Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if you could help me with question 2&3 that would be great! Use the following information to complete the questions below: Total acquisition price: $1,162,000.

if you could help me with question 2&3 that would be great!

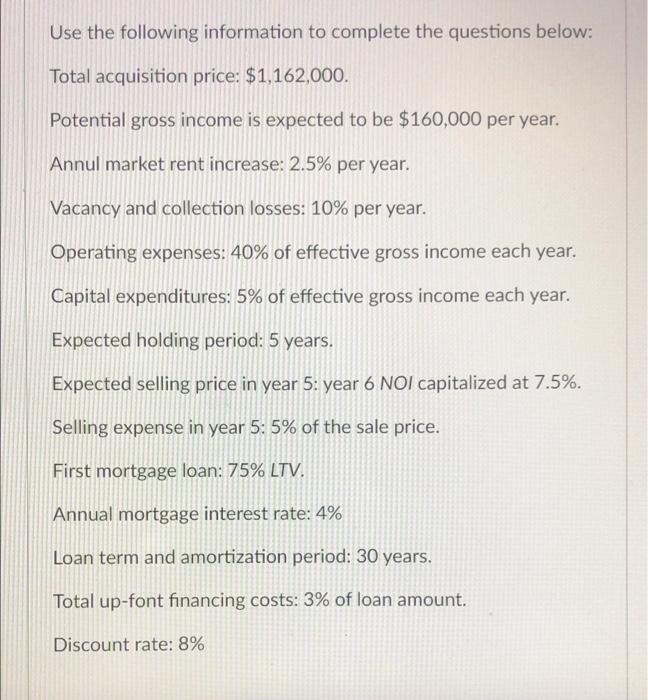

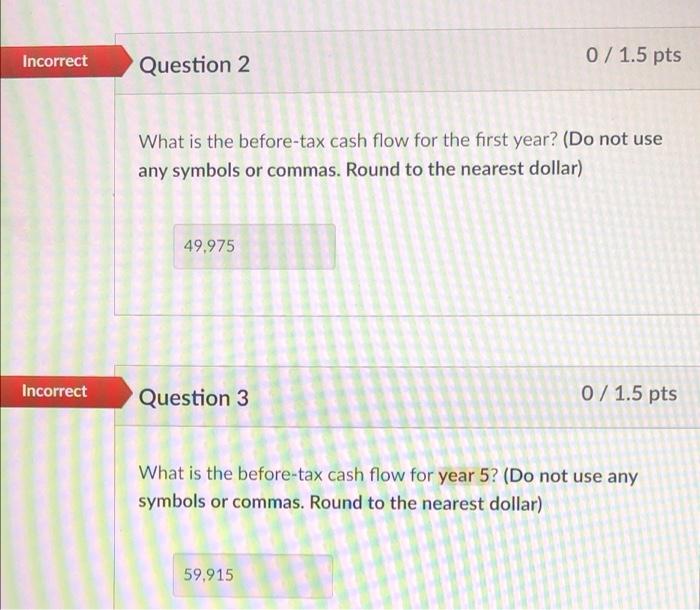

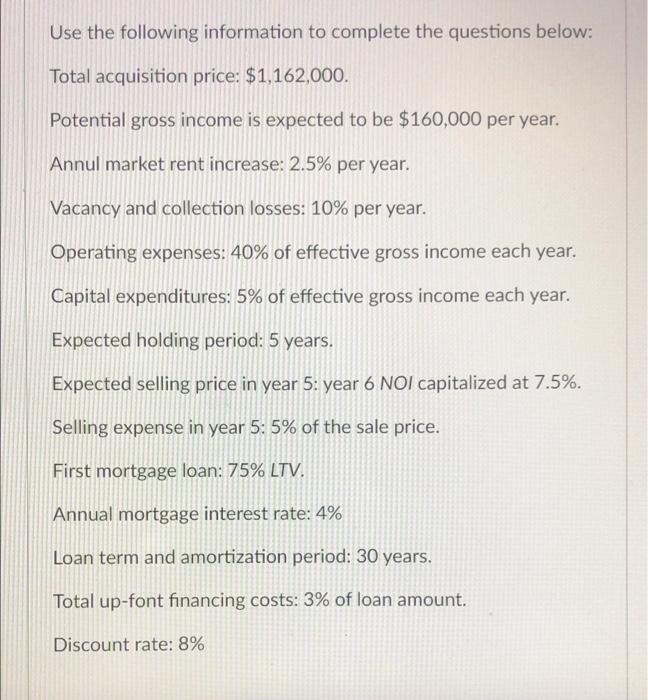

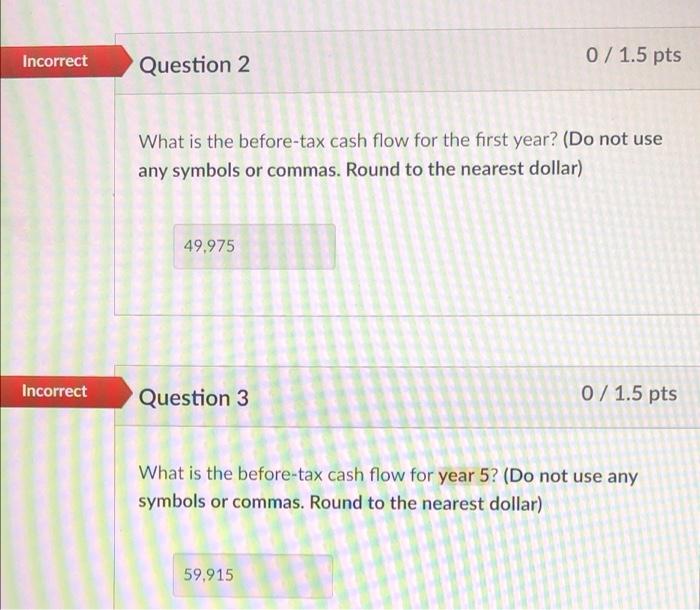

Use the following information to complete the questions below: Total acquisition price: $1,162,000. Potential gross income is expected to be $160,000 per year. Annul market rent increase: 2.5% per year. Vacancy and collection losses: 10% per year. Operating expenses: 40% of effective gross income each year. Capital expenditures: 5% of effective gross income each year. Expected holding period: 5 years. Expected selling price in year 5: year 6 NOI capitalized at 7.5%. Selling expense in year 5: 5% of the sale price. First mortgage loan: 75% LTV. Annual mortgage interest rate: 4% Loan term and amortization period: 30 years. Total up-font financing costs: 3% of loan amount. Discount rate: 8% Incorrect 0 / 1.5 pts Question 2 What is the before-tax cash flow for the first year? (Do not use any symbols or commas. Round to the nearest dollar) 49.975 Incorrect Question 3 0 / 1.5 pts What is the before-tax cash flow for year 5? (Do not use any symbols or commas. Round to the nearest dollar) 59,915 Use the following information to complete the questions below: Total acquisition price: $1,162,000. Potential gross income is expected to be $160,000 per year. Annul market rent increase: 2.5% per year. Vacancy and collection losses: 10% per year. Operating expenses: 40% of effective gross income each year. Capital expenditures: 5% of effective gross income each year. Expected holding period: 5 years. Expected selling price in year 5: year 6 NOI capitalized at 7.5%. Selling expense in year 5: 5% of the sale price. First mortgage loan: 75% LTV. Annual mortgage interest rate: 4% Loan term and amortization period: 30 years. Total up-font financing costs: 3% of loan amount. Discount rate: 8% Incorrect 0 / 1.5 pts Question 2 What is the before-tax cash flow for the first year? (Do not use any symbols or commas. Round to the nearest dollar) 49.975 Incorrect Question 3 0 / 1.5 pts What is the before-tax cash flow for year 5? (Do not use any symbols or commas. Round to the nearest dollar) 59,915

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started