2,800 Interest expense has been accrued for one month on the note. d. Insurance for one month has expired. The company has performed one month of the service contract. f. Office supplies on hand, $650. 5 Prepare an adimusted trial balance as of February 28 2021 r. C. e. 3. Prepare an unadjusted trial balance as of February 28, 2021. 4. Journalize and post the adjusting journal entries on February 28, 2021. The following information is provided: a. Salaries incurred but not paid, $1,200 b. Depreciation expense on vehicle, building, equipment, and computer equipment $2,800 c. Interest expense has been accrued for one month on the note. d. Insurance for one month has expired. e. The company has performed one month of the service contract. f. Office supplies on hand, $650. 5. Prepare an adjusted trial balance as of February 28, 2021. 6. Prepare a balance sheet, income statement, and statement of shareholder equity as of February 28, 2021. Please list expenses in descending amounts on the income statement. 7. Journalize and post the closing entries to the T-accounts. 8. Prepare a post-closing trial balance as of February 28, 2021. a. February 1 --Invested $20,000 cash and a building valued at $60,000 to start Broncho Computer Solutions, Inc. The business issued 20,000 shares of no-par common stock in exchange for these assets. b. February 3--Borrowed $70,000 from Last National Bank. The loan is due in 1 year and has an interest rate of 14%. c. February 4--Purchased computer equipment from Alpha Byte Systems for $25,000 cash. d. February 4Purchased office furniture from Staples for $8,000 cash. e. February 5--Purchased a minivan from Danny Stewart Motors for $28,000 cash. f. February 5--The Corporation purchased a nine-month insurance policy for $6,300 and charged the amount to an asset account. g. February 7--Performed computer services for City Hospital and received $8,400 cash. h. February 8--Completed a $10,000 computer security job and billed Statesville College for the amount due. i. February 15--Paid employee salaries of $4,300. j. February 16--Received $5,600 from Lady GaGa for website setup. k. February 17--Received $72,000 from Where's My Family (a genealogy organization) for an annual website contract. The amount was charged to a revenue account. 1. February 18--Received a check from Statesville College for the full amount due. m. February 19--Received a bill from Edmond Telephone Company for $925. n. February 19--Received an electric bill from Edmond Light and Power for $1,850. 0. February 20--Purchased fuel for the minivan on credit for $290. p. February 21--Purchased office supplies from Staples for $1,800 cash and recorded them in an inventory account. 4. February 22--Paid the telephone bill and the electric bill. 1. February 25--Paid $105 to Slow-Joe Lube Company for auto service. S. February 27--Received cash of $6,200 for several internet jobs. t. February 28--Paid a cash dividend to the owner of $2,000. u. February 28-Paid AllTel $2,500 for monthly service fees. Instructions: 1. Journalize each of the above transactions in the general journal. 2. Open the following T accounts: a. Cash b. Accounts Receivable c. Supplies Inventory d. Prepaid Insurance e. Autos and Trucks f. Office Equipment g. Computer Equipment h. Building i. Accumulated Depreciation j. Accounts Payable k. Salaries Payable 1. Interest Payable m. Notes Payable n. Unearned Service Revenue Common Stock p. Dividends q. Service Revenue Salaries Expense s. Depreciation Expense t. Interest Expense u. Insurance Expense v. Fuel Expense w. Internet Service Fees X. Auto Expense y. Supplies Expense Z. Utilities Expense aa. Telephone Expense 3. Prepare an unadjusted trial balance as of February 28, 2021. 4. Journalize and post the adjusting journal entries on February 28, 2021. The following information is provided: a. Salaries incurred but not paid, $1,200 b. Depreciation expense on vehicle, building, equipment, and computer equipment $2,800 Interest expense has been accrued for one month on the note. d. Insurance for one month has expired. The company has performed one month of the service contract. f. Office supplies on hand, $650. 5 Prepare an adimusted trial balance as of February 28 2021 r. C. e. 3. Prepare an unadjusted trial balance as of February 28, 2021. 4. Journalize and post the adjusting journal entries on February 28, 2021. The following information is provided: a. Salaries incurred but not paid, $1,200 b. Depreciation expense on vehicle, building, equipment, and computer equipment $2,800 c. Interest expense has been accrued for one month on the note. d. Insurance for one month has expired. e. The company has performed one month of the service contract. f. Office supplies on hand, $650. 5. Prepare an adjusted trial balance as of February 28, 2021. 6. Prepare a balance sheet, income statement, and statement of shareholder equity as of February 28, 2021. Please list expenses in descending amounts on the income statement. 7. Journalize and post the closing entries to the T-accounts. 8. Prepare a post-closing trial balance as of February 28, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started