Answered step by step

Verified Expert Solution

Question

1 Approved Answer

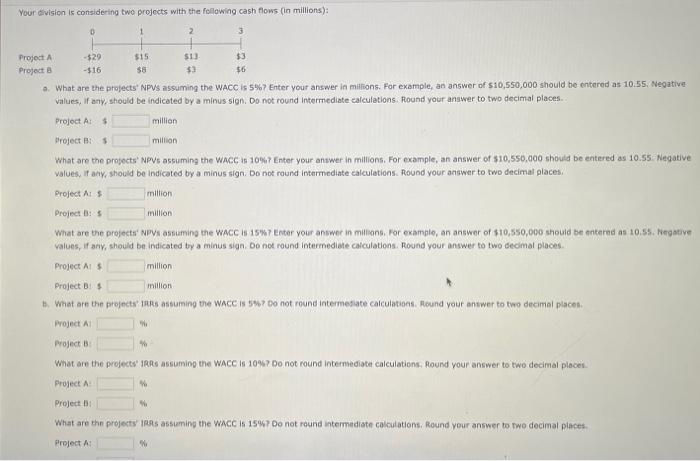

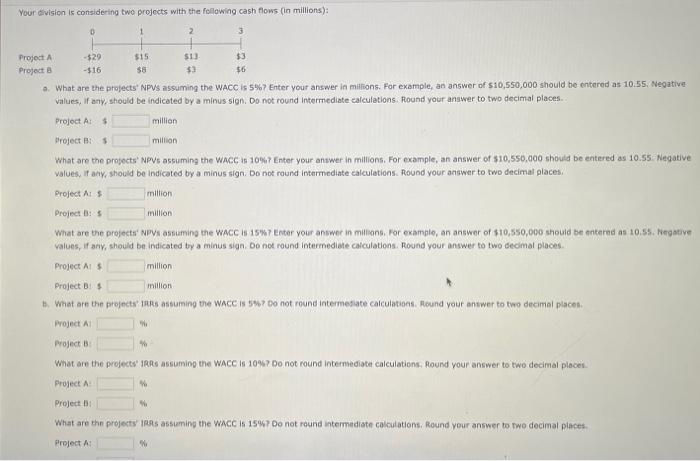

if you could show any steps that u can on a finance caculator, that would be amazing:) Your division is considering two projects with the

if you could show any steps that u can on a finance caculator, that would be amazing:)

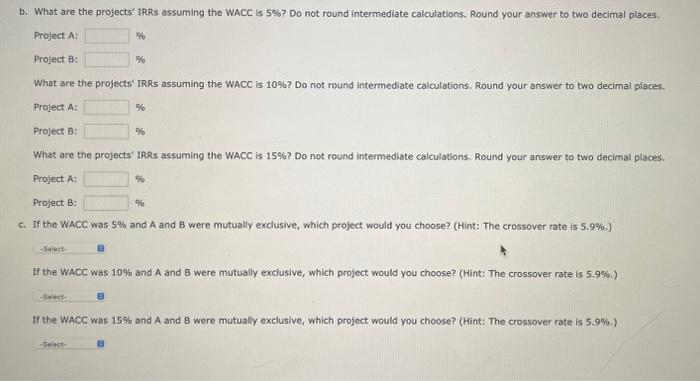

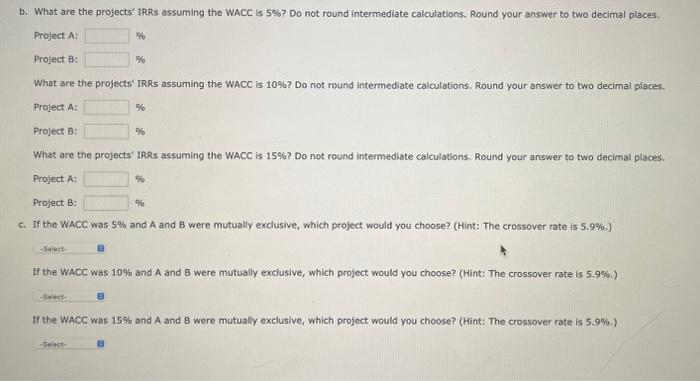

Your division is considering two projects with the following cash flows (in millions): 9. What are the profects' NPVs assuming the WACC is 5% ? Enter your answer in millions. For example, an answer of 510,550,000 should be entered as 10.55 , Negative values, if any, should be indiceted by a minus sign. Do not round intermediate calculations. flound your answer to two decimal places. What are the progects' NPV5 assuming the WacC is 10\%. Enter your anwwer in millions. For example, an answer of 510,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. found your answer to two decimal places. What are the projects' NPVs assuming the WACC is 15W? Enter your answer in milians, For example, an answer of 110,550,000 should be tritered as 10,55, Negative values, if any, should be indicated by a minus sign. Do not round intermediate caiculations. Round your answer to two decimal places. ProjectAs$ProjectB:1millionmillion B. What are the projects' iaks assuming the Wace is 5 ? 00 not round intermesiate calculations. Round your answer to two decimel places. Project A Project B What are the projects" HRRs assiamiog the WACC is 10%5 Do not round intemsediate calculations. found your answer to two decimal ploces. Project A Project 11 What are the projects tars assuming the WACc is 15% Do not round intermediste calbulations. Round your answer to two decimal places. Project A : b. What are the projects' IRRs assuming the WACC is 5%. Do not round intermediate calculations. Round your answer to two decimal places. Project A: Project B: What are the projects' IRRs assuming the WACC is 10% ? Do not round intermediate calculations. Round your answer to two decimal places. Project A: % Project B: What are the projects' IRRs assuming the WACC is 15% ? Do not round intermediate calculations. Round your answer to two decimal places. Project A: Project B: c. If the WACC was 5% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 5.9%.) If the WACC was 10% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 5.9%, ) If the WACC was 15% and A and B were mutually excluslve, which project would you choose? (Hint: The crossover rate is 5.9%.) Your division is considering two projects with the following cash flows (in millions): 9. What are the profects' NPVs assuming the WACC is 5% ? Enter your answer in millions. For example, an answer of 510,550,000 should be entered as 10.55 , Negative values, if any, should be indiceted by a minus sign. Do not round intermediate calculations. flound your answer to two decimal places. What are the progects' NPV5 assuming the WacC is 10\%. Enter your anwwer in millions. For example, an answer of 510,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. found your answer to two decimal places. What are the projects' NPVs assuming the WACC is 15W? Enter your answer in milians, For example, an answer of 110,550,000 should be tritered as 10,55, Negative values, if any, should be indicated by a minus sign. Do not round intermediate caiculations. Round your answer to two decimal places. ProjectAs$ProjectB:1millionmillion B. What are the projects' iaks assuming the Wace is 5 ? 00 not round intermesiate calculations. Round your answer to two decimel places. Project A Project B What are the projects" HRRs assiamiog the WACC is 10%5 Do not round intemsediate calculations. found your answer to two decimal ploces. Project A Project 11 What are the projects tars assuming the WACc is 15% Do not round intermediste calbulations. Round your answer to two decimal places. Project A : b. What are the projects' IRRs assuming the WACC is 5%. Do not round intermediate calculations. Round your answer to two decimal places. Project A: Project B: What are the projects' IRRs assuming the WACC is 10% ? Do not round intermediate calculations. Round your answer to two decimal places. Project A: % Project B: What are the projects' IRRs assuming the WACC is 15% ? Do not round intermediate calculations. Round your answer to two decimal places. Project A: Project B: c. If the WACC was 5% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 5.9%.) If the WACC was 10% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 5.9%, ) If the WACC was 15% and A and B were mutually excluslve, which project would you choose? (Hint: The crossover rate is 5.9%.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started