Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you want to save $50,000 for a down payment on a home in 7 years, assuming an interest rate of 4.7 percent compounded annually,

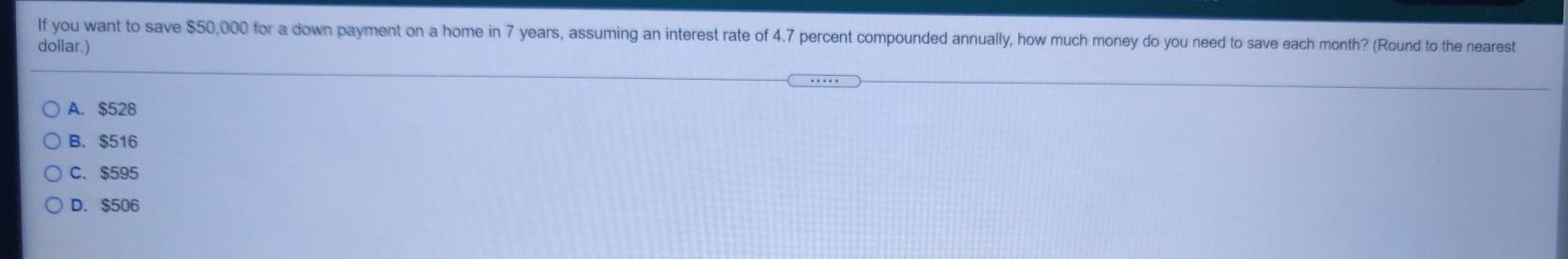

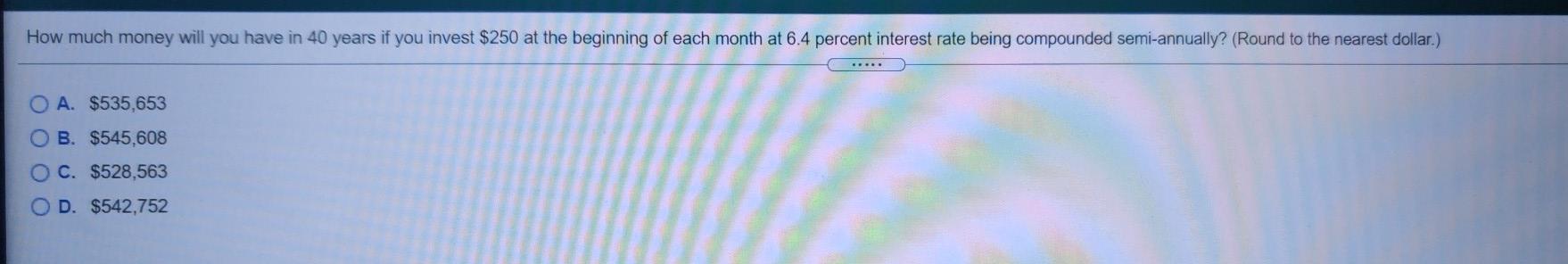

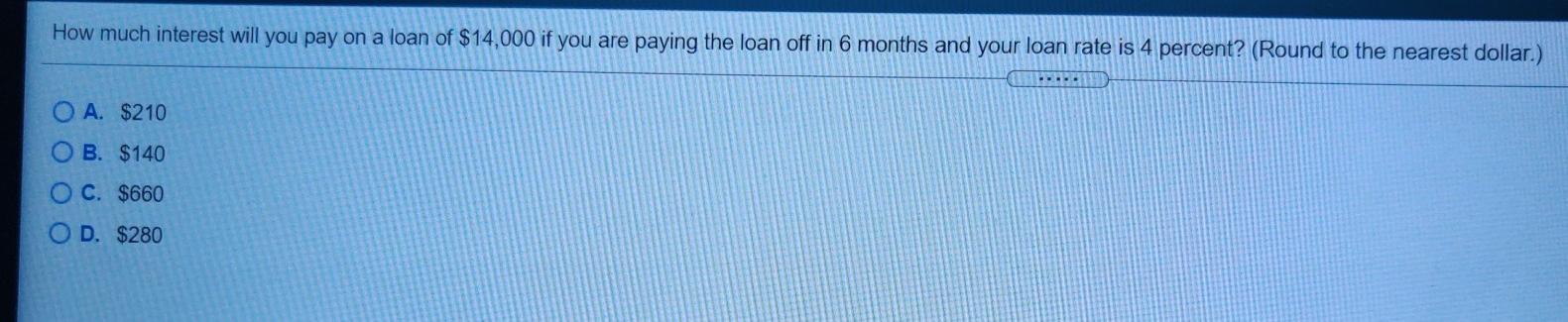

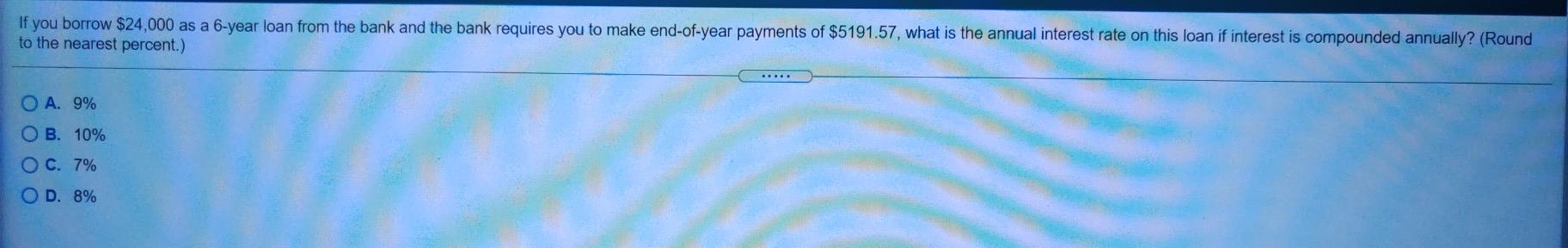

If you want to save $50,000 for a down payment on a home in 7 years, assuming an interest rate of 4.7 percent compounded annually, how much money do you need to save each month? (Round to the nearest dollar.) O A. $528 B. $516 OC. $595 OD. $506 How much money will you have in 40 years if you invest $250 at the beginning of each month at 6.4 percent interest rate being compounded semi-annually? (Round to the nearest dollar.) .... O A. $535,653 O B. $545,608 OC. $528,563 O D. $542,752 How much interest will you pay on a loan of $14,000 if you are paying the loan off in 6 months and your loan rate is 4 percent? (Round to the nearest dollar.) A. $210 OB. $140 O C. $660 OD. $280 If you borrow $24,000 as a 6-year loan from the bank and the bank requires you to make end-of-year payments of $5191.57, what is the annual interest rate on this loan if interest is compounded annually? (Round to the nearest percent.) ... O A. 9% OB. 10% O C. 7% OD. 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started