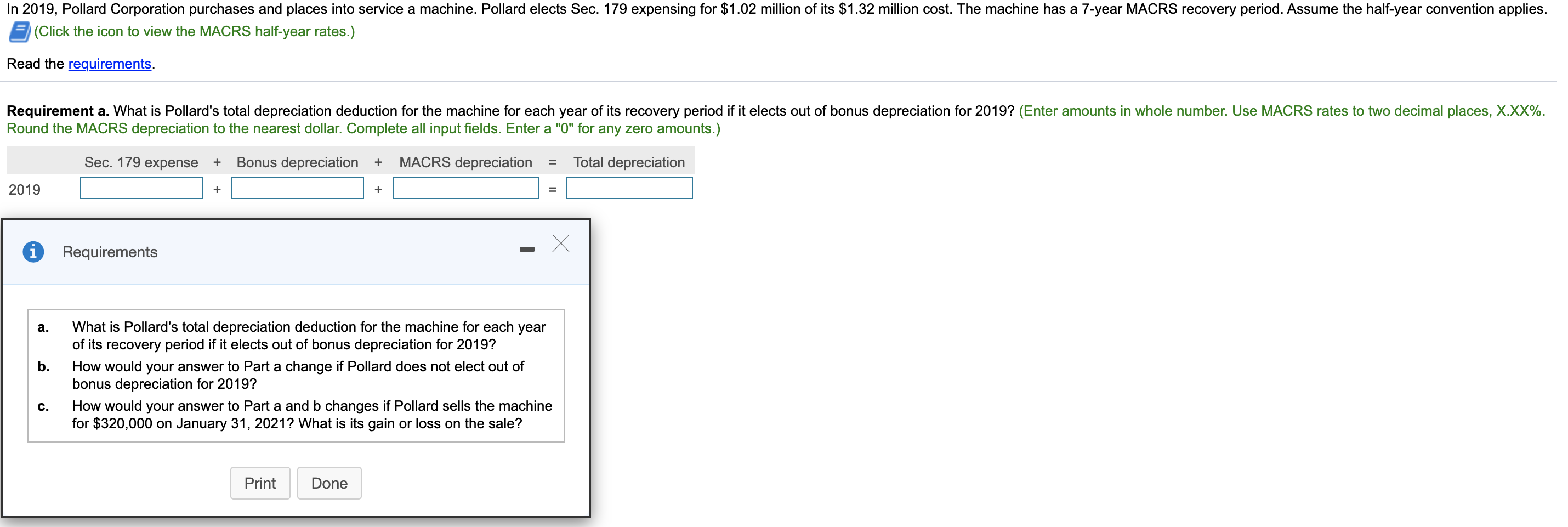

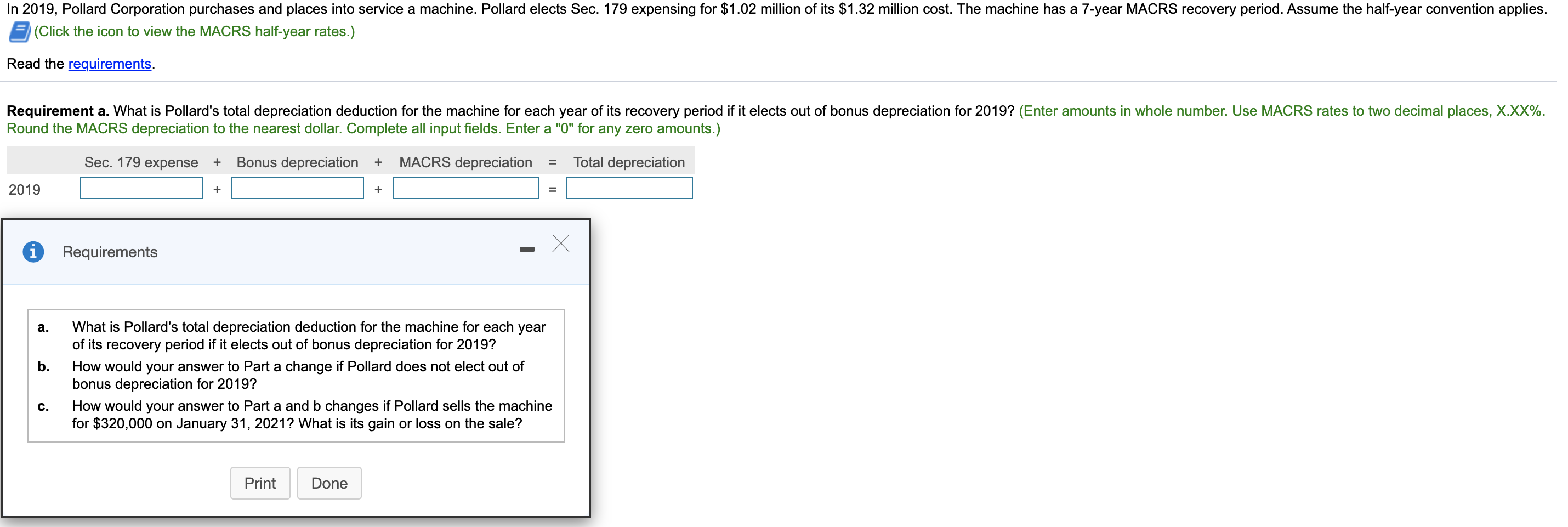

In 2019, Pollard Corporation purchases and places into service a machine. Pollard elects Sec. 179 expensing for $1.02 million of its $1.32 million cost. The machine has a 7-year MACRS recovery period. Assume the half-year convention applies. 5 (Click the icon to view the MACRS half-year rates.) Read the requirements. Requirement a. What is Pollard's total depreciation deduction for the machine for each year of its recovery period if it elects out of bonus depreciation for 2019? (Enter amounts in whole number. Use MACRS rates to two decimal places, X.XX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" for any zero amounts.) Sec. 179 expense MACRS depreciation Total depreciation + Bonus depreciation + + + = = 2019 A Requirements a. b. What is Pollard's total depreciation deduction for the machine for each year of its recovery period if it elects out of bonus depreciation for 2019? How would your answer to Part a change if Pollard does not elect out of bonus depreciation for 2019? How would your answer to Part a and b changes if Pollard sells the machine for $320,000 on January 31, 2021? What is its gain or loss on the sale? c. Print Done In 2019, Pollard Corporation purchases and places into service a machine. Pollard elects Sec. 179 expensing for $1.02 million of its $1.32 million cost. The machine has a 7-year MACRS recovery period. Assume the half-year convention applies. 5 (Click the icon to view the MACRS half-year rates.) Read the requirements. Requirement a. What is Pollard's total depreciation deduction for the machine for each year of its recovery period if it elects out of bonus depreciation for 2019? (Enter amounts in whole number. Use MACRS rates to two decimal places, X.XX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" for any zero amounts.) Sec. 179 expense MACRS depreciation Total depreciation + Bonus depreciation + + + = = 2019 A Requirements a. b. What is Pollard's total depreciation deduction for the machine for each year of its recovery period if it elects out of bonus depreciation for 2019? How would your answer to Part a change if Pollard does not elect out of bonus depreciation for 2019? How would your answer to Part a and b changes if Pollard sells the machine for $320,000 on January 31, 2021? What is its gain or loss on the sale? c. Print Done