Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you download stock price data from the Yahoo finance, you would see Open/Hig/Low/Close/Volume/Adj Close data. Please use the adjusted closing price data as it

If you download stock price data from the Yahoo finance, you would see Open/Hig/Low/Close/Volume/Adj Close data. Please use the adjusted closing price data as it adjusts the stock price data to account for the dividend payments for problems.

For problem please clearly specify the name of the company and sample period of your stock price data.

You do not have to report the results of problem(a).

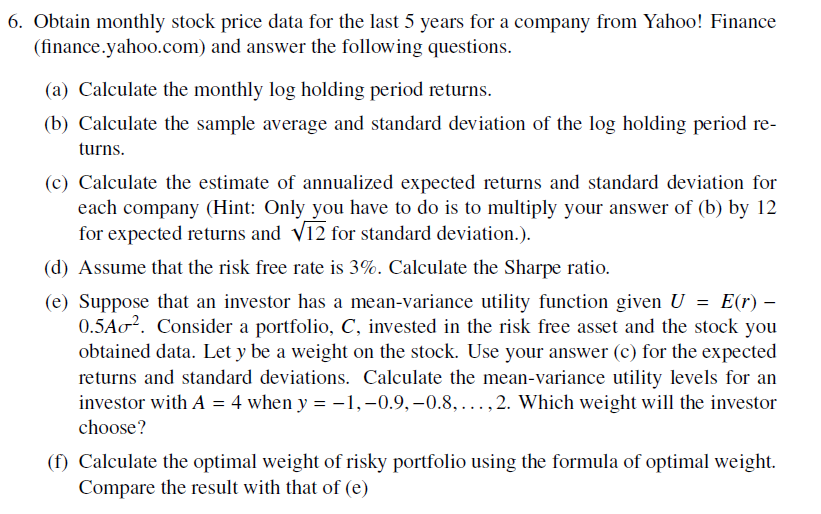

6. Obtain monthly stock price data for the last 5 years for a company from Yahoo! Finance (finance.yahoo.com) and answer the following questions. (a) Calculate the monthly log holding period returns. (b) Calculate the sample average and standard deviation of the log holding period re- turns. (c) Calculate the estimate of annualized expected returns and standard deviation for each company (Hint: Only you have to do is to multiply your answer of (b) by 12 for expected returns and V12 for standard deviation.). (d) Assume that the risk free rate is 3%. Calculate the Sharpe ratio. (e) Suppose that an investor has a mean-variance utility function given U = E(r) - 0.5A02. Consider a portfolio, C, invested in the risk free asset and the stock you obtained data. Let y be a weight on the stock. Use your answer (c) for the expected returns and standard deviations. Calculate the mean-variance utility levels for an investor with A = 4 when y = -1,-0.9,-0.8,..., 2. Which weight will the investor choose? (f) Calculate the optimal weight of risky portfolio using the formula of optimal weight. Compare the result with that of (e)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started