Answered step by step

Verified Expert Solution

Question

1 Approved Answer

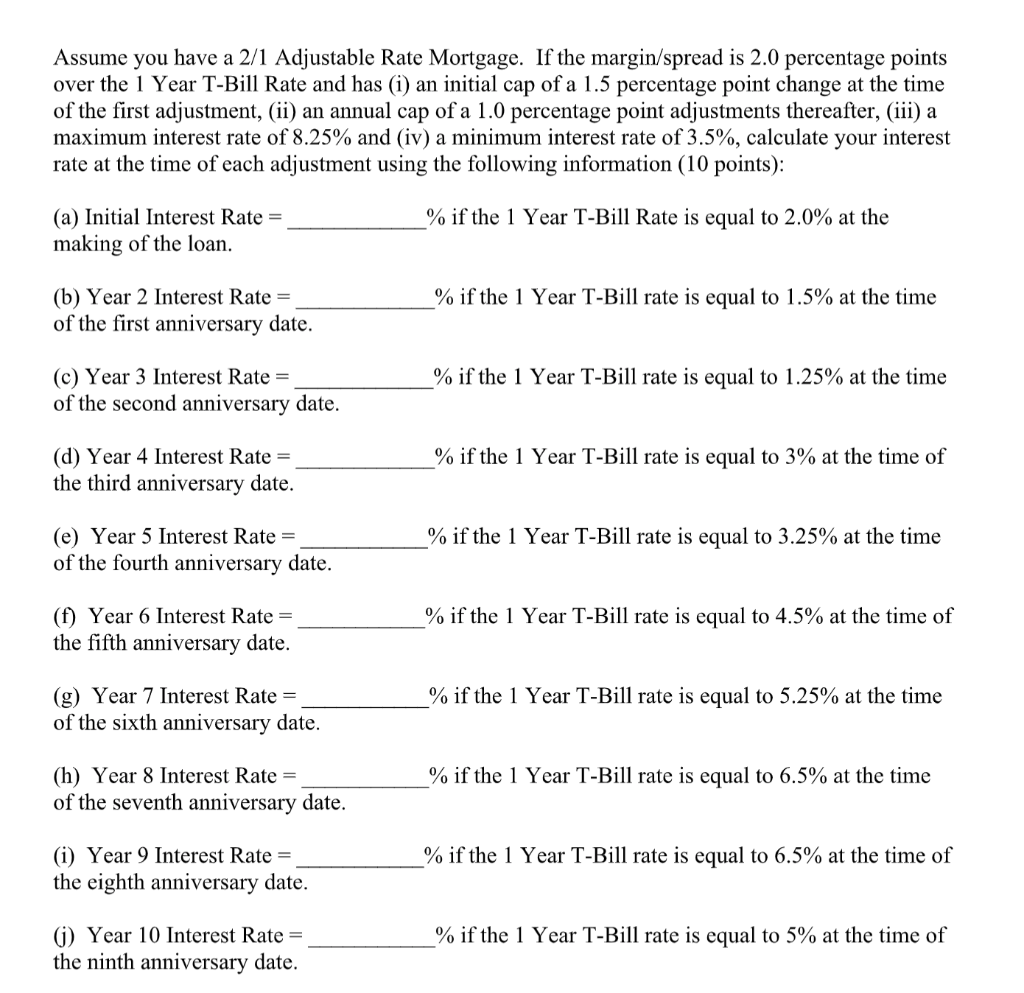

If you could explain how to solve that would be superb. Assume you have a 2/1 Adjustable Rate Mortgage. If the margin/spread is 2.0 percentage

If you could explain how to solve that would be superb.

Assume you have a 2/1 Adjustable Rate Mortgage. If the margin/spread is 2.0 percentage points over the 1 Year T-Bill Rate and has (i) an initial cap of a 1.5 percentage point change at the time of the first adjustment, (ii) an annual cap of a 1.0 percentage point adjustments thereafter, (iii) a maximum interest rate of 8.25% and (iv) a minimum interest rate of 3.5%, calculate your interest rate at the time of each adjustment using the following information (10 points): _% if the 1 Year T-Bill Rate is equal to 2.0% at the (a) Initial Interest Rate = making of the loan. % if the 1 Year T-Bill rate is equal to 1.5% at the time (b) Year 2 Interest Rate = of the first anniversary date. % if the 1 Year T-Bill rate is equal to 1.25% at the time (C) Year 3 Interest Rate = of the second anniversary date. % if the 1 Year T-Bill rate is equal to 3% at the time of (d) Year 4 Interest Rate = the third anniversary date. % if the 1 Year T-Bill rate is equal to 3.25% at the time (e) Year 5 Interest Rate = of the fourth anniversary date. (f) Year 6 Interest Rate = the fifth anniversary date. _% if the 1 Year T-Bill rate is equal to 4.5% at the time of % if the 1 Year T-Bill rate is equal to 5.25% at the time (g) Year 7 Interest Rate = of the sixth anniversary date. % if the 1 Year T-Bill rate is equal to 6.5% at the time (h) Year 8 Interest Rate = of the seventh anniversary date. (i) Year 9 Interest Rate = the eighth anniversary date. _% if the 1 Year T-Bill rate is equal to 6.5% at the time of % if the 1 Year T-Bill rate is equal to 5% at the time of (i) Year 10 Interest Rate = the ninth anniversary dateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started