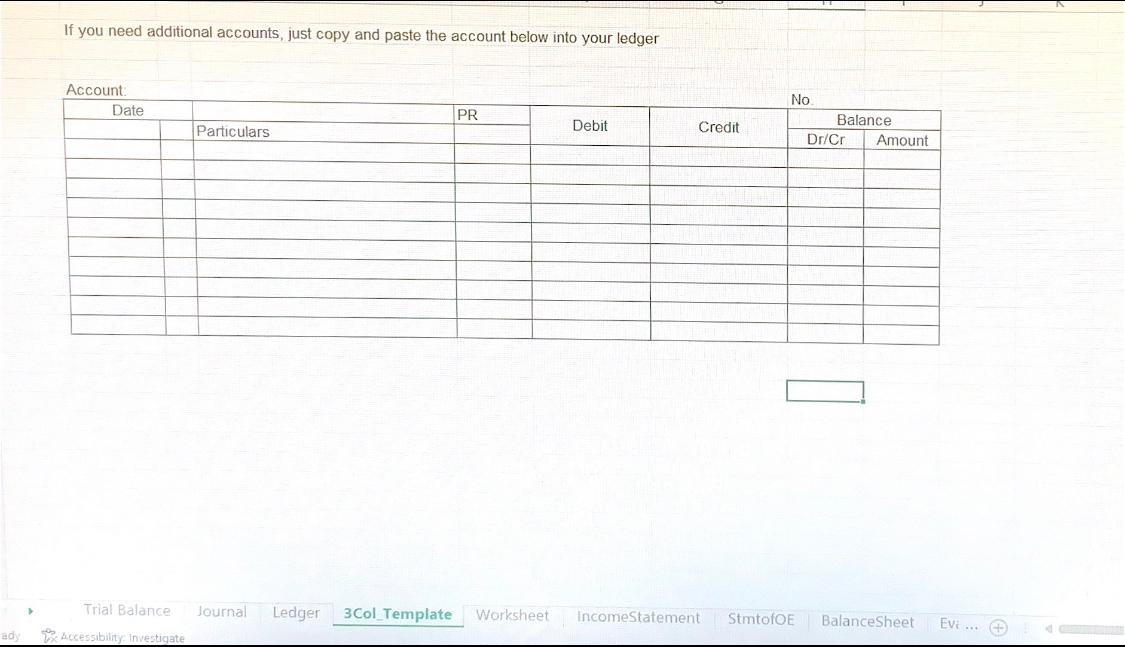

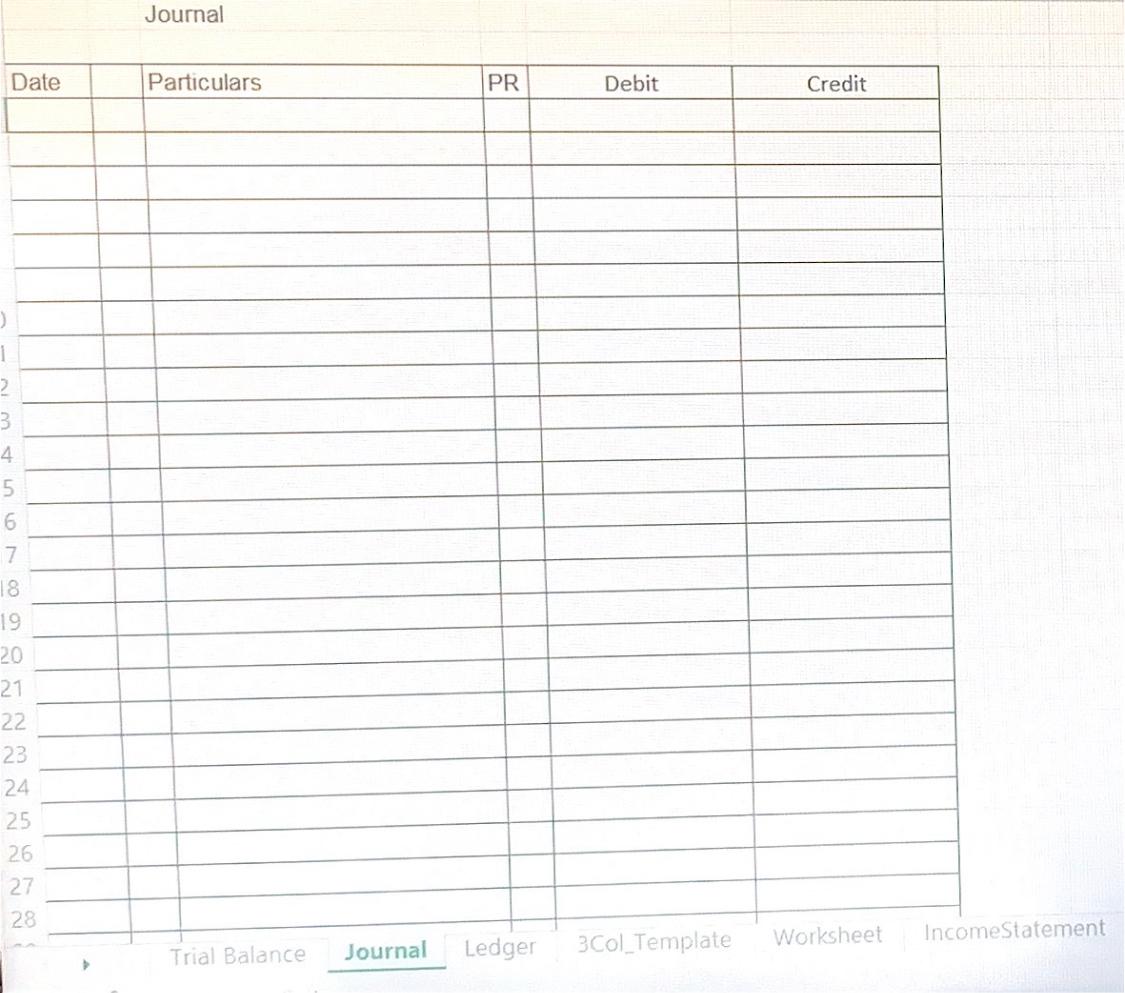

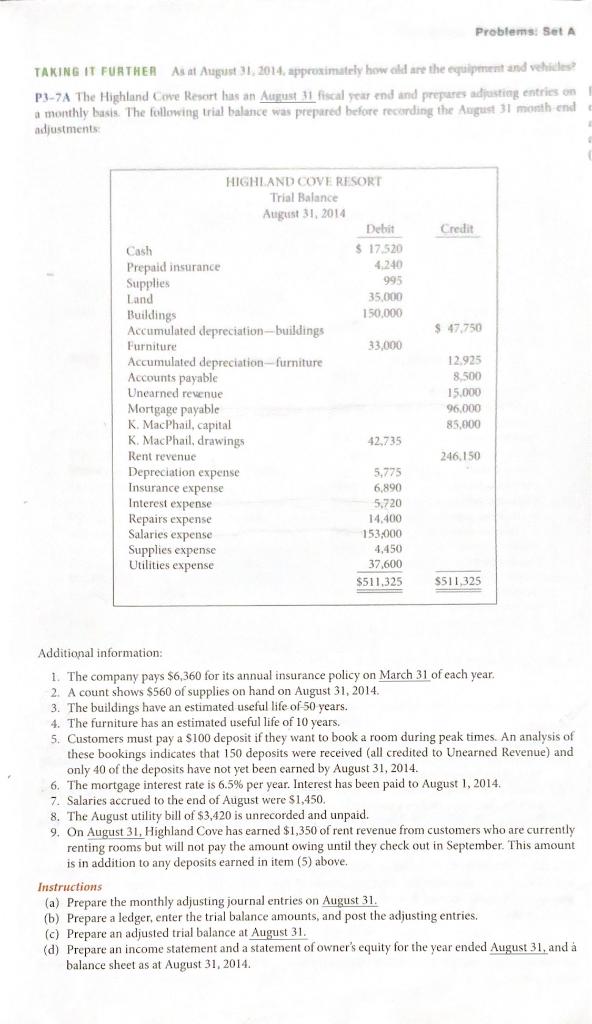

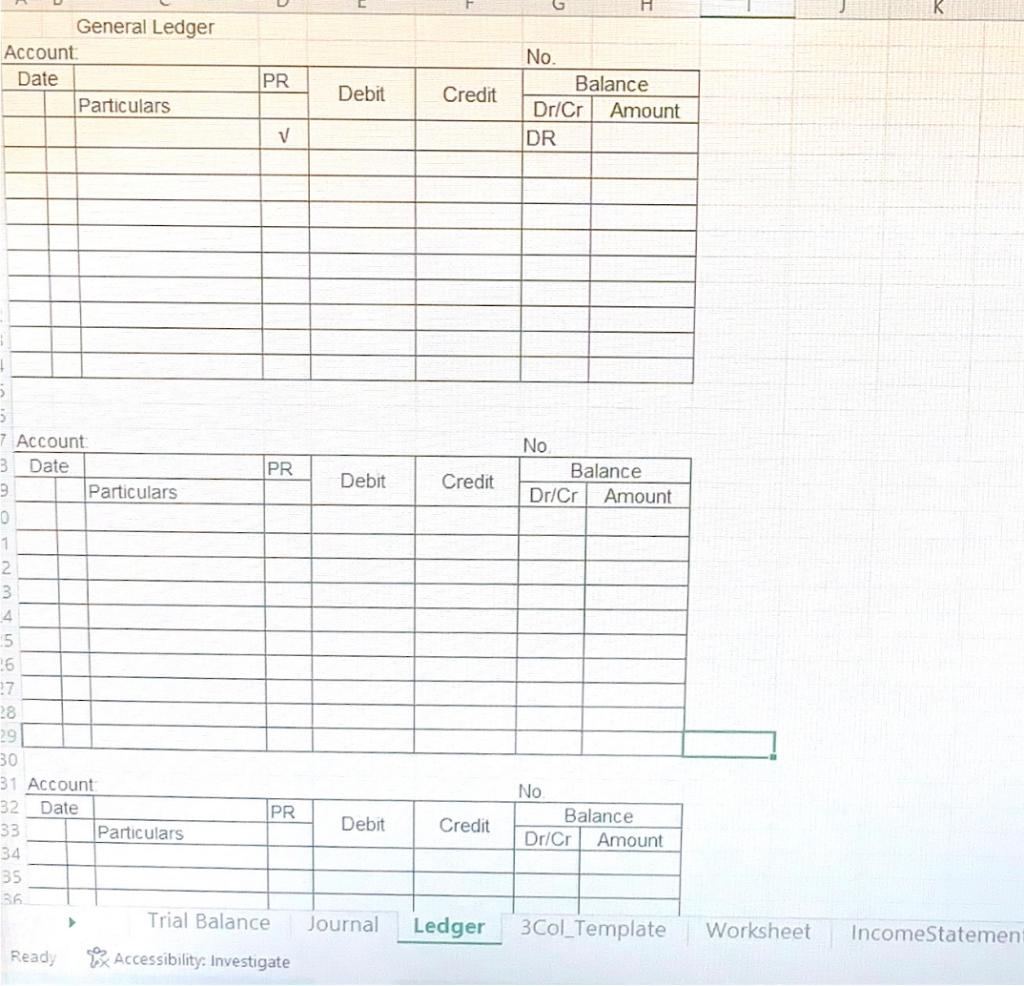

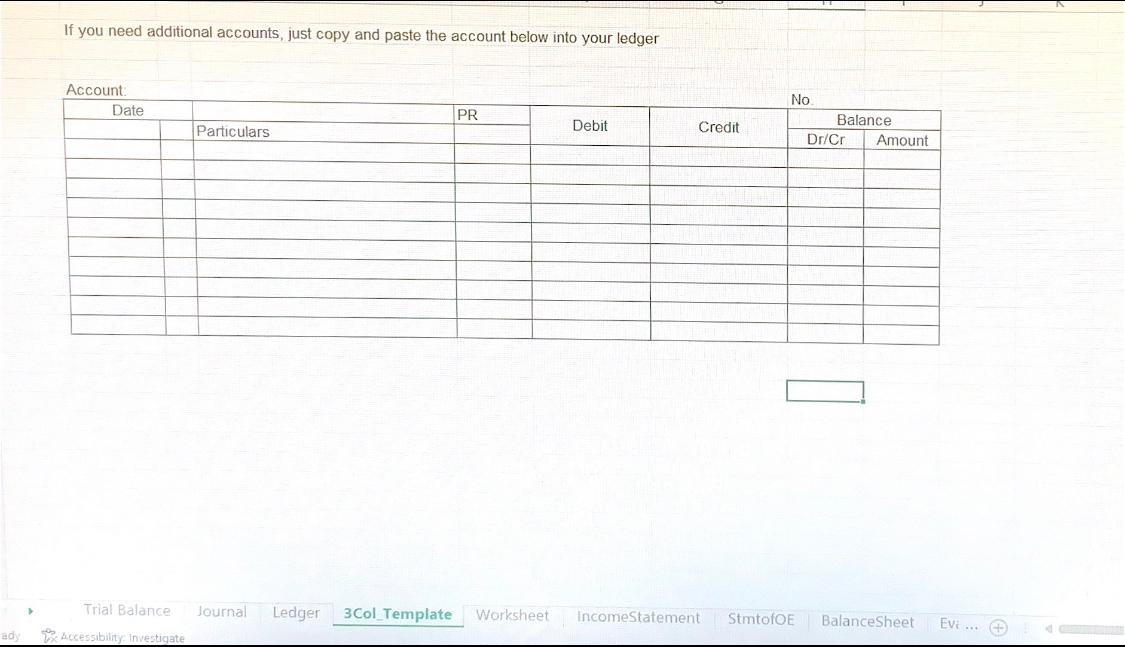

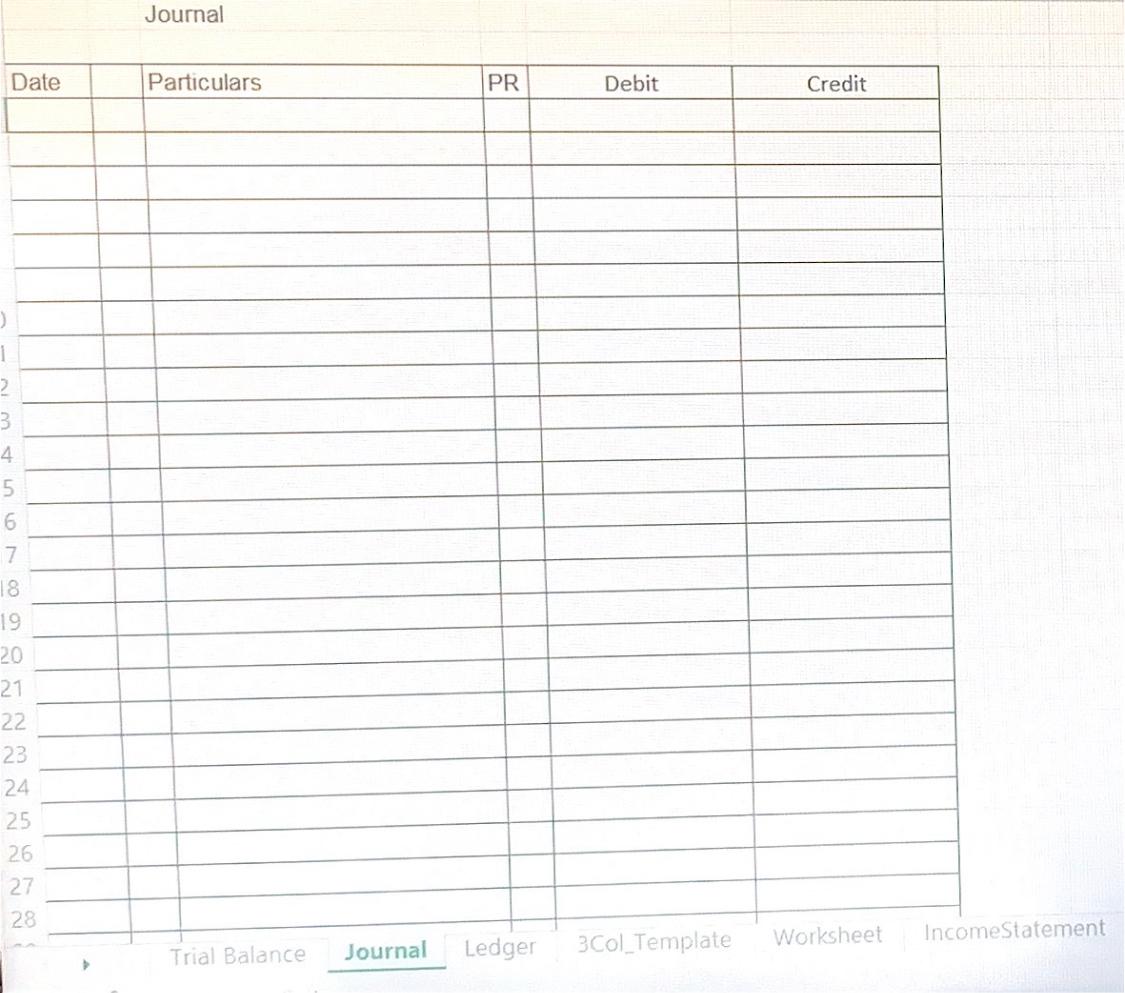

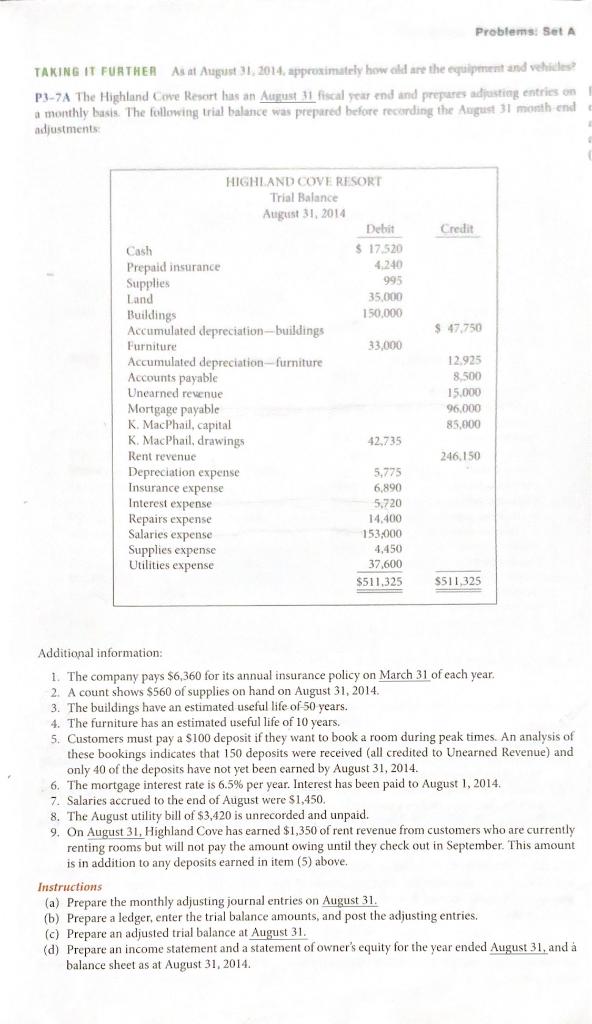

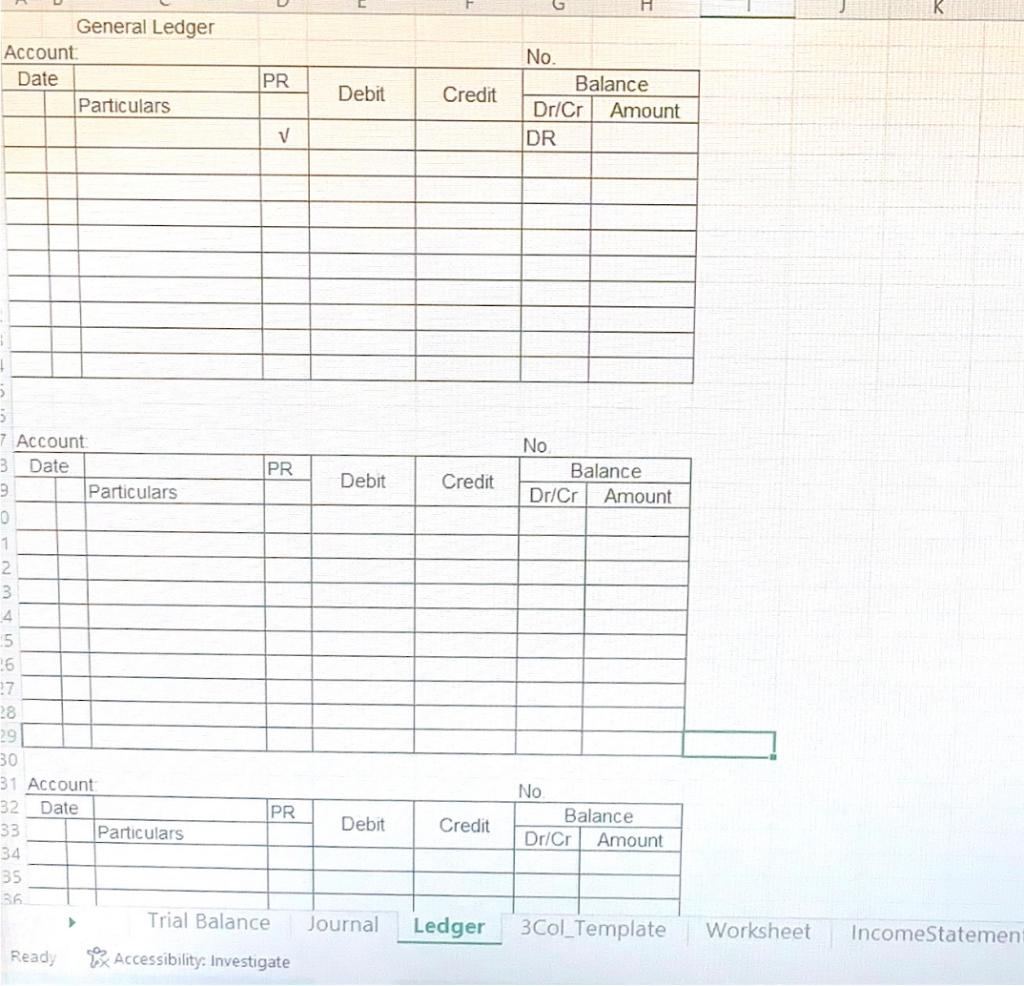

If you need additional accounts, just copy and paste the account below into your ledger Account Date PR Particulars Debit No Balance Dr/Cr Amount Credit Trial Balance Journal Ledger 3 Col Template Worksheet Income Statement StmtofOE BalanceSheet Evi ady Accessibility Investigate Journal Date Particulars PR Debit Credit 1 > 3 4 5 6 SLO 000 07 18 19 20 21 22 23 24 25 26 27 28 Worksheet Income Statement Journal 3 Col_Template Trial Balance Ledger > Problems: Set A TAKING IT FURTHER As at August 31, 2014, approximately how old are the equipment and vehicles P3-7A The Highland Cove Resort has an August 31 fiscal year end and prepares adjusting entries on a monthly basis. The following trial balance was prepared before recording the August 31 month-end adjustments Credit Buildings $ 47,750 HIGHLAND COVE RESORT Trial Balance August 31, 2014 Debit Cash $ 17.520 Prepaid insurance 4.240 Supplies 995 Land 35,000 150,000 Accumulated depreciation-buildings Furniture 33.000 Accumulated depreciation-furniture Accounts payable Unearned revenue Mortgage payable K. MacPhail, capital K. MacPhail, drawings 42,735 Rent revenue Depreciation expense 5,775 Insurance expense 6,890 Interest expense 5,720 Repairs expense 14.400 153,000 Supplies expense 4,450 Utilities expense 37,600 $511.325 12.925 8.500 15.000 96,000 85.000 246,150 Salaries expense $511325 Additional information: 1. The company pays $6,360 for its annual insurance policy on March 31 of each year. 2. A count shows $560 of supplies on hand on August 31, 2014 3. The buildings have an estimated useful life of 50 years. 4. The furniture has an estimated useful life of 10 years. 5. Customers must pay a 100 deposit if they want to book a room during peak times. An analysis of these bookings indicates that 150 deposits were received (all credited to Unearned Revenue) and only 40 of the deposits have not yet been earned by August 31, 2014. 6. The mortgage interest rate is 6.5% per year. Interest has been paid to August 1, 2014. 7. Salaries accrued to the end of August were $1,450. 8. The August utility bill of $3,420 is unrecorded and unpaid. 9. On August 31, Highland Cove has earned $1,350 of rent revenue from customers who are currently renting rooms but will not pay the amount owing until they check out in September. This amount is in addition to any deposits earned in item (5) above. Instructions (a) Prepare the monthly adjusting journal entries on August 31. (b) Prepare a ledger, enter the trial balance amounts, and post the adjusting entries, (c) Prepare an adjusted trial balance at August 31. (d) Prepare an income statement and a statement of owner's equity for the year ended August 31, and a balance sheet as at August 31, 2014 G General Ledger Account Date Particulars PR Debit Credit No. Balance Dr/Cr Amount DR V No Balance Dr/Cr Amount Debit Credit 7 Account 3 Date PR 2 Particulars 0 1 2 3 4 5 16 37 28 19 30 31 Account 32 Date 33 Particulars 34 35 36 Trial Balance PR Debit Credit No Balance Dr/CH Amount > Journal Ledger 3Col_Template Worksheet Income Statemen Ready Accessibility. Investigate