Question

If you could please explain the process. Please and Thank you. Salsa Company is considering an investment in technology to improve its operations. The investment

If you could please explain the process. Please and Thank you.

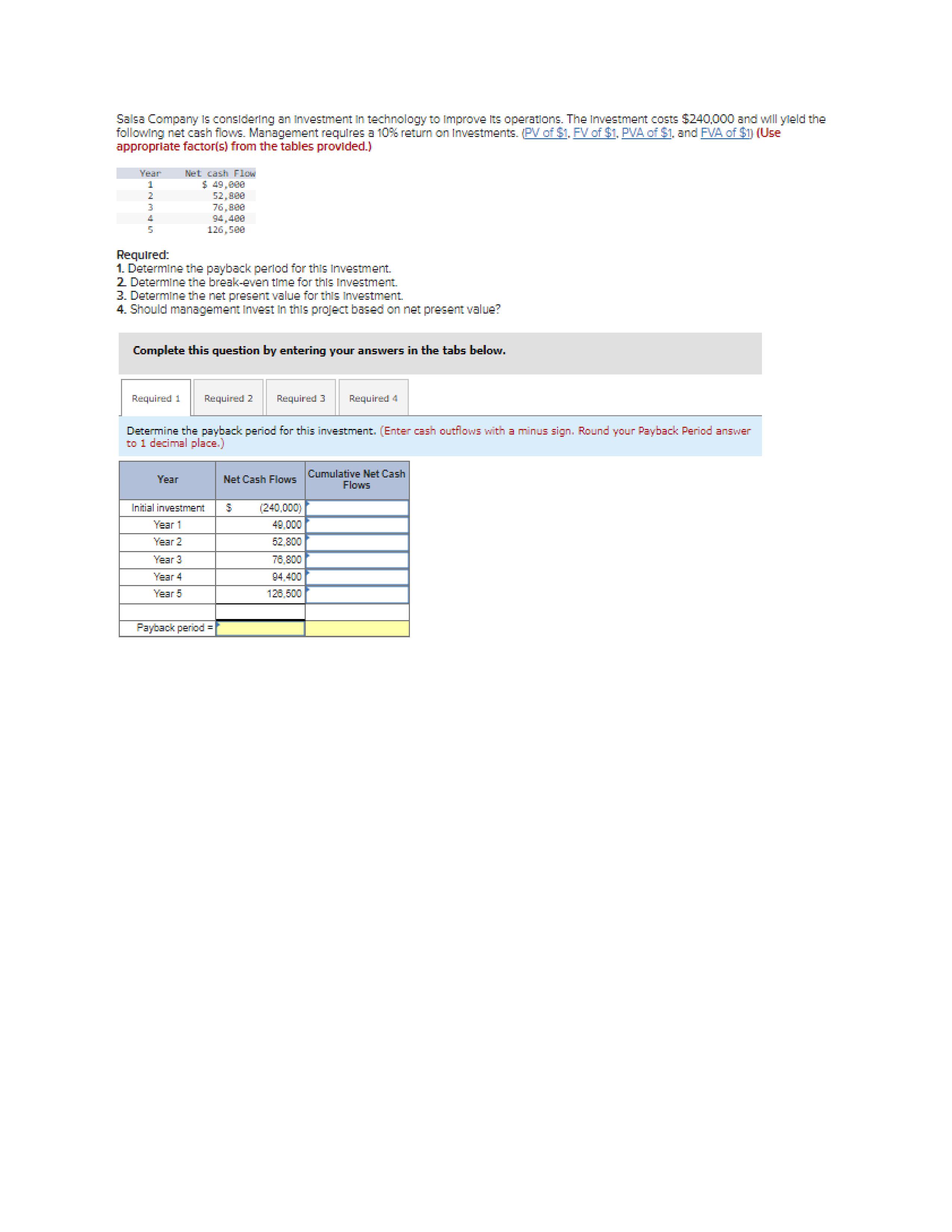

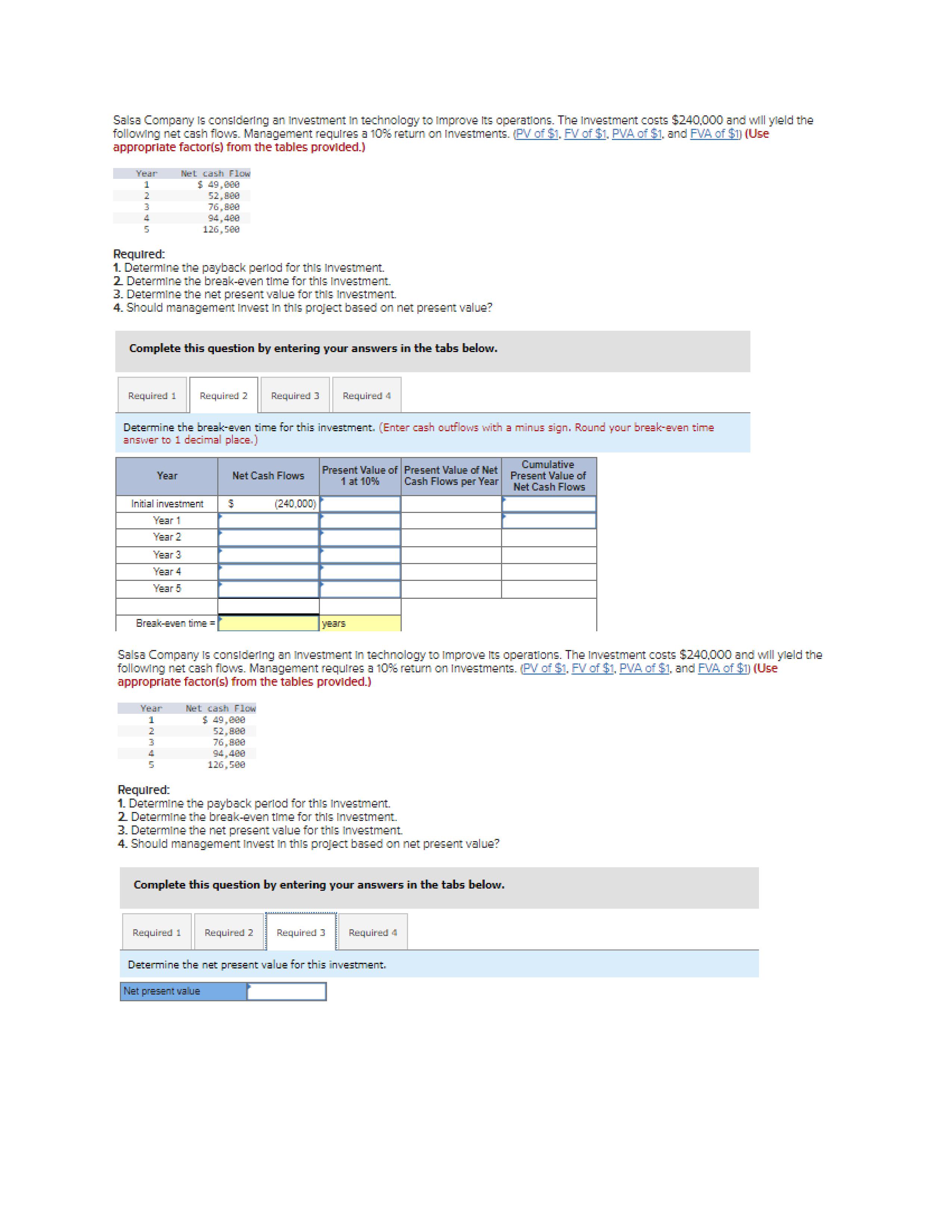

Salsa Company is considering an investment in technology to improve its operations. The investment costs $240,000 and will yield the following net cash flows. Management requires a 10% return on investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Year | Net cash Flow |

|---|---|

| 1 | $ 49,000 |

| 2 | 52,800 |

| 3 | 76,800 |

| 4 | 94,400 |

| 5 | 126,500 |

Required: 1. Determine the payback period for this investment. 2. Determine the break-even time for this investment. 3. Determine the net present value for this investment. 4. Should management invest in this project based on net present value?

Salsa Compary is considering an Investment in technology to improve its operatlons. The lnvestment costs $240,000 and will yleld the following net cash flows. Management requlres a 10\% return on Investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the payback perlod for this investment. 2 Determine the break-even time for this Investment. 3. Determine the net present value for this Investment. 4. Should management Invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Determine the payback period for this investment. (Enter cash outflows with a minus sign. Round your Payback Period answer to 1 decimal place.) Salsa Compary is considering an lnvestment In technology to improve its operatlons. The Investment costs $240,000 and wil yleld the following net cash flows. Management requires a 10% return on Investments. (PV of \$1. FV of $1, PVA of \$1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the payback perlod for this Investment. 2 Determine the break-even time for this Investment. 3. Determine the net present value for this lnvestment. 4. Should management Invest in this project based on net pregent value? Complete this question by entering your answers in the tabs below. Determine the break-even time for this investment. (Enter cash outflows with a minus sign, Round your break-even time answer to 1 decimal place.] Salsa Company is considering an lnvestment ln technology to improve its operatlons. The Investment costs $240,000 and will yleld the following net cash flows. Management requires a 10% return on Investments. (PV of $1. FV of $1, PVA of $1, and PVA of $1 ) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the payback perlod for this Investment. 2 Determine the break-even time for this Investment. 3. Determine the net present value for this lnvestment. 4. Should management Invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Determine the net present value for this investment. Salsa Compary is considering an Investment In technology to improve its operatlons. The Investmert costs $240,000 and will yleld the following net cash flows. Management requires a 10\% return on Investments. (PV of $1. FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the payback perlod for this investment. 2 Determine the break-even time for this investment. 3. Determine the net present value for this investment. 4. Should management invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Should management irvest in this project based on net present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started