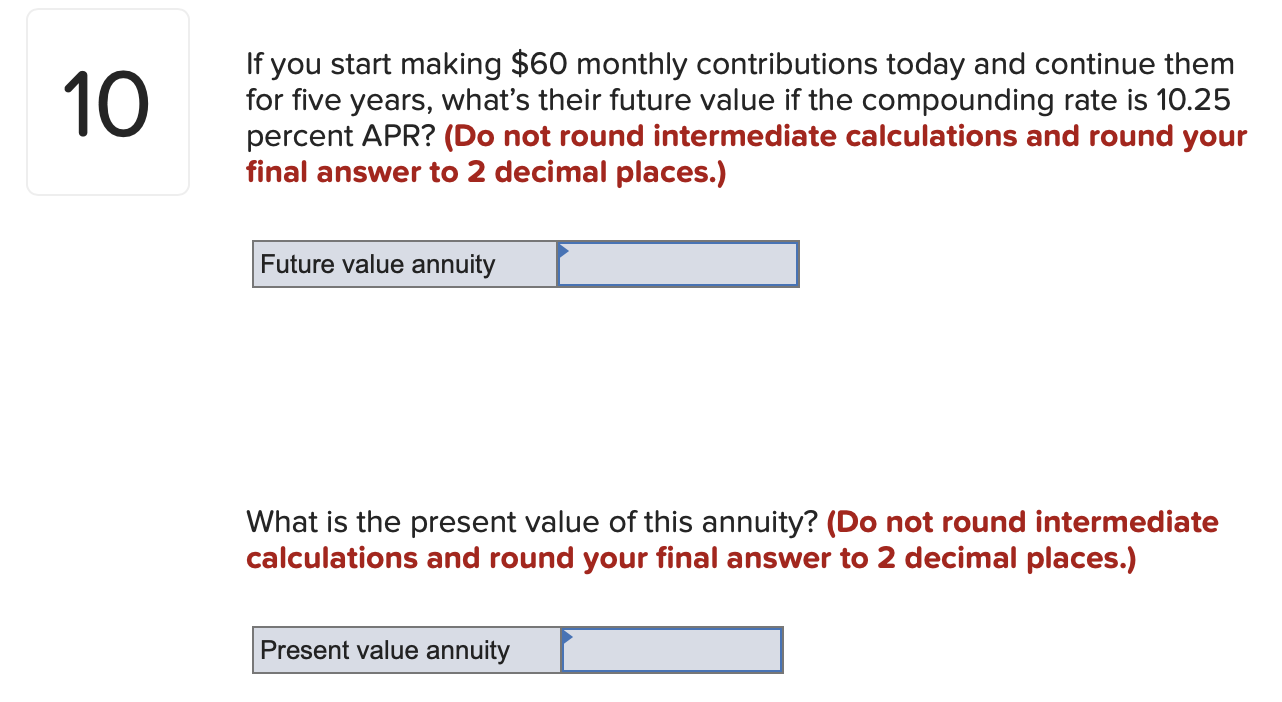

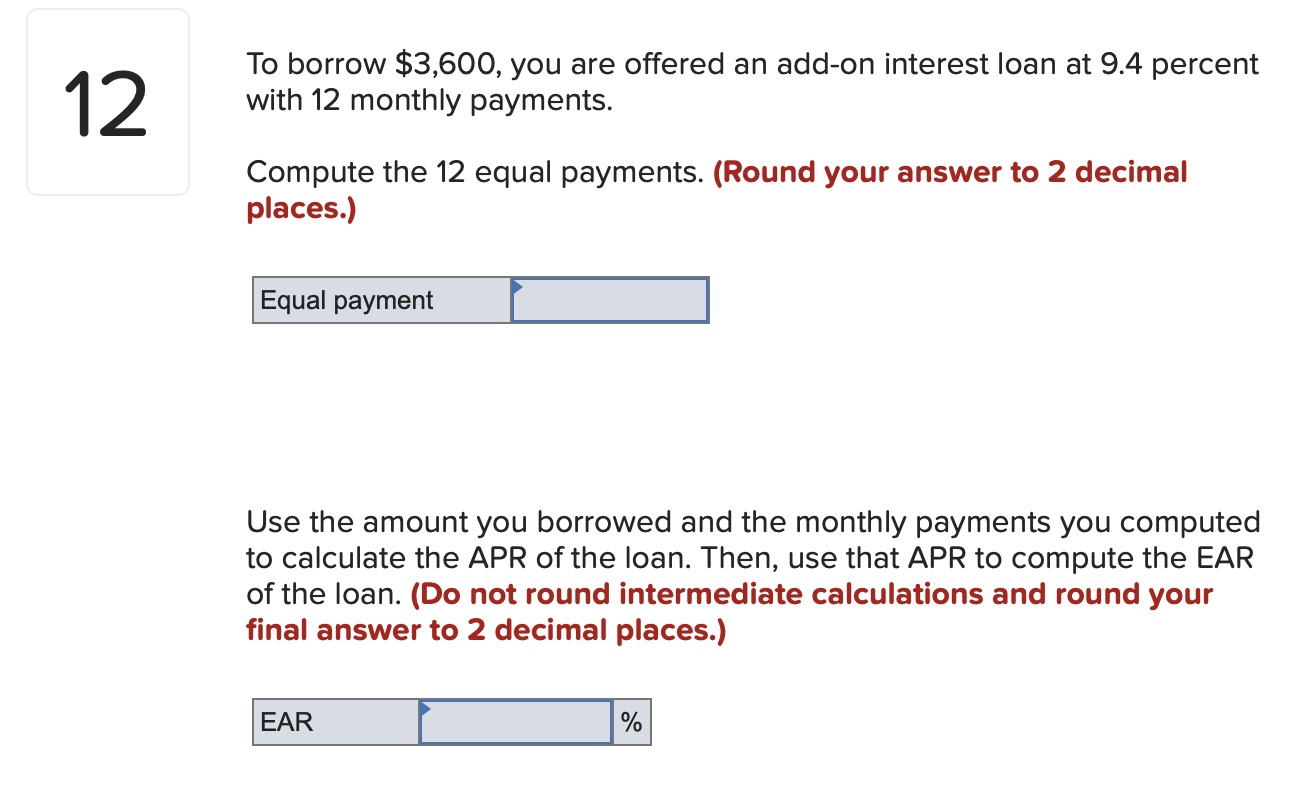

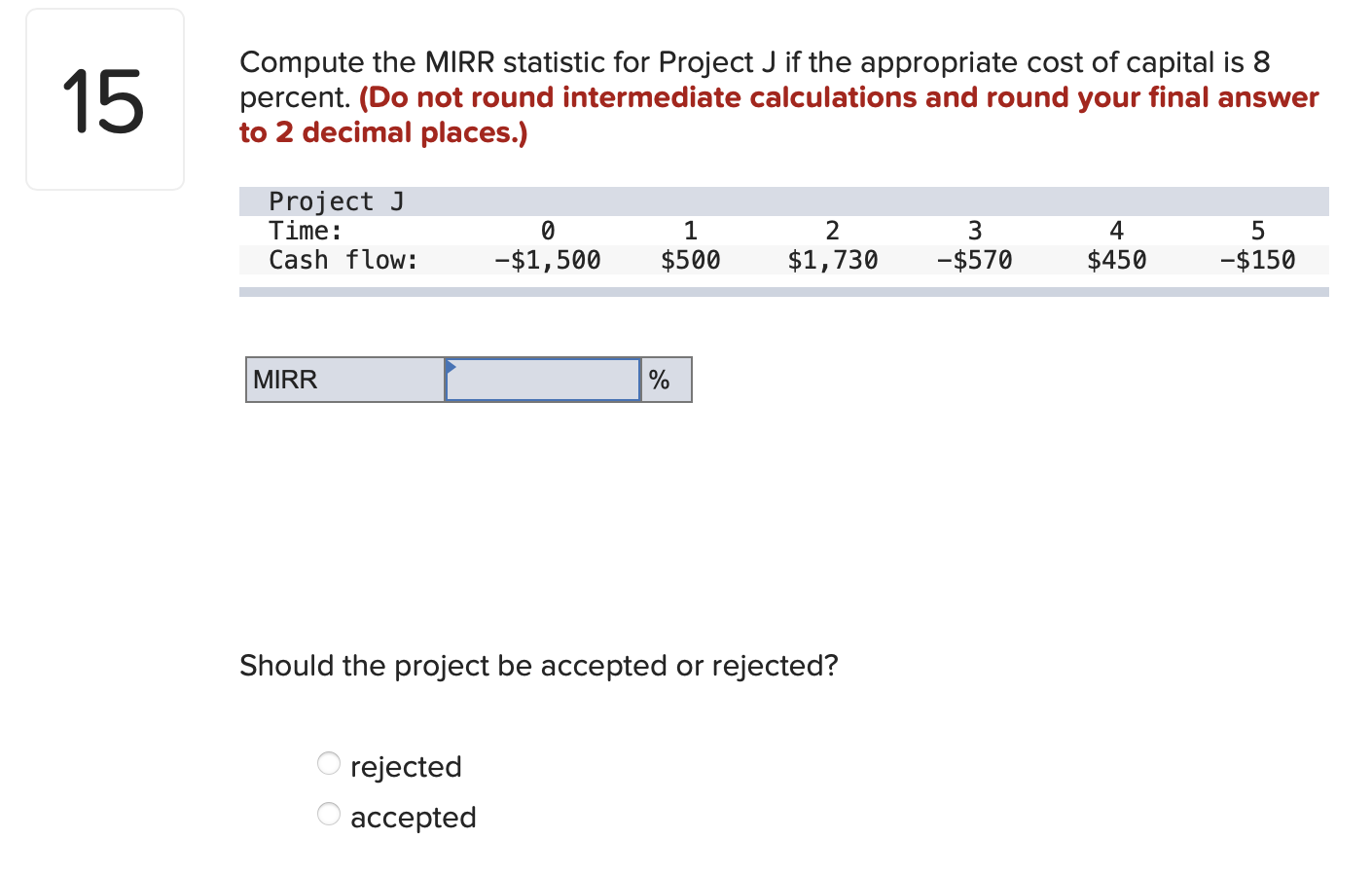

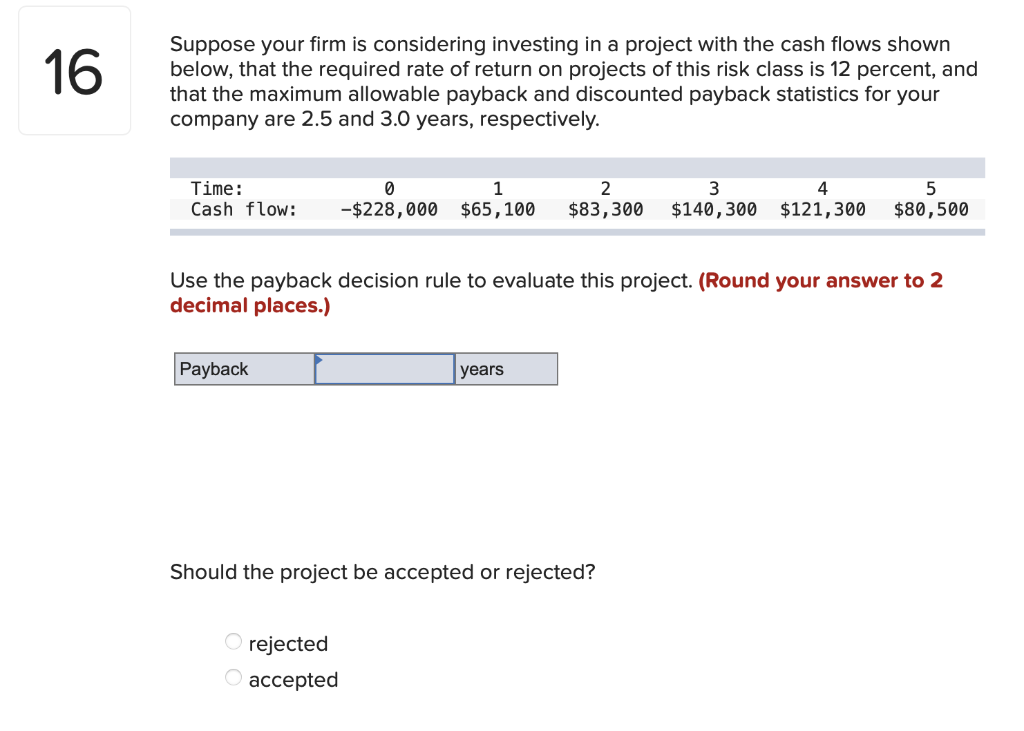

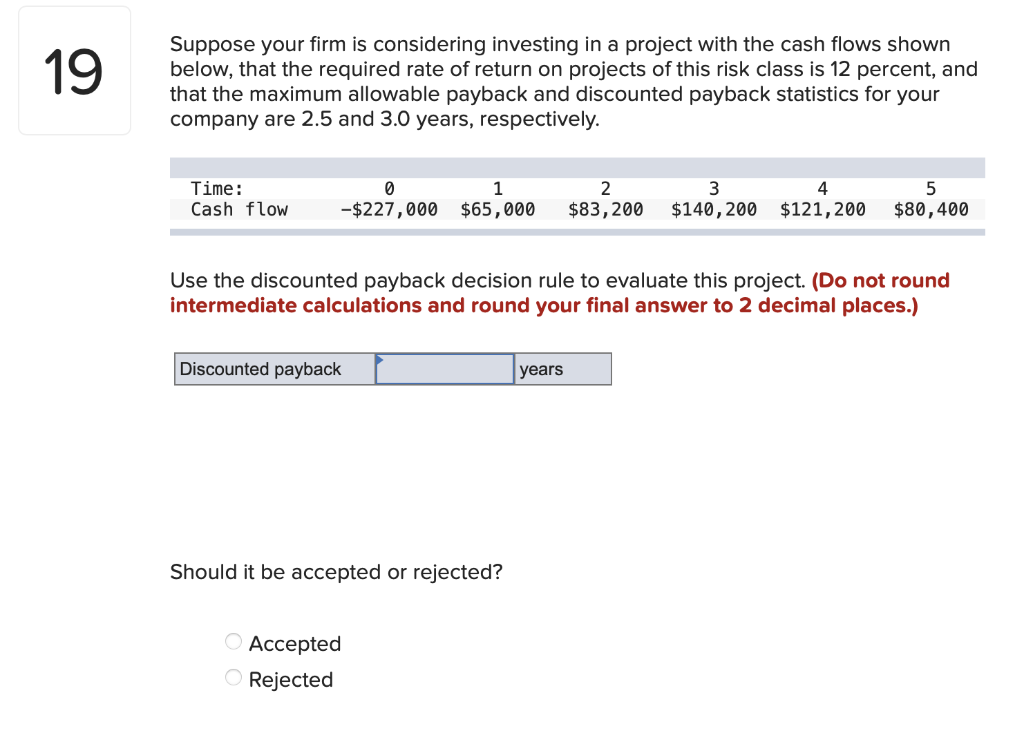

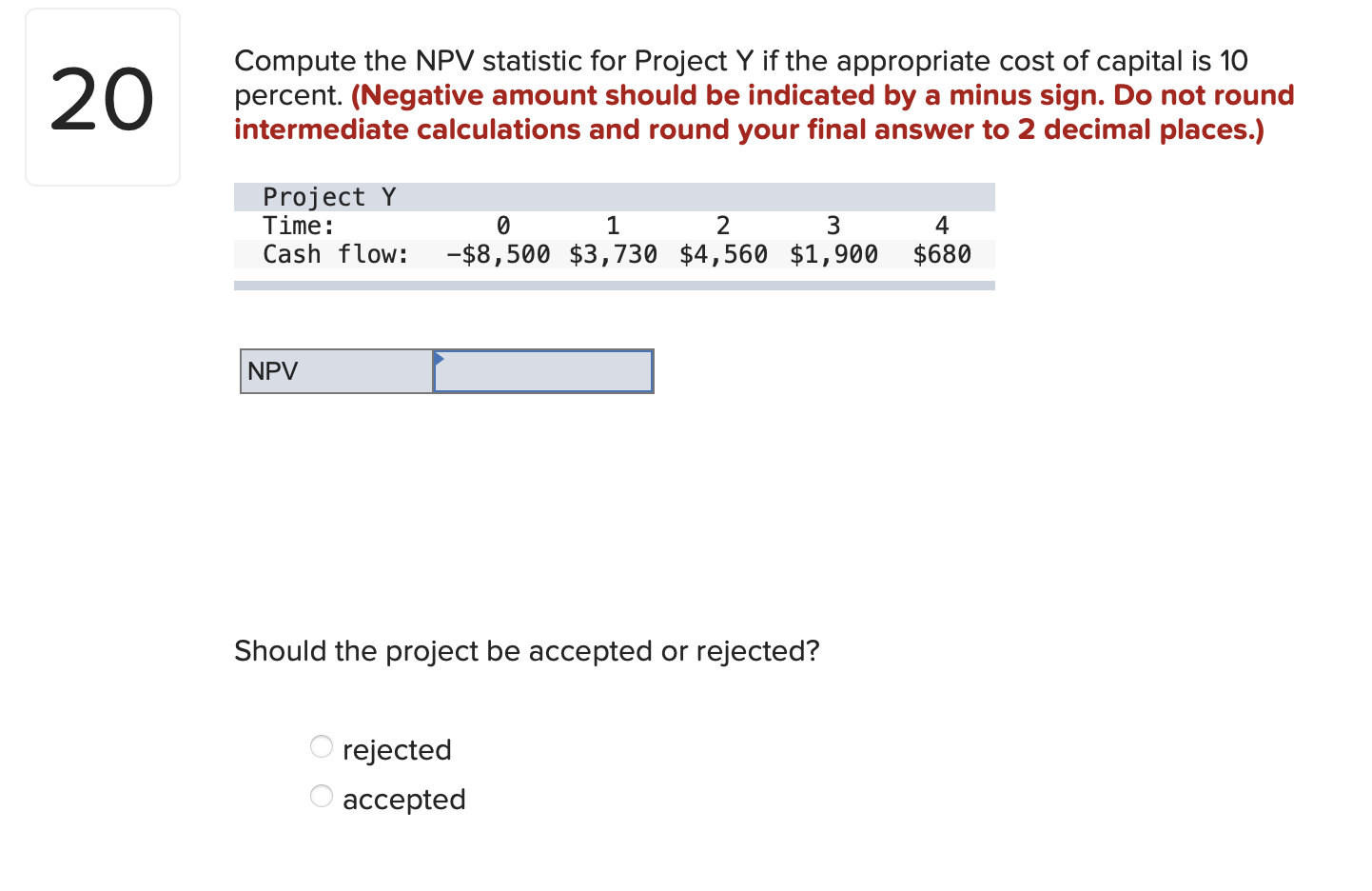

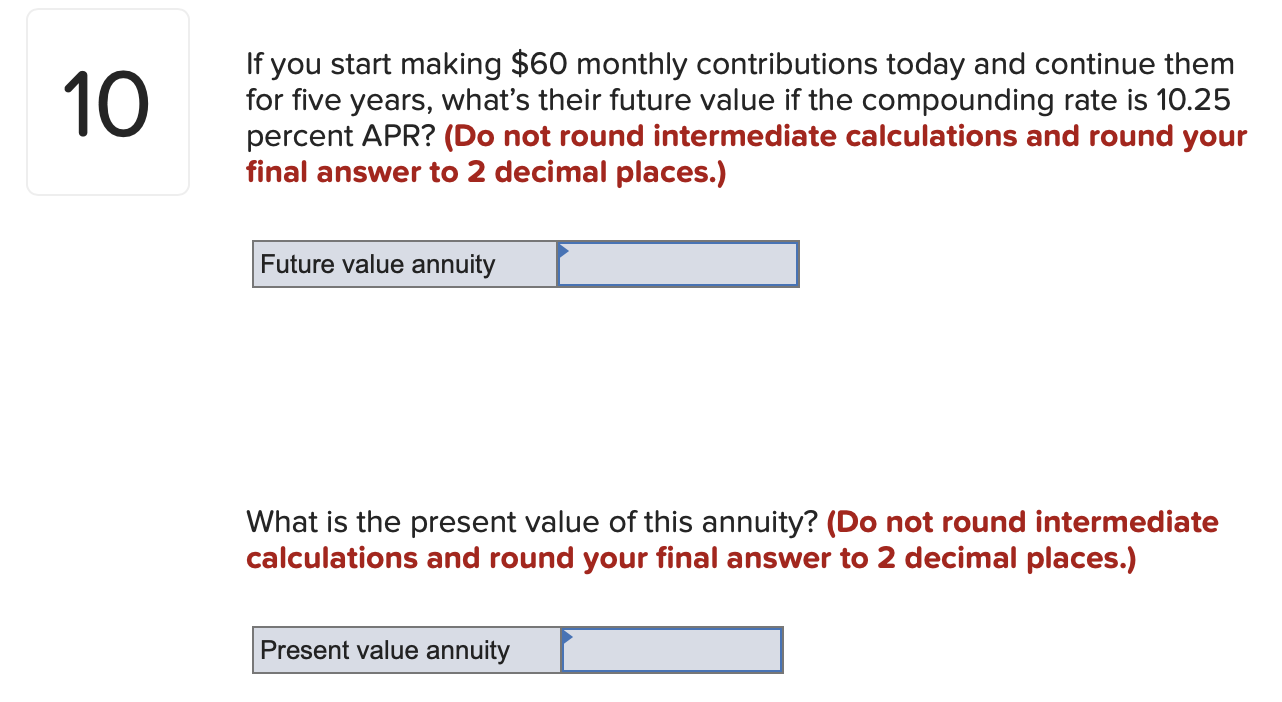

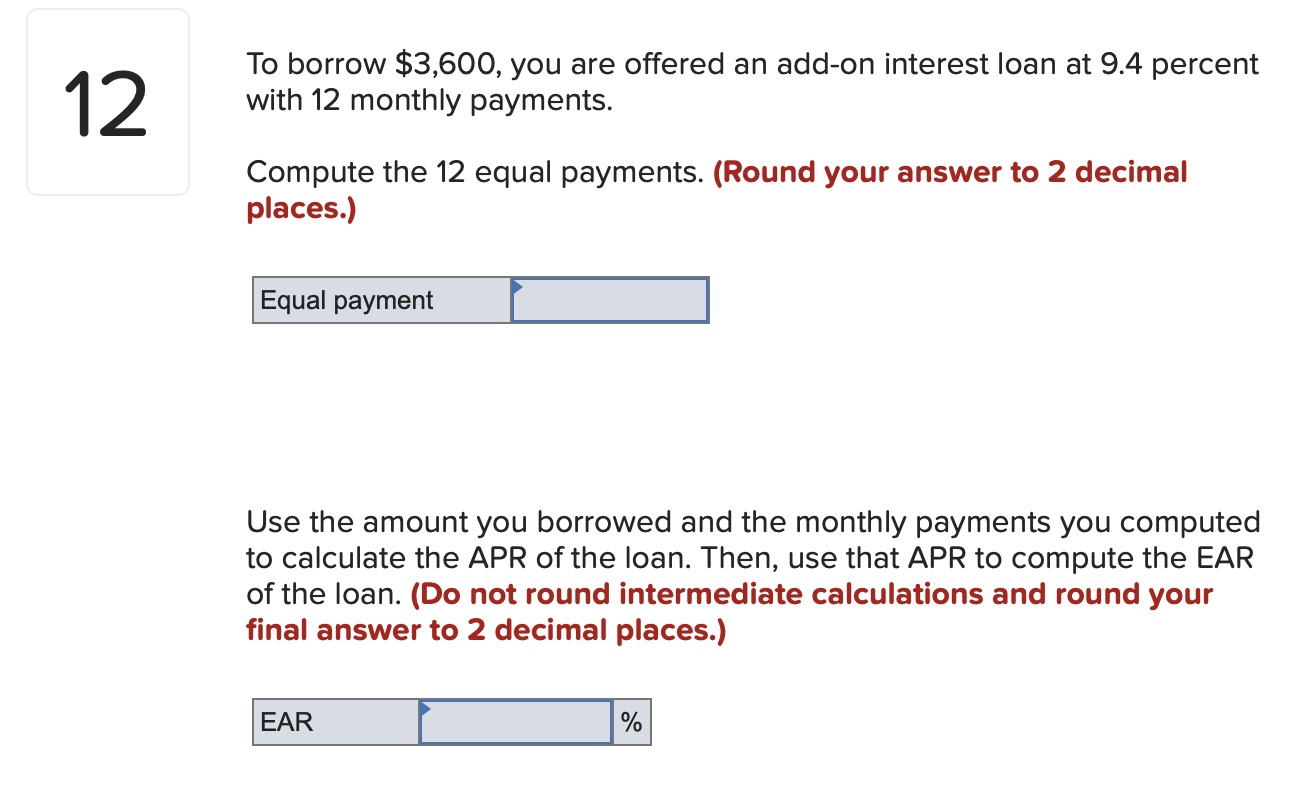

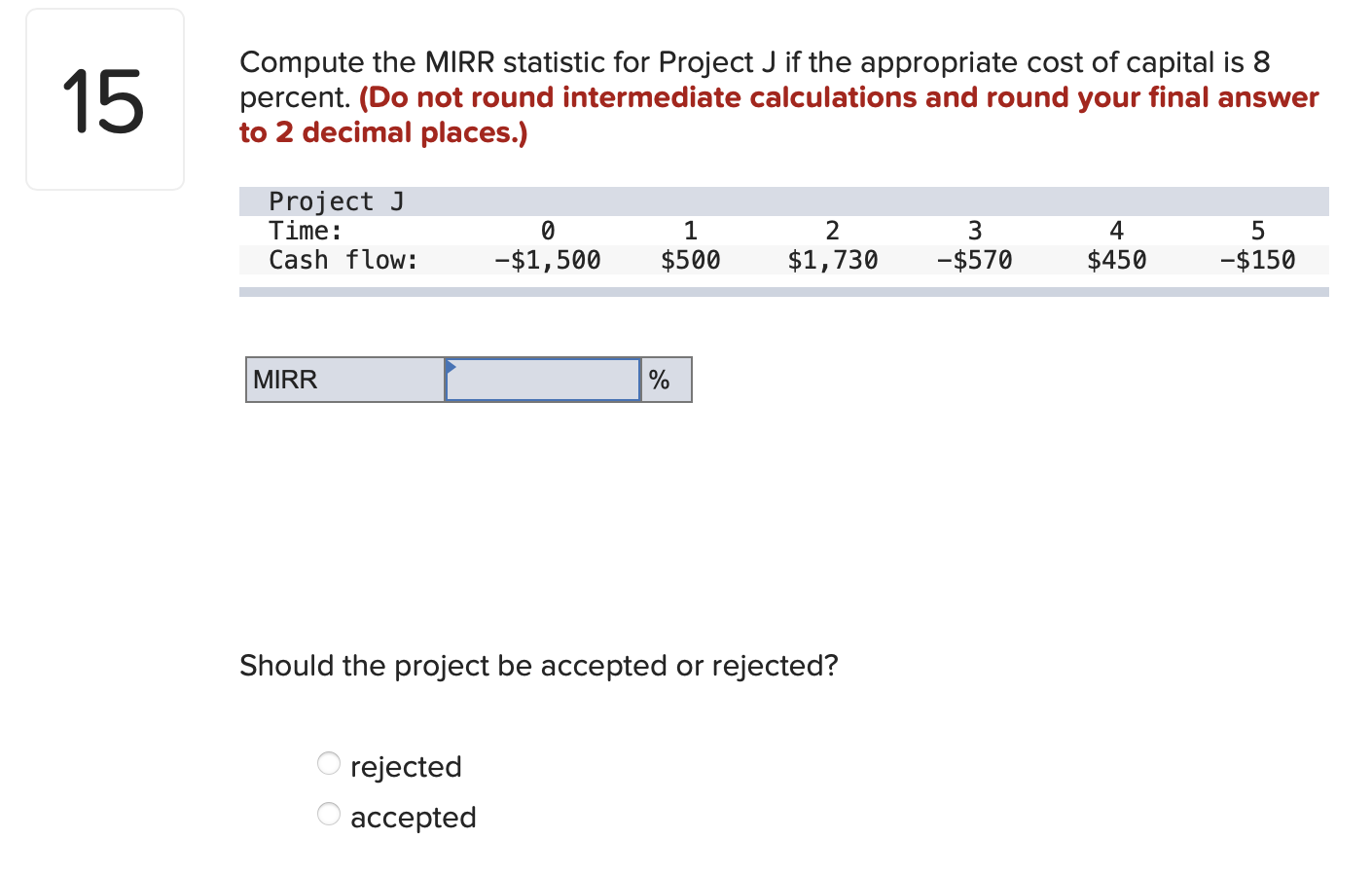

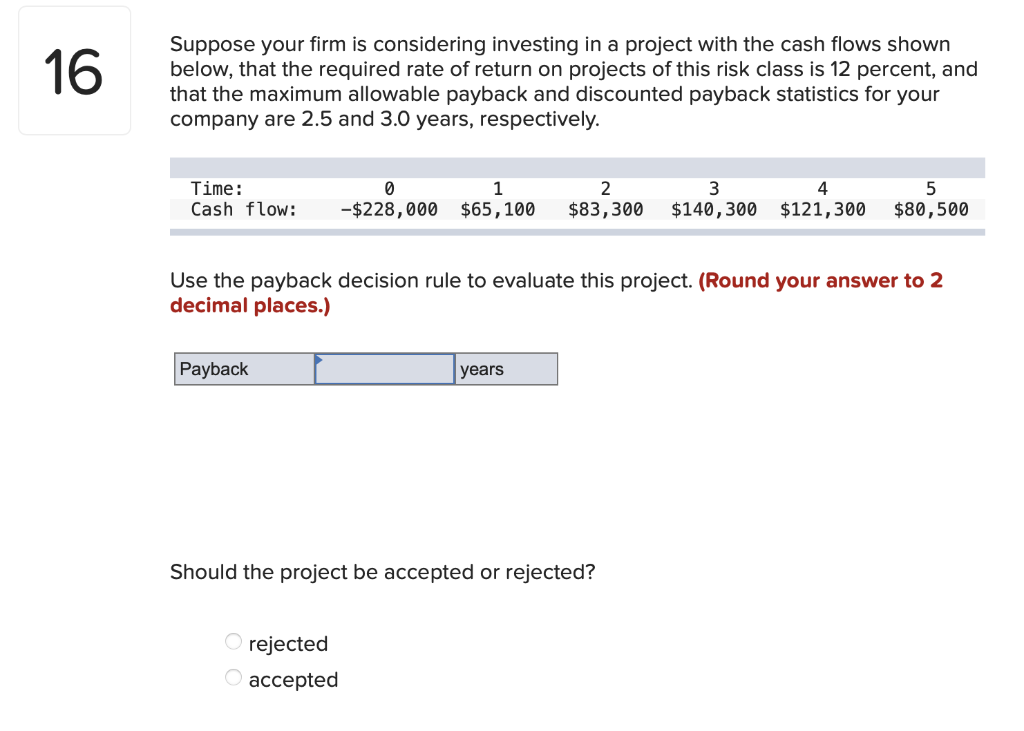

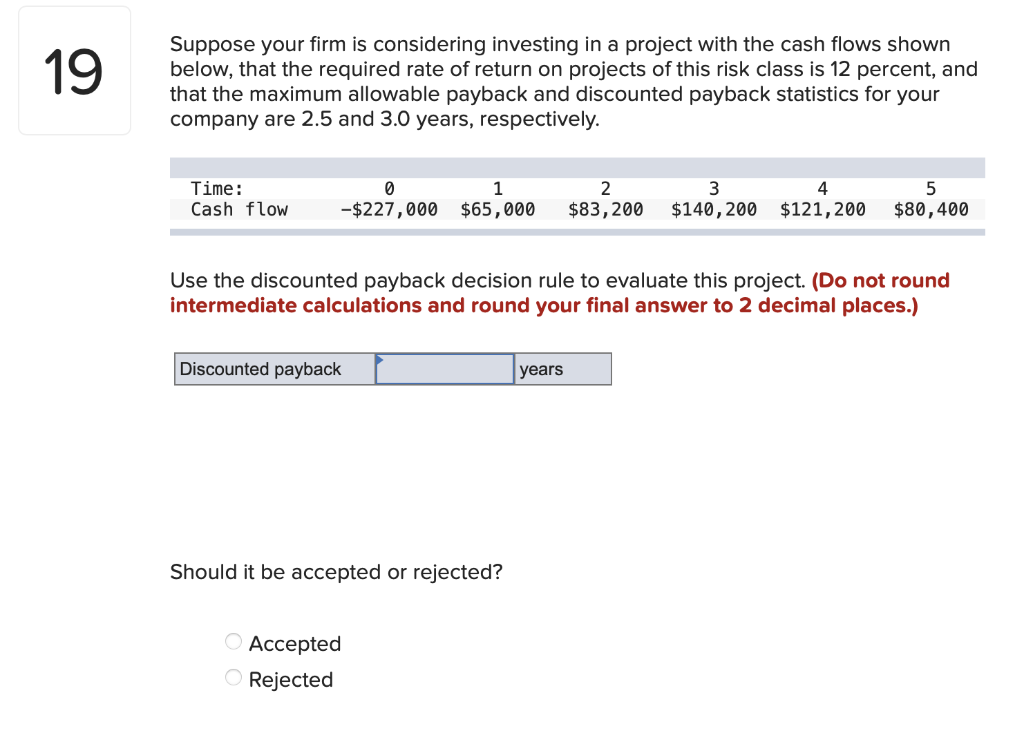

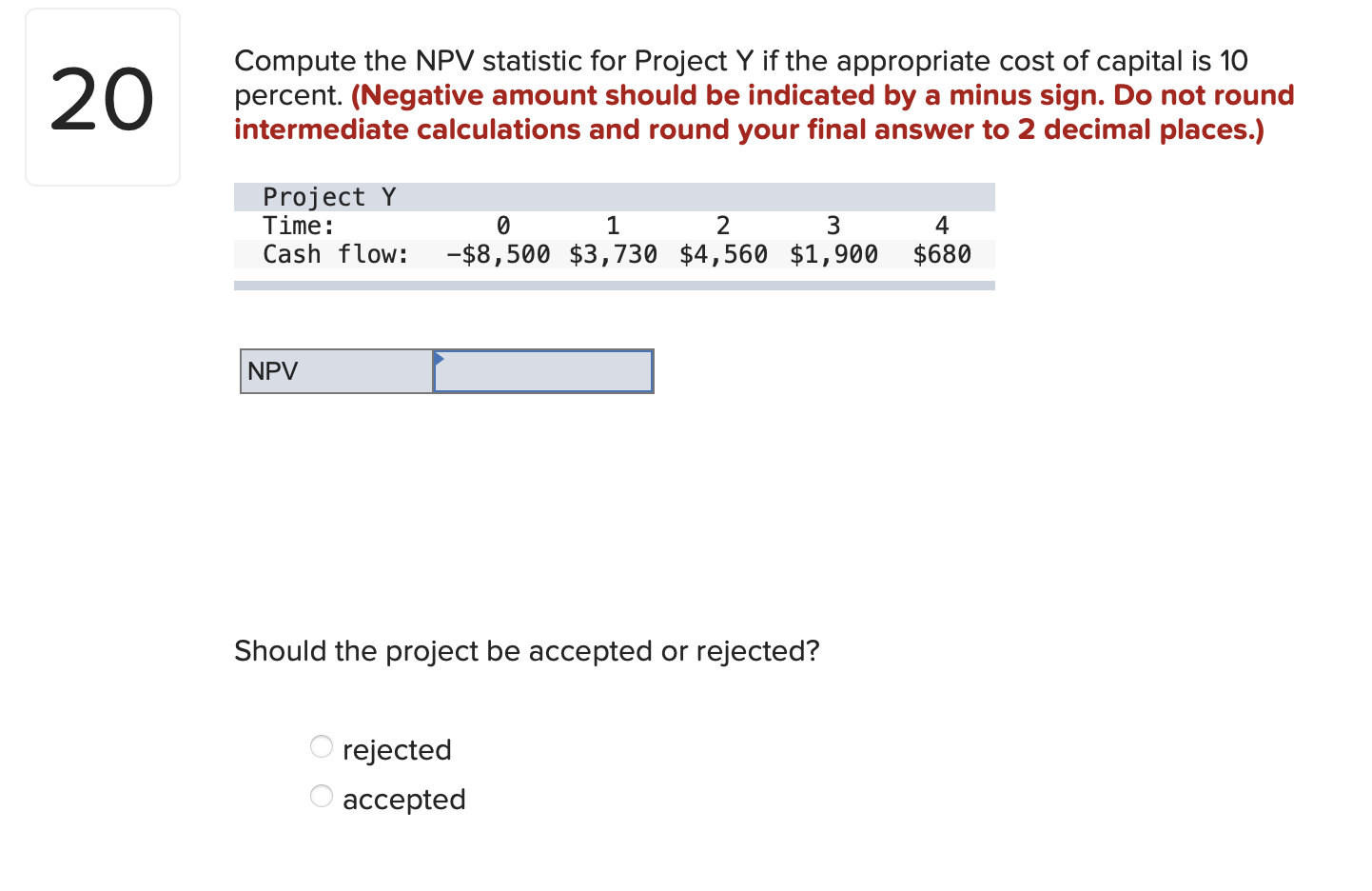

If you start making $60 monthly contributions today and continue them for five years, what's their future value if the compounding rate is 10.25 percent APR? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Future value annuity What is the present value of this annuity? (Do not round intermediate calculations and round your final answer to 2 decimal places.) To borrow $3,600, you are offered an add-on interest loan at 9.4 percent with 12 monthly payments. Compute the 12 equal payments. (Round your answer to 2 decimal places.) Equal payment Use the amount you borrowed and the monthly payments you computed to calculate the APR of the loan. Then, use that APR to compute the EAR of the loan. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Compute the MIRR statistic for Project J if the appropriate cost of capital is 8 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) MIRR 0 Should the project be accepted or rejected? rejected accepted Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistics for your company are 2.5 and 3.0 years, respectively. Use the payback decision rule to evaluate this project. (Round your answer to 2 decimal places.) Should the project be accepted or rejected? rejected accepted Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistics for your company are 2.5 and 3.0 years, respectively. Use the discounted payback decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Should it be accepted or rejected? Accepted Rejected Compute the NPV statistic for Project Y if the appropriate cost of capital is 10 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) NPV Should the project be accepted or rejected? rejected accepted