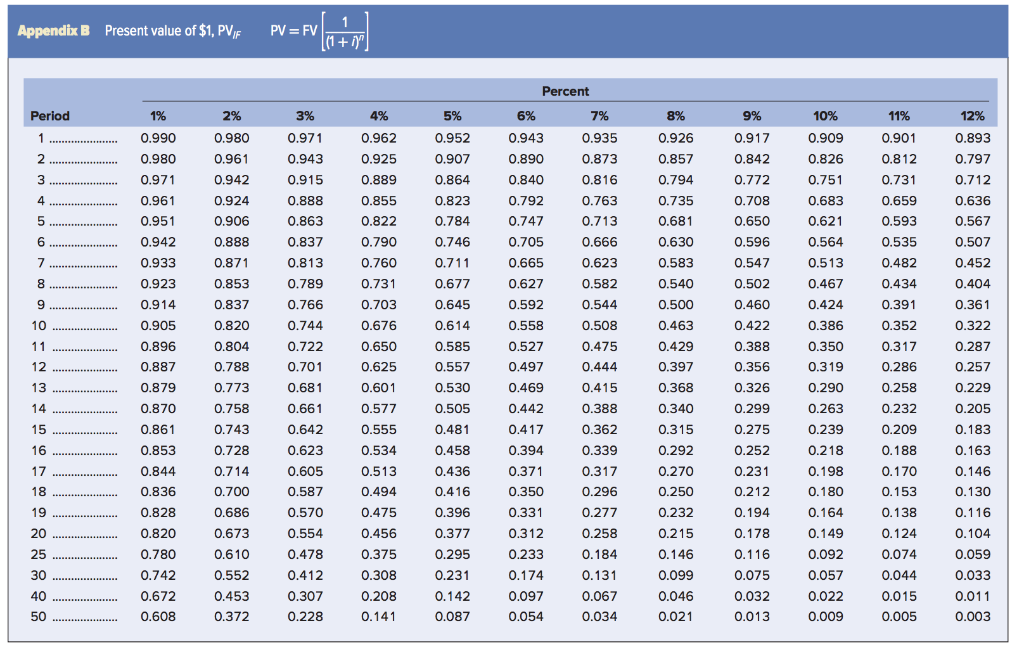

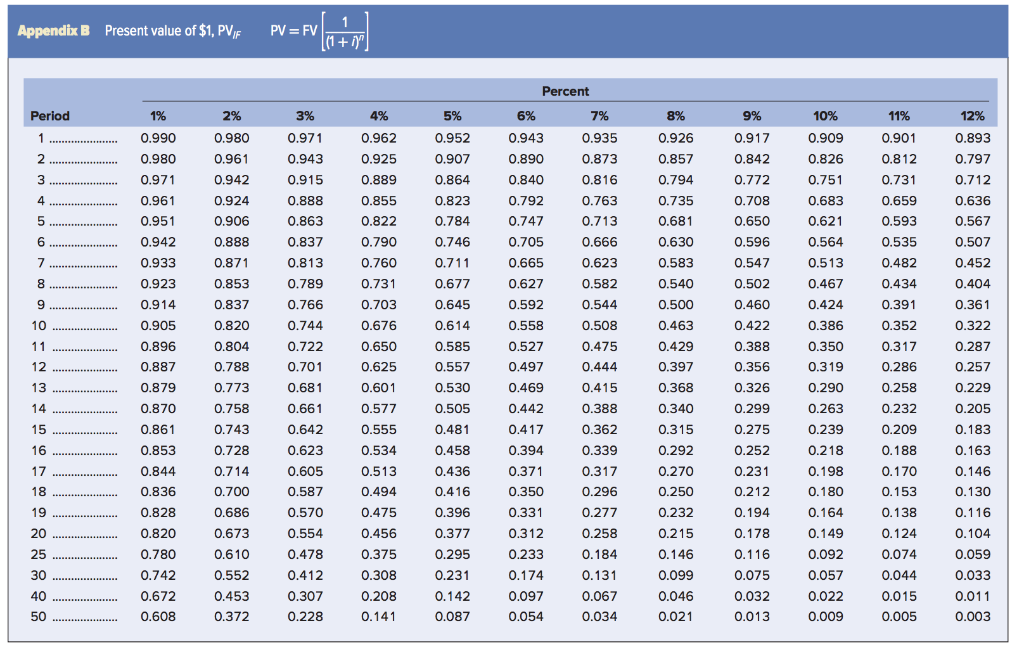

If you owe $47,000 payable at the end of five years, what amount should your creditor accept in payment immediately if she could earn 8 percent on her money? Use Appendix B for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

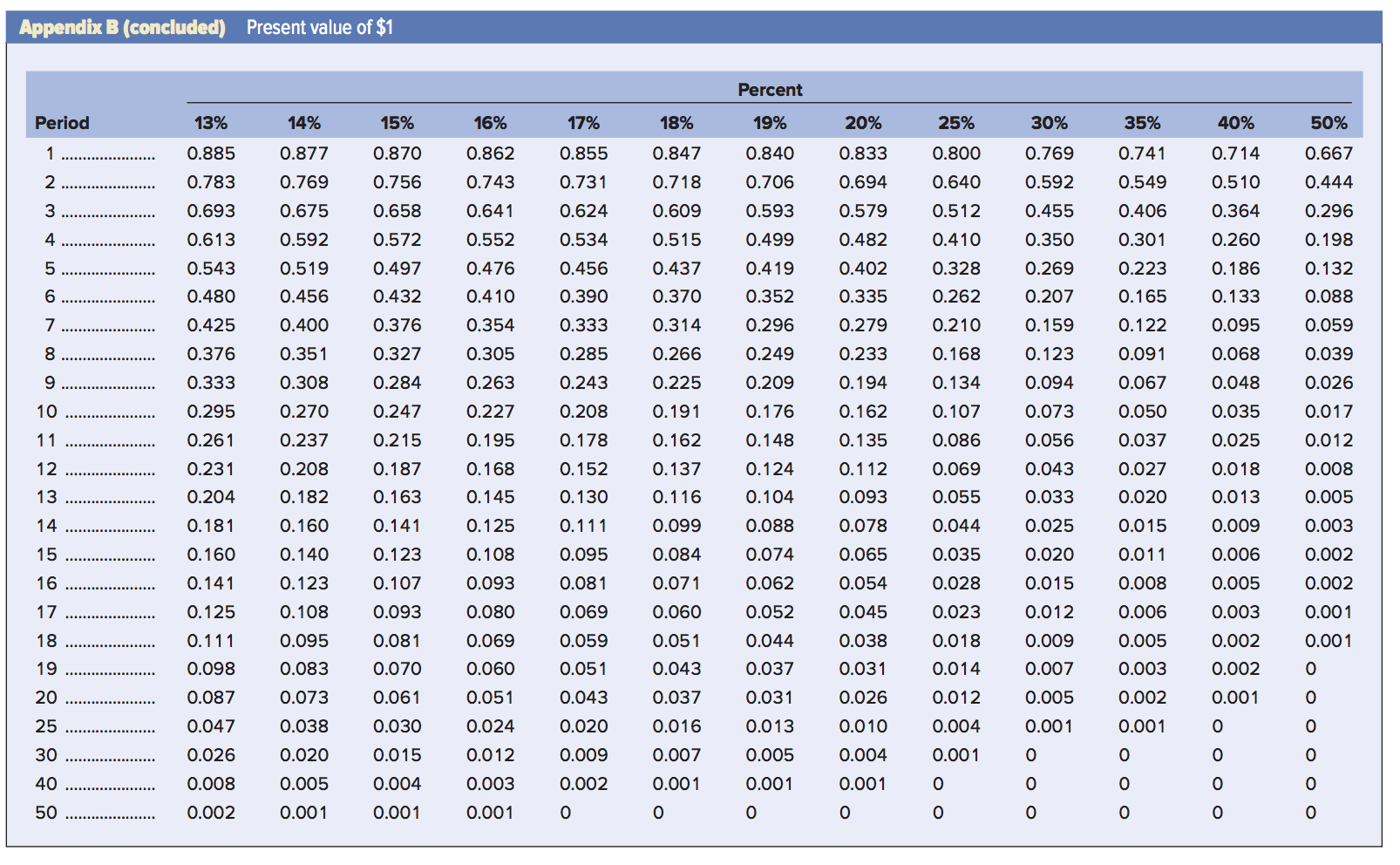

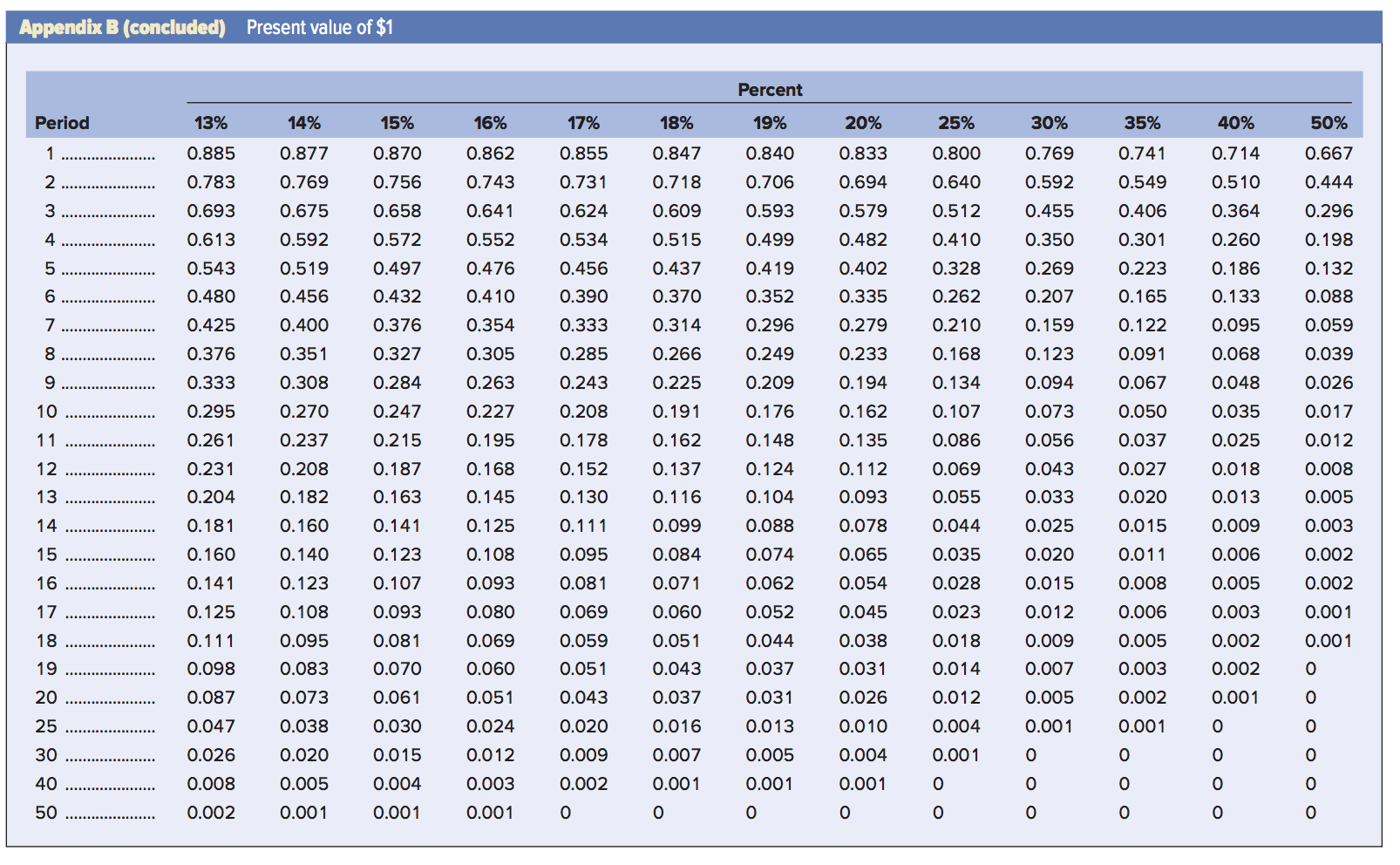

Appendix B (concluded) Present value of $1 Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 0.877 0.870 0.833 2 1 2 0.885 0.783 0.862 0.743 0.641 0.855 0.731 0.624 0.847 0.718 0.609 0.840 0.706 0.756 0.800 0.640 0.667 0.444 0.714 0.510 0.364 0.694 0.579 3 0.693 0.658 0.593 0.512 0.296 4 0.613 0.572 0.552 0.534 0.482 0.260 0.198 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.476 0.515 0.437 0.370 0.543 0.480 0.402 0.410 0.328 0.262 5 6 7 8 0.186 0.133 0.410 0.497 0.432 0.376 0.327 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0.067 0.050 0.499 0.419 0.352 0.296 0.249 0.209 0.456 0.390 0.333 0.285 0.243 0.335 0.279 0.132 0.088 0.059 0.354 0.095 0.425 0.376 0.333 0.295 0.123 0.305 0.263 0.314 0.266 0.225 0.191 0.210 0.168 0.134 0.233 0.194 0.068 0.048 0.039 0.026 9 0.308 0.284 0.094 10 0.208 0.162 0.107 0.073 0.035 0.017 0.270 0.237 0.227 0.195 11 0.178 0.162 0.135 0.086 0.025 12 0.261 0.231 0.204 0.168 0.137 0.018 0.208 0.182 0.152 0.130 0.112 0.093 0.069 0.055 0.056 0.043 0.033 0.025 0.012 0.008 0.005 13 0.116 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.013 14 0.181 0.111 0.099 0.078 0.044 0.009 0.145 0.125 0.108 0.093 15 0.065 0.160 0.140 0.123 0.108 0.035 0.160 0.141 0.125 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.095 0.081 0.069 0.084 0.071 0.020 0.015 16 17 0.003 0.002 0.002 0.001 0.028 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.005 0.003 0.002 0.001 0.054 0.045 0.080 0.023 0.060 0.051 0.006 0.005 0.003 0.002 0.002 0.001 18 0.111 0.059 0.018 0.095 0.083 0.001 0.081 0.070 0.012 0.009 0.007 0.069 0.060 19 0.098 0.051 0.038 0.031 0.026 0.043 0 0.014 0.012 20 0.061 0.051 0.005 0.087 0.047 0.073 0.038 0.043 0.020 25 0.030 0.024 0.037 0.016 0.007 0.010 0.004 0.001 0 0.013 0.005 30 0.026 0.020 0.015 0.012 0.009 0.004 0.001 40 0.008 0.005 0.003 0.002 0.001 0.001 0.001 0.004 0.001 o o 0 0 O O O 50 0.002 0.001 0.001 0 0 0 O Appendix B Present value of $1, PVF 1 PV = FV (1 + i" Yin + 1% 2% 4% 5% 7% 8% Period 1 2 3 0.990 0.980 3% 0.971 0.943 0.962 0.925 0.889 0.952 0.907 0.864 0.926 0.857 0.794 % 9% 0.917 0.842 0.772 0.971 Percent 6% 6 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0.665 0.623 0.627 0.582 4 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.915 0.888 0.863 0.837 0.813 0.823 0.855 0.822 5 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.735 0.681 0.630 0.583 0.708 0.650 0.596 0.547 6 0.784 0.746 0.711 0.677 0.790 0.760 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 7 8 0.540 0.502 0.404 9 0.544 0.391 0.361 0.645 0.614 0.460 0.422 10 0.508 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.731 0.703 0.676 0.650 0.625 0.601 11 0.592 0.558 0.527 0.497 0.469 0.585 0.557 0.530 0.475 0.444 0.500 0.463 0.429 0.397 0.368 0.388 0.356 0.326 12 0.352 0.317 0.286 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 0.322 0.287 0.257 13 0.879 0.415 0.258 0.229 14 0.870 0.232 0.340 0.315 15 0.861 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 16 0.388 0.362 0.339 0.317 0.442 0.417 0.394 0.371 0.350 0.853 0.844 0.836 17 0.292 0.270 0.250 18 19 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 0.828 0.820 0.780 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 0.331 0.312 0.233 0.174 0.097 0.054 20 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 0.296 0.277 0.258 0.184 0.131 0.067 0.034 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 0.232 0.215 0.146 0.099 0.046 0.021 25 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 30 40 0.742 0.672 0.608 0.552 0.453 0.372 50