Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you can only use stock fund and bond fund to build a portfolio that generates an expected return of 10%. What is the

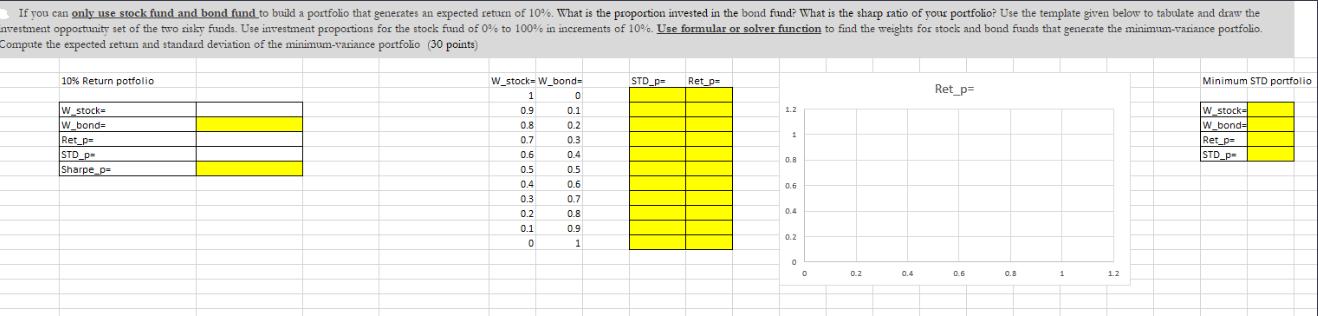

If you can only use stock fund and bond fund to build a portfolio that generates an expected return of 10%. What is the proportion invested in the bond fund? What is the sharp ratio of your portfolio? Use the template given below to tabulate and draw the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of 0% to 100% in increments of 10%. Use formular or solver function to find the weights for stock and bond funds that generate the minimum-variance portfolio. Compute the expected return and standard deviation of the minimum-variance portfolio (30 points) 10% Return potfolio W_stock= W_bond= Ret_p STD_p Sharpe p W_stock- W_bond- 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 STD_p= Ret_p= 1.2 1 0.8 0.6 0.4 0.2 0 0 0.2 0.4 Ret_p= 0.6 0.8 1 1.2 Minimum STD portfolio W_stock- W_bond- Ret_p STD_p

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to find the proportion of the portfolio invested in the bond fund that generates an expected return of 10 We will also calculate the Sharpe ratio of the portfolio Lets us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started