Answered step by step

Verified Expert Solution

Question

1 Approved Answer

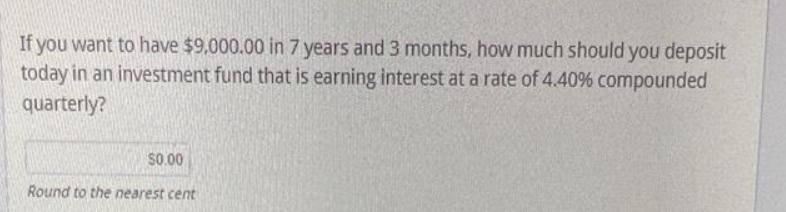

If you want to have $9,000.00 in 7 years and 3 months, how much should you deposit today in an investment fund that is

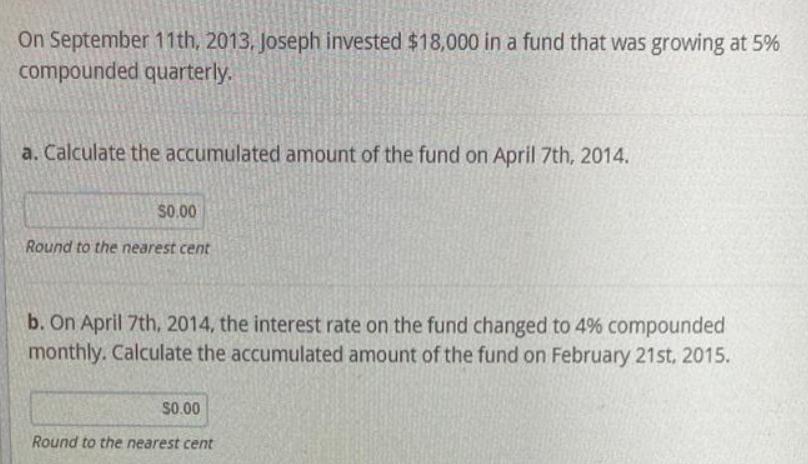

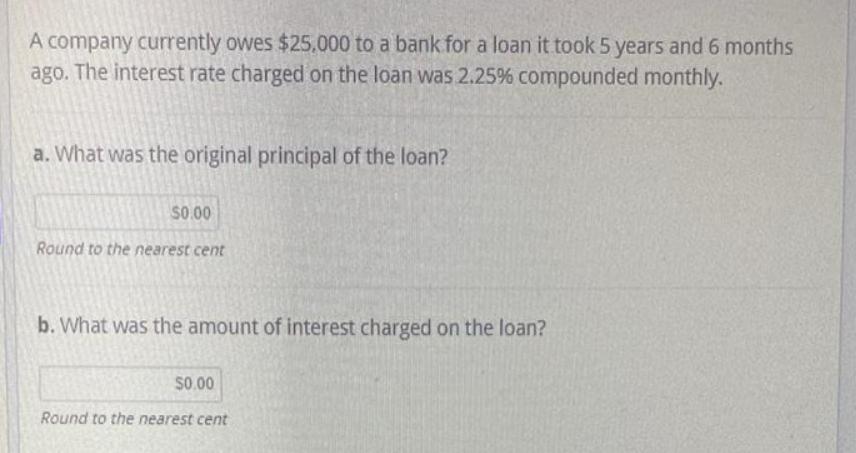

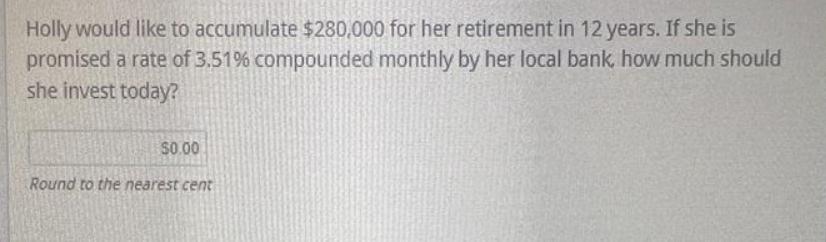

If you want to have $9,000.00 in 7 years and 3 months, how much should you deposit today in an investment fund that is earning interest at a rate of 4.40% compounded quarterly? $0.00 Round to the nearest cent On September 11th, 2013, Joseph invested $18,000 in a fund that was growing at 5% compounded quarterly. a. Calculate the accumulated amount of the fund on April 7th, 2014. $0.00 Round to the nearest cent b. On April 7th, 2014, the interest rate on the fund changed to 4% compounded monthly. Calculate the accumulated amount of the fund on February 21st, 2015. $0.00 Round to the nearest cent A company currently owes $25,000 to a bank for a loan it took 5 years and 6 months ago. The interest rate charged on the loan was 2.25% compounded monthly. a. What was the original principal of the loan? $0.00 Round to the nearest cent b. What was the amount of interest charged on the loan? $0.00 Round to the nearest cent Holly would like to accumulate $280,000 for her retirement in 12 years. If she is promised a rate of 3.51% compounded monthly by her local bank, how much should she invest today? $0.00 Round to the nearest cent

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 PVFV1rnnt Here FV9000 r044 n4 compounded quarterly t743 31 qtrs Plug in the values PV90001011431 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started