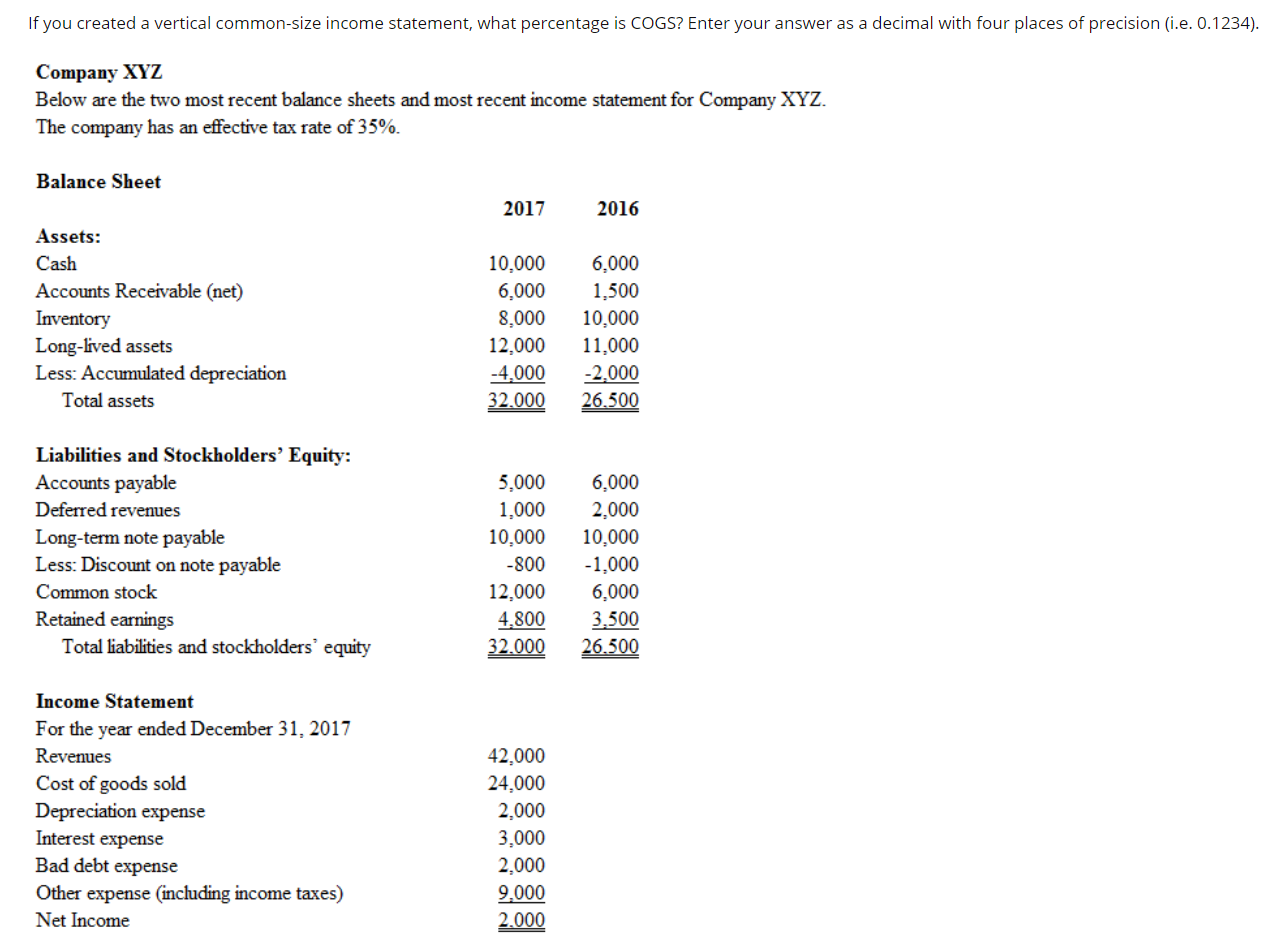

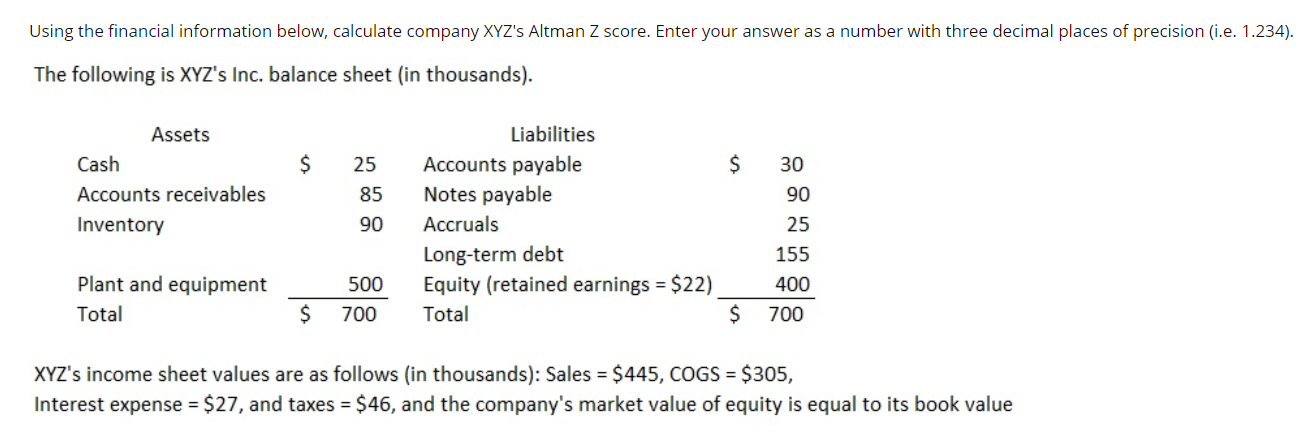

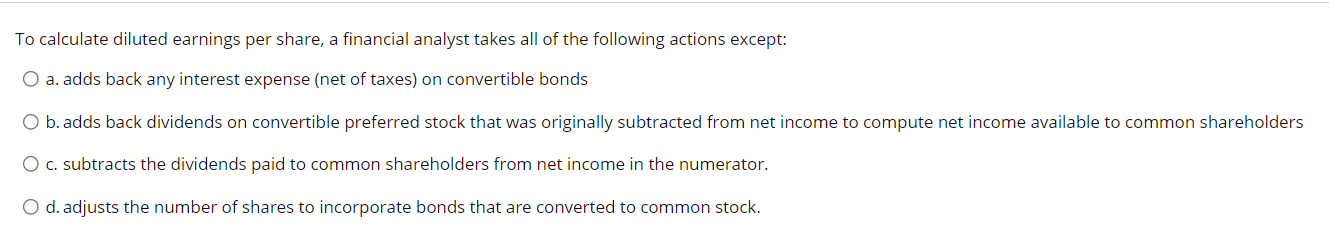

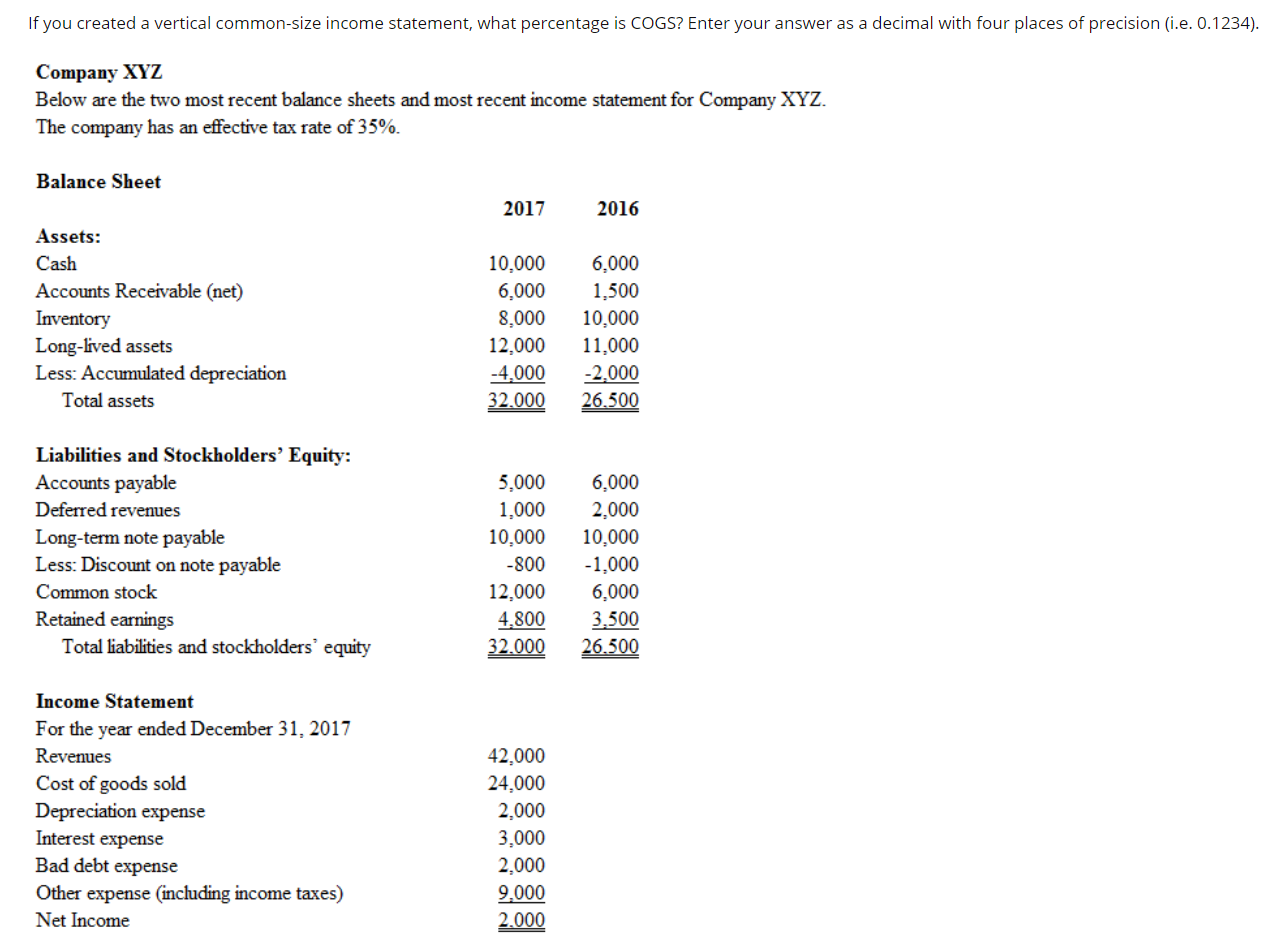

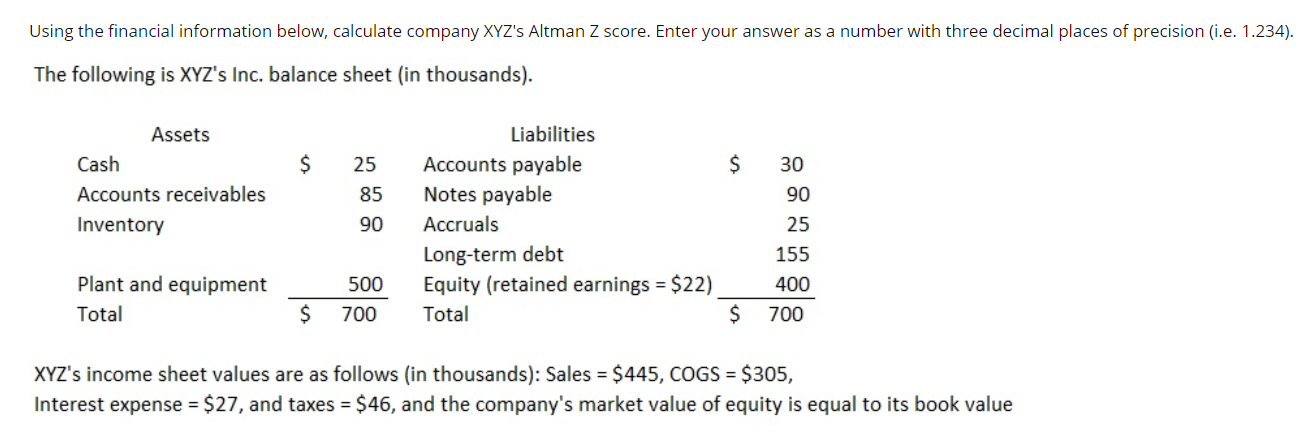

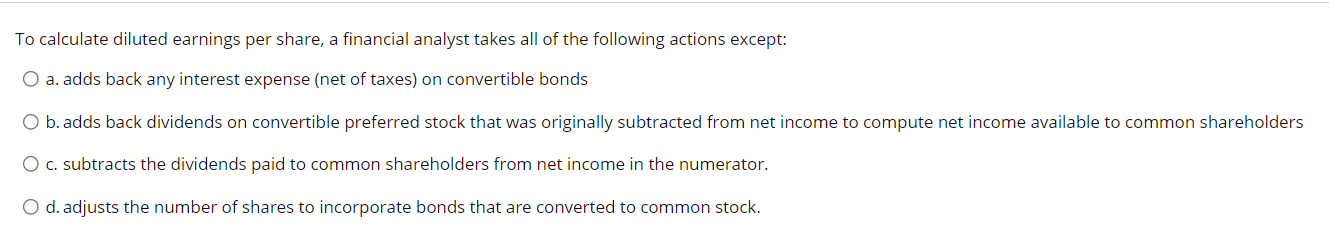

If you created a vertical common-size income statement, what percentage is COGS? Enter your answer as a decimal with four places of precision (i.e. 0.1234). Company XYZ Below are the two most recent balance sheets and most recent income statement for Company XYZ. The company has an effective tax rate of 35% Balance Sheet 2017 2016 Assets: Cash Accounts Receivable (net) Inventory Long-lived assets Less: Accumulated depreciation Total assets 10,000 6,000 8.000 12,000 -4,000 32.000 6,000 1,500 10,000 11,000 -2.000 26.500 Liabilities and Stockholders' Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock Retained earnings Total liabilities and stockholders' equity 5,000 1,000 10,000 -800 12,000 4,800 32.000 6,000 2,000 10,000 -1,000 6,000 3.500 26.500 Income Statement For the year ended December 31, 2017 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net Income 42,000 24,000 2,000 3,000 2,000 9.000 2.000 Using the financial information below, calculate company XYZ's Altman Z score. Enter your answer as a number with three decimal places of precision (i.e. 1.234). The following is XYZ's Inc. balance sheet (in thousands). $ $ Assets Cash Accounts receivables Inventory 25 85 90 Liabilities Accounts payable Notes payable Accruals Long-term debt Equity (retained earnings = $22) Total 30 90 25 155 400 700 Plant and equipment Total 500 700 $ $ XYZ's income sheet values are as follows (in thousands): Sales = $445, COGS = $305, Interest expense = $27, and taxes = $46, and the company's market value of equity is equal to its book value To calculate diluted earnings per share, a financial analyst takes all of the following actions except: O a. adds back any interest expense (net of taxes) on convertible bonds O b. adds back dividends on convertible preferred stock that was originally subtracted from net income to compute net income available to common shareholders O c. subtracts the dividends paid to common shareholders from net income in the numerator. O d. adjusts the number of shares to incorporate bonds that are converted to common stock