Answered step by step

Verified Expert Solution

Question

1 Approved Answer

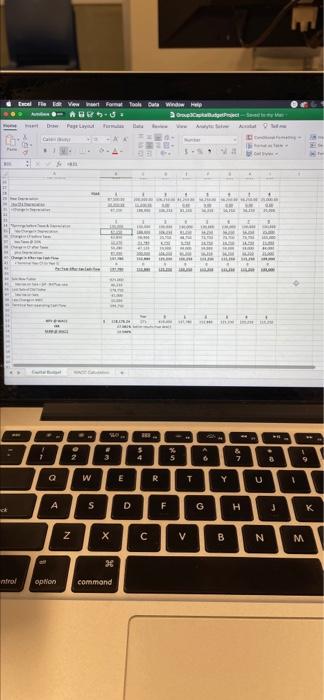

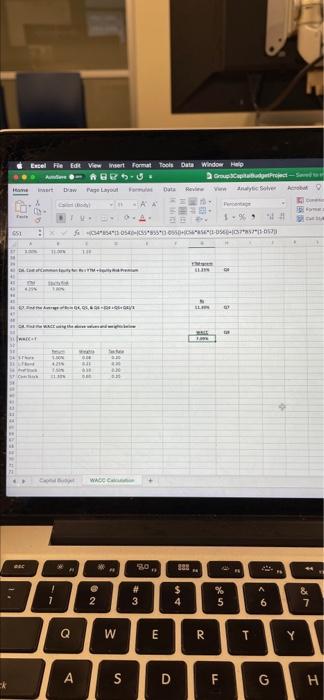

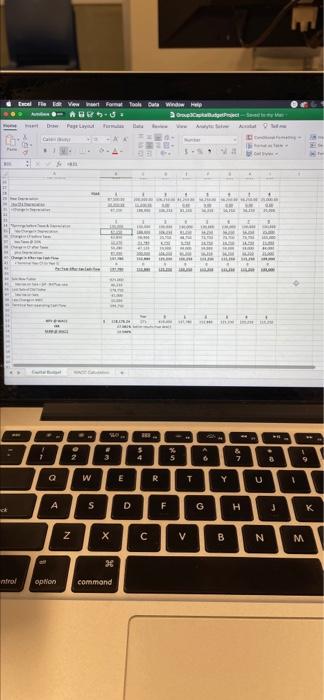

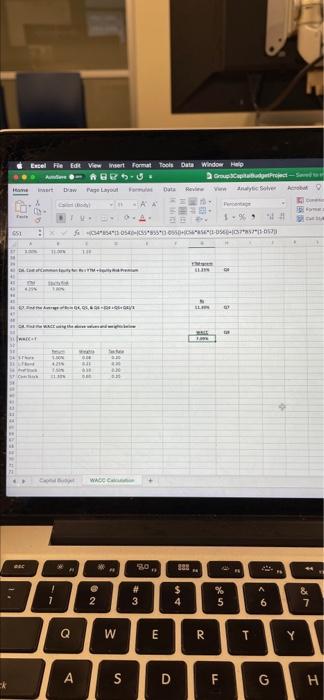

if you need more pictures of the data frim excel i can provide pictures of the stuff above the WACC NPV IRR MIRR CF as

if you need more pictures of the data frim excel i can provide pictures of the stuff above the WACC NPV IRR MIRR

CF as part of cash flows reached in Year 51 (17 points) 14. Based on your answer is (1.3) above, explain why or by the firm should buy the New Fluxxer. In your wwwer provide an integration of the NPV and IRR. "Who that NPVM. BREWACC whitePRWACCE (1?print MACRS 5-year and year Claw Depreciation Schedule: Clan 1 2 1 4 5 S-year 20% 329 19% 1296 11 Tuyer 149 25% 7 6 69 99 4 09 4% Carital Budet Temolate % 5 6 8 7 9 0 R Y U O 1 1 F 6 H " : V . N M . / t Command option E Emel The Vam Formal Tools Out Wind Help 20--at- AV - D 1 1 - TH - . 1 ** BE 2 3 4 % 5 7 3 6 a W E R T Y 1 A S D F G ok H H K Z C V B N M X natrol gpion command Tools Data Excel File Edit Viewer format ABR.3. Daw Pepe Layout Window Help Groupotret- Solver Date Y T. of 361 - est... : 193 par TI 21 IT SET WADE C 30. " 935 & # 3 $ 4 % 5 7 NO 2 9 7 Q Q W M E E R R T Y A S DT F G H H CF as part of cash flows reached in Year 51 (17 points) 14. Based on your answer is (1.3) above, explain why or by the firm should buy the New Fluxxer. In your wwwer provide an integration of the NPV and IRR. "Who that NPVM. BREWACC whitePRWACCE (1?print MACRS 5-year and year Claw Depreciation Schedule: Clan 1 2 1 4 5 S-year 20% 329 19% 1296 11 Tuyer 149 25% 7 6 69 99 4 09 4% Carital Budet Temolate % 5 6 8 7 9 0 R Y U O 1 1 F 6 H " : V . N M . / t Command option E Emel The Vam Formal Tools Out Wind Help 20--at- AV - D 1 1 - TH - . 1 ** BE 2 3 4 % 5 7 3 6 a W E R T Y 1 A S D F G ok H H K Z C V B N M X natrol gpion command Tools Data Excel File Edit Viewer format ABR.3. Daw Pepe Layout Window Help Groupotret- Solver Date Y T. of 361 - est... : 193 par TI 21 IT SET WADE C 30. " 935 & # 3 $ 4 % 5 7 NO 2 9 7 Q Q W M E E R R T Y A S DT F G H H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started