if you don't want to do the problem, that's perfectly fine. If at all possible, please list the forms needed to do this? It would be greatly appreciated.

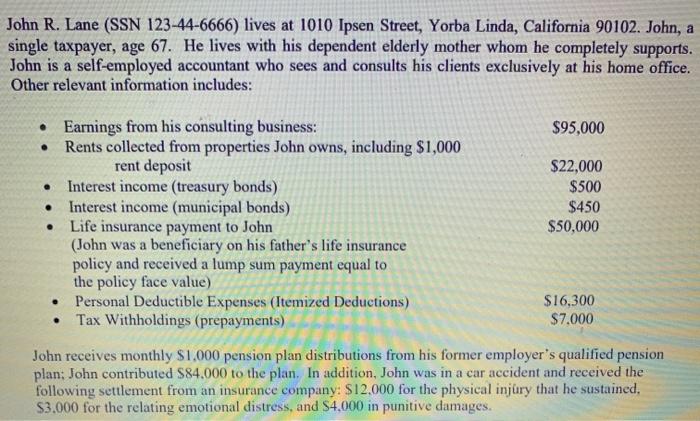

John R. Lane (SSN 123-44-6666) lives at 1010 Ipsen Street, Yorba Linda, California 90102. John, a single taxpayer, age 67. He lives with his dependent elderly mother whom he completely supports. John is a self-employed accountant who sees and consults his clients exclusively at his home office. Other relevant information includes: . Earnings from his consulting business: $95,000 Rents collected from properties John owns, including $1,000 rent deposit $22,000 Interest income treasury bonds) $500 Interest income (municipal bonds) $450 Life insurance payment to John $50,000 (John was a beneficiary on his father's life insurance policy and received a lump sum payment equal to the policy face value) Personal Deductible Expenses (Itemized Deductions) $16,300 Tax Withholdings (prepayments) $7.000 John receives monthly $1.000 pension plan distributions from his former employer's qualified pension plan: John contributed S84,000 to the plan. In addition, John was in a car accident and received the following settlement from an insurance company: $12,000 for the physical injury that he sustained. $3.000 for the relating emotional distress, and S4,000 in punitive damages. John R. Lane (SSN 123-44-6666) lives at 1010 Ipsen Street, Yorba Linda, California 90102. John, a single taxpayer, age 67. He lives with his dependent elderly mother whom he completely supports. John is a self-employed accountant who sees and consults his clients exclusively at his home office. Other relevant information includes: . Earnings from his consulting business: $95,000 Rents collected from properties John owns, including $1,000 rent deposit $22,000 Interest income treasury bonds) $500 Interest income (municipal bonds) $450 Life insurance payment to John $50,000 (John was a beneficiary on his father's life insurance policy and received a lump sum payment equal to the policy face value) Personal Deductible Expenses (Itemized Deductions) $16,300 Tax Withholdings (prepayments) $7.000 John receives monthly $1.000 pension plan distributions from his former employer's qualified pension plan: John contributed S84,000 to the plan. In addition, John was in a car accident and received the following settlement from an insurance company: $12,000 for the physical injury that he sustained. $3.000 for the relating emotional distress, and S4,000 in punitive damages