Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if you could please help! i dont know if these are right thank you!! Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following

if you could please help! i dont know if these are right thank you!!

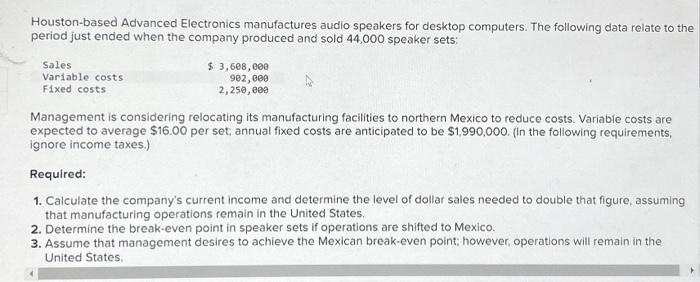

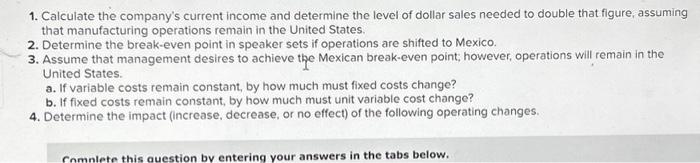

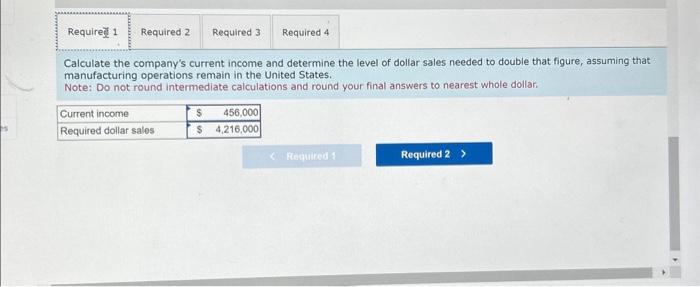

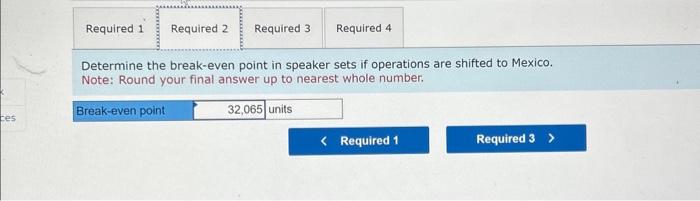

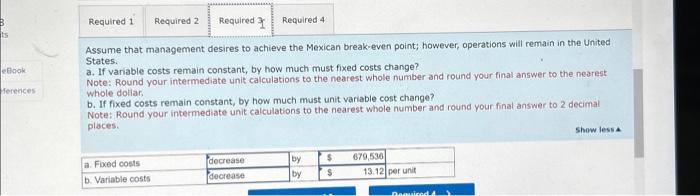

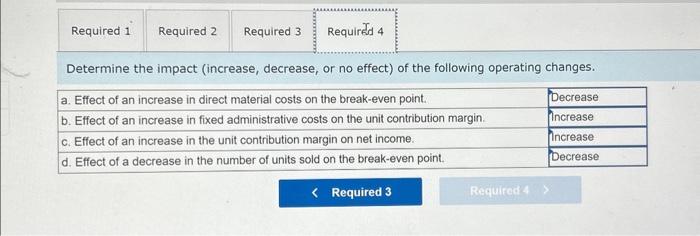

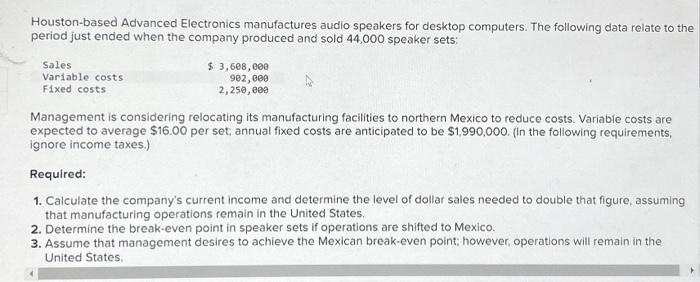

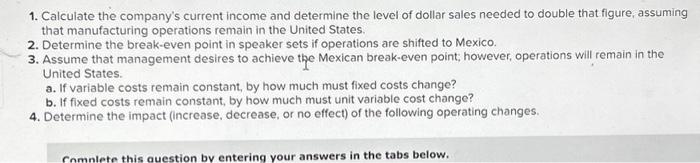

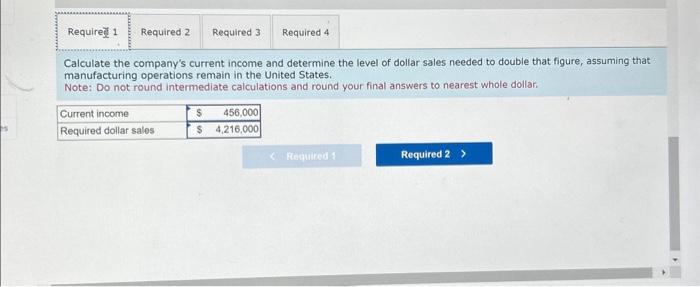

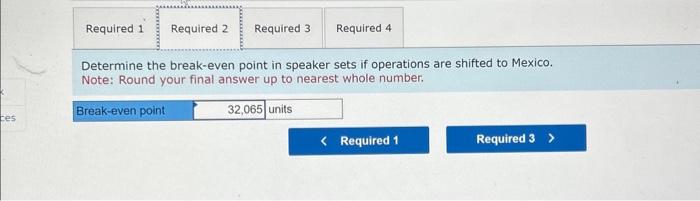

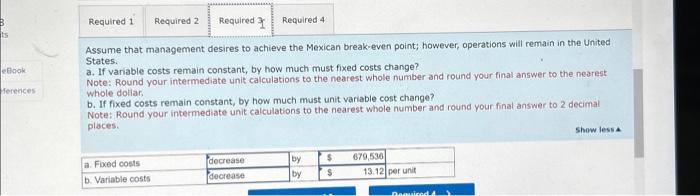

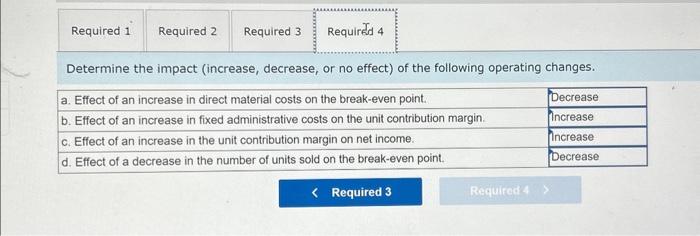

Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following data relate to the period just ended when the company produced and sold 44,000 speaker sets: Management is considering relocating its manufacturing facilities to northern Mexico to reduce costs. Variable costs are expected to average $16.00 per set; annual fixed costs are anticipated to be $1,990,000. (In the following requirements, ignore income taxes.) Required: 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? b. If fixed costs remain constant, by how much must unit variable cost change? 4. Determine the impact (increase, decrease, or no effect) of the following operating changes. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. Note: Do not round intermediate calculations and round your final answers to nearest whole dollar. Determine the break-even point in speaker sets if operations are shifted to Mexico. Note: Round your final answer up to nearest whole number. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? Note: Round your intermediate unit calculations to the nearest whole number and round your final answer to the nearest whole dotiar: b. If fixed costs remain constant, by how much must unit variable cost change? Note: Round your intermediate unit calculations to the nearest whole number and round your final answer to 2 decimal places. Determine the impact (increase, decrease, or no effect) of the following operating changes. Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following data relate to the period just ended when the company produced and sold 44,000 speaker sets: Management is considering relocating its manufacturing facilities to northern Mexico to reduce costs. Variable costs are expected to average $16.00 per set; annual fixed costs are anticipated to be $1,990,000. (In the following requirements, ignore income taxes.) Required: 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? b. If fixed costs remain constant, by how much must unit variable cost change? 4. Determine the impact (increase, decrease, or no effect) of the following operating changes. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. Note: Do not round intermediate calculations and round your final answers to nearest whole dollar. Determine the break-even point in speaker sets if operations are shifted to Mexico. Note: Round your final answer up to nearest whole number. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? Note: Round your intermediate unit calculations to the nearest whole number and round your final answer to the nearest whole dotiar: b. If fixed costs remain constant, by how much must unit variable cost change? Note: Round your intermediate unit calculations to the nearest whole number and round your final answer to 2 decimal places. Determine the impact (increase, decrease, or no effect) of the following operating changes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started