Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you can please try to answer these, I would be truly grateful! Thank you so much for your time :) Quantitative ProblemBellinger Industries is

If you can please try to answer these, I would be truly grateful! Thank you so much for your time :)

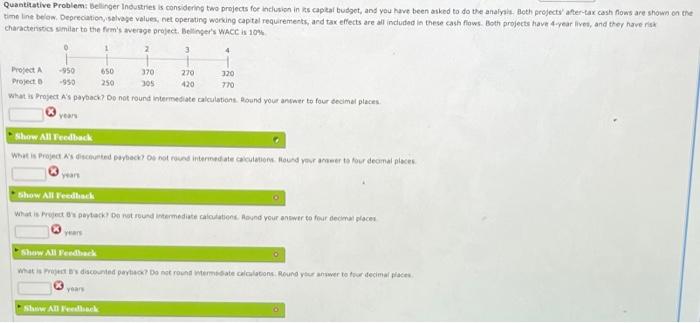

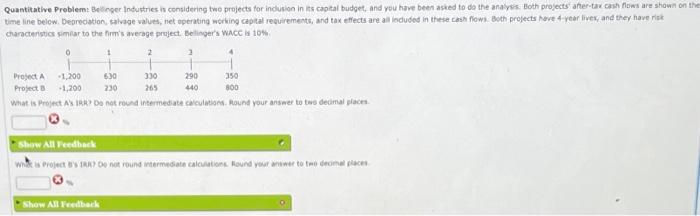

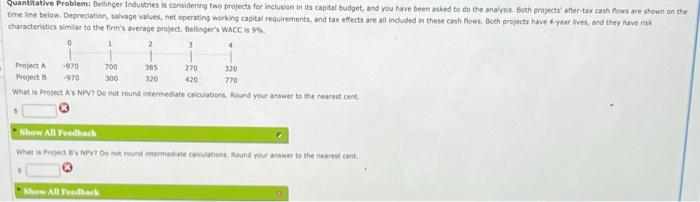

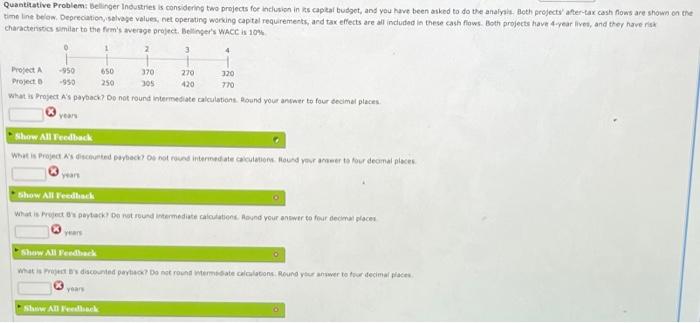

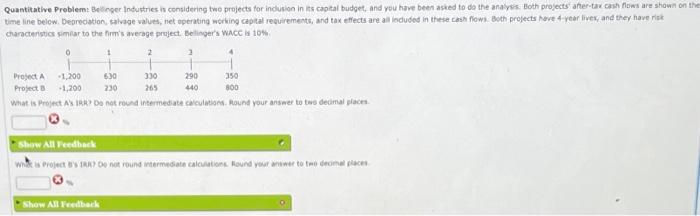

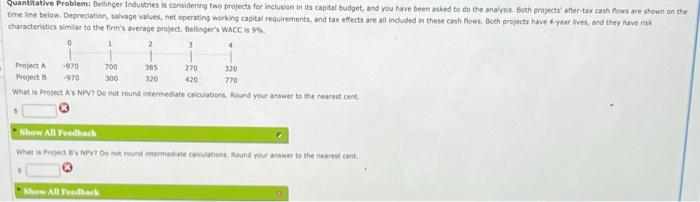

Quantitative ProblemBellinger Industries is considering two projects for inclusion in s capital budget, and you have been asked to do the analysis. Both projects after-tax cash flows are shown on the time line below. Depreciation, selvage values, net operating working capital requrements, and tax effects are all included in these cash flows. Both projects have ever lives, and they have risk characteristics similar to the firm's werage project. Beiner's WACC is 10% 3 270 Project -950 650 370 320 Project -950 250 305 420 770 What Project A's payback? Do not round intermediate calculations. Round your answer to four decimal places Year Show All Feedback What is Project discounted pack? oe not run intermediate calculator Round your rower to four decimal places years Show All Feedback What is Project Daytark? Do not found intermediate calculations. Round your answer to four decimal places Show All Feedback What is discounted payt? Do round Wermate calculations. Round your answer to four decimal Places years sha Anteelam Quantitative Problem: Beiger Industries is considering two projects for indusion in its capital budget, and you have been asked to do the analysis. Both projects ahertax cash flows are shown on the time line below. Deprecation, salvage values, net operating working capital requirements, and tax effects are all louded in these cash row. Both projects have 4-year lives and they have risk characteristics similar to the firm's average project. Betinger's WACC 10% 1 2 2 Project A -1,200 3.30 290 Projects 1,200 265 440 800 What is Project A IRRY DO round intermediate calculations. Round your answer to the decimal places 6.30 230 350 Show All Feedback wiges Project T Dot Yound intermediate calculation found your answer to the domes Show All Feedback Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects after-tax cash flows are shown on the time tine below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have your lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9 0 1 2 3 4 Project -970 700 270 320 Project 300 320 What is Project A's NV? Do not found intermediate calculations. Round your answer to the nearest cent 770 Show All Feedback What is how? Do not round wurmediate Round your answer to the nearest cent Show All Feedback

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started