Question

if you plan to have 4,000,00 when you retire, how long will you be able to withdraw 500,000 per year if the account earns interest

if you plan to have 4,000,00 when you retire, how long will you be able to withdraw 500,000 per year if the account earns interest at a rate of 6% per year(Hint: use interpolation)?8) corrosion problems- and manufacturing defeat rendered gasoline pipeline between El Paso and Phoenix subject to longitudinal weld seam failure. Therefore. the pressure washer is used to 80% of the de sign value. If the reduced pressure results in delivery of $100,000 per month less product what will be the value of the last revenue after a 3-year period at an interest rate of 11.940397% per year compared it consensually!

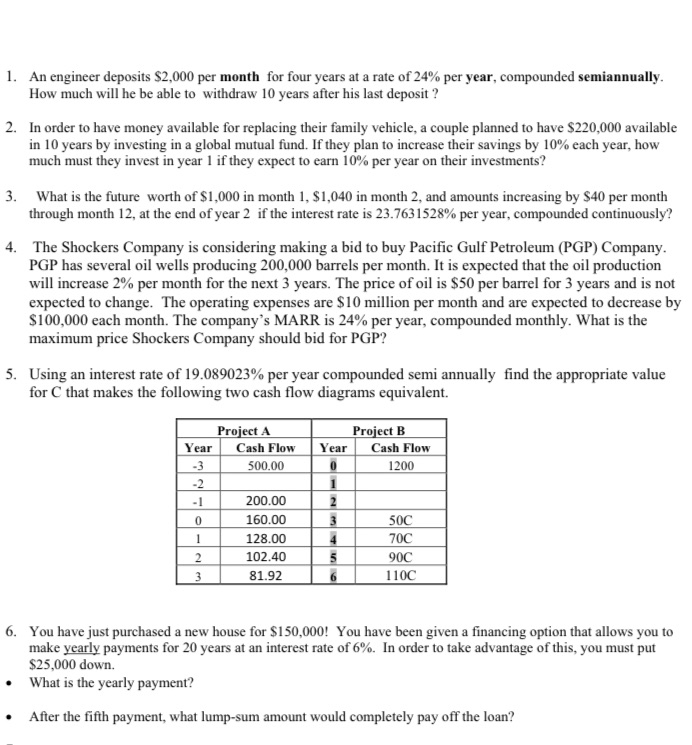

1. An engineer deposits $2,000 per month for four years at a rate of 24% per year, compounded semiannually. How much will he be able to withdraw 10 years after his last deposit ? 2. In order to have money available for replacing their family vehicle, a couple planned to have $220,000 available in 10 years by investing in a global mutual fund. If they plan to increase their savings by 10% each year, how much must they invest in year 1 if they expect to earn 10% per year on their investments? 3. What is the future worth of $1,000 in month 1, $1,040 in month 2, and amounts increasing by $40 per month through month 12, at the end of year 2 if the interest rate is 23.7631528% per year, compounded continuously? 4. The Shockers Company is considering making a bid to buy Pacific Gulf Petroleum (PGP) Company. PGP has several oil wells producing 200,000 barrels per month. It is expected that the oil production will increase 2% per month for the next 3 years. The price of oil is $50 per barrel for 3 years and is not expected to change. The operating expenses are $10 million per month and are expected to decrease by $100,000 each month. The company's MARR is 24% per year, compounded monthly. What is the maximum price Shockers Company should bid for PGP? 5. Using an interest rate of 19.089023% per year compounded semi annually find the appropriate value for C that makes the following two cash flow diagrams equivalent. Project A Year Cash Flow -3 500.00 -2 -1 0 1 2 3 200.00 160.00 128.00 102.40 81.92 Year 0 1 2 3 5 6 Project B Cash Flow 1200 50C 70C 90C 110C 6. You have just purchased a new house for $150,000! You have been given a financing option that allows you to make yearly payments for 20 years at an interest rate of 6%. In order to take advantage of this, you must put $25,000 down. What is the yearly payment? After the fifth payment, what lump-sum amount would completely pay off the loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions with calculations shown 1 An engineer deposits 2000 per month for four years at a rate of 24 per year compounded semiannually How much will he be able to withdraw ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started